- tries to pressure them to make a decision or sign a contract

- makes claims about ‘unclaimed credits’ or similar

- says they are acting on behalf of the VOA

- demands large sums of money up front

Don’t be caught out over false claims about business rate appeal deadlines, says VOA

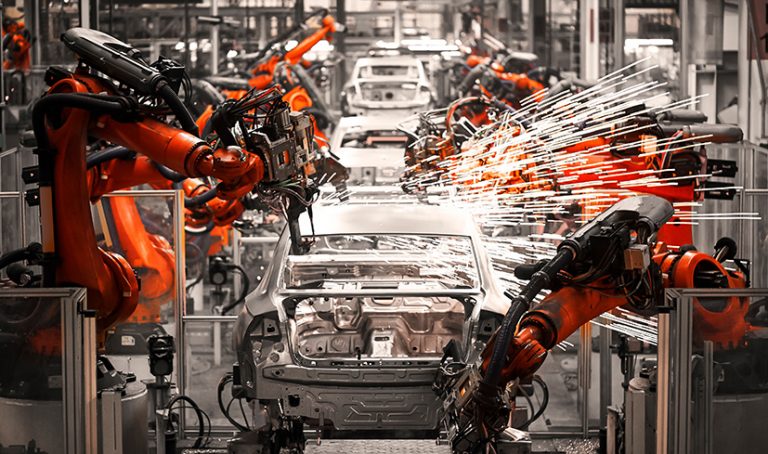

Yorkshire & Humber manufacturers see boost to growth prospects

Two further tenants secured for Sheffield Catalyst Business Park

1.5 million sq ft industrial & logistics development set for Gascoigne Interchange in Yorkshire

Harworth Group has secured a resolution to grant planning permission from North Yorkshire Council’s Strategic Planning Committee for the development of a major rail-connected industrial and logistics hub at its 185 acre Gascoigne Interchange site in Leeds.

The approved plans will see the development of up to 1.5 million sq ft of industrial and logistics space at Gascoigne Interchange, in line with the Group’s strategy to increase its direct development of industrial and logistics space from its extensive landbank, and has the potential to deliver up to £190 million gross development value (GDV). The proposal is the delivery of seven units, ranging from 57,000 sq ft to 1 million sq ft, all built to Grade A specification, with Harworth expecting to start on site in 2025. The brownfield site is one of Harworth’s next-generation of development sites and is situated in Selby, to the east of Leeds and adjacent to Sherburn Industrial Estate. It is one of the most strategically located, rail-connected sites in the region, enabling future occupiers to utilise the existing main line rail connection from the site for a wide variety of uses, including low carbon freight movement. The site, which is accessed via Junction 42 of the A1(M), has an extensive collection of rail sidings on either side of Network Rail’s Leeds to Hull main line route, with current operational connections into the northern and southern plots on the site. The rail access to the north of the site offers scope to create a dedicated railhead serving the buildings on site, with the ability to handle containers, bulk commodities or next-generation express freight services, and puts most of the UK within three hours of the site. The plots to the south of the site benefit from 1,200 metres of frontage onto the main line with connections at either end capable of accommodating a major intermodal terminal for on-site and off-site customers. Lynda Shillaw, Chief Executive, Harworth Group, said: “Our development at Gascoigne Interchange is another example of Harworth’s unique ability to identify, acquire and transform brownfield sites to generate value, create jobs and increase investment in the region. “This development complements Harworth’s extensive pipeline of industrial and logistics sites and we continue to see high demand for high-specification strategically-connected Grade A industrial space.”Chairman of Leeds-based Bailie Group awarded CBE

Hull to consider next phase of green energy projects

Leeds Bradford Airport enters new era of security scanners

CPP Group disposes of legacy operations in Italy

Hudson Contract sees increase in ‘more aggressive tactics’ as HMRC questions construction firms

HMRC is said to be stepping up compliance checks on the construction industry – using its powers to investigate payments for off-payroll labour and gross payments to net paid subcontractors for plant and materials.

Bridlington-based Hudson Contract says it has seen a noticeable increase in HMRC activity and the deployment of what it cals ‘more aggressive tactics’ in recent months, with twelve companies seeking its support in the last six weeks alone.

The company’s Compliance Director Dan Davies said: “The firms concerned are groundworks, joinery, scaffolding and surfacing contractors located across England with turnovers ranging from £2m to £18m.

“HMRC has written to the companies with demands for information including schedule of payments to ‘all workers on a self-employed or off-payroll basis, a description of work undertaken by each worker, sample contracts and company handbooks, information used to determine employment status, details and costs of all materials supplied, evidence of third-party plant hire costs, and supply chain compliance

“In some of the correspondence, HMRC also enclosed an in-depth questionnaire, probing employment status and the categories of off-payroll workers engaged directly, through limited companies or via agencies, umbrella companies and managed service companies.”

Mr Davies said company directors often found the level of questioning to be invasive, ambiguous and a cause for concern, even when their books were in order.HE said: “The costs of getting it wrong can be significant. In one recent case involving a roofing company that engaged between 15 and 20 labour-only sub-contractors, HMRC hit the firm with a statutory income tax notice for more than £330,000 for just one financial year, another was handed a VAT assessment totalling £900,000 because of a tax loss in his supply chain.

“These cases show that HMRC is stepping up the enforcement of off-payroll working rules known as IR35, VAT compliance and general CIS and PAYE compliance issues such as paying net paid subbies gross amounts for plant and materials.”