Record-breaking year of growth for Tall

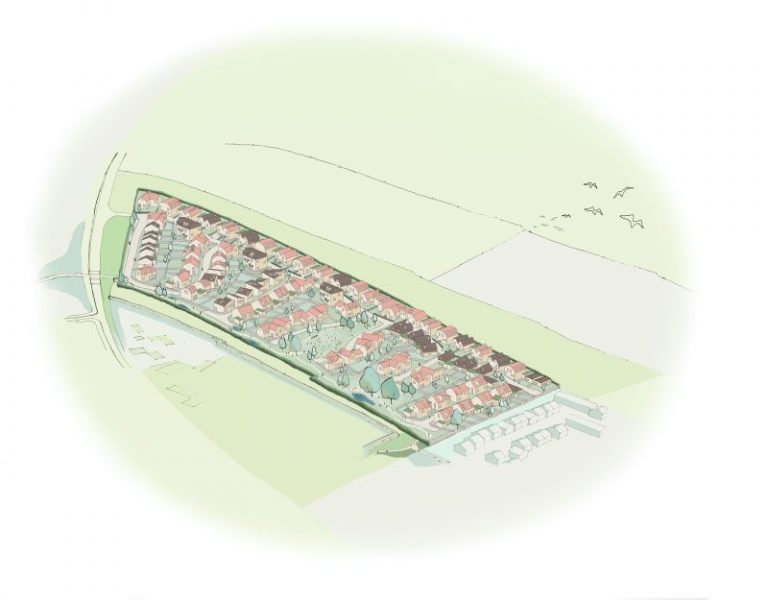

Plans lodged for 150-home scheme in Pickering

One of Yorkshire’s leading estate agents joins Lister Haigh

Leeds letting set to strengthen city centre leisure scene

Yorkshire businesses help furnishing industry charity raise £250,000 in record-breaking year of fundraising

Connectivity shortfalls hinder tech investment on UK farms

A lack of reliable internet access is limiting productivity gains and delaying digital adoption across UK agriculture, according to new industry data.

The survey, commissioned by infrastructure provider CityFibre, found that 8% of farms still have no internet access, while 42% of respondents cite slow or unstable connections as a key barrier to investing in new technology. This comes despite nearly 60% of farmers expecting to scale up their use of digital tools—including AI and real-time data systems—over the next five years.

While cost remains the top obstacle to tech investment, poor connectivity is directly undermining the uptake of precision farming, operational automation, and digital admin tools. On farms where full fibre broadband is already in place, respondents reported tangible improvements in efficiency and diversification.

The issue goes beyond operations. Poor rural broadband is also disrupting workflows at the household level, with 90% of farmers avoiding internet use at peak times, creating friction in both business and personal settings.

CityFibre, one of the private players tasked with delivering the UK Government’s Project Gigabit programme, has secured £865 million in public funding to build out fibre networks across nine rural regions. Combined with private co-investment, the initiative represents £1.2 billion aimed at connecting over 1.3 million homes and businesses.

With agriculture under pressure to modernise amid rising costs and tight margins, the survey reinforces the commercial case for accelerated digital infrastructure in underserved areas.

Solar energy project near Heckington moves to next approval stage

The proposed Beacon Fen Energy Park, a large-scale solar and battery storage development located 2.5 km north of Heckington, is advancing to the pre-examination phase after the UK Planning Inspectorate accepted its Development Consent Order (DCO) application.

The project, led by renewable energy firm Low Carbon, aims to deliver approximately 400 megawatts of electricity through ground-mounted solar panels, with an additional 600 megawatts of battery storage capacity. It is intended to support the UK Government’s target of reaching 70 gigawatts of solar power by 2035.

Now in the pre-examination stage, the scheme will undergo a formal six-month review in 2025, involving written submissions and public hearings. Businesses and stakeholders can register to participate in the process through the Planning Inspectorate’s platform.

If granted consent, construction could begin as early as 2027. The project is positioned to contribute to the UK’s net zero ambitions while strengthening long-term energy security through increased renewable generation and storage infrastructure.

Elovade expands into UK with acquisition of Brigantia Partners

European cybersecurity distributor Elovade Group has entered the UK market through the acquisition of Brigantia Partners Ltd., based in North Yorkshire.

The deal is Elovade’s eighth and largest acquisition, strengthening its footprint across Europe, where it already operates in Germany, Austria, Switzerland, the Nordics and Italy. Brigantia, headquartered in Thirsk, will continue to operate under its existing brand for the time being.

The acquisition retains Brigantia’s current vendor portfolio and team, with managing director Angus Shaw now leading Elovade’s operations across the UK and Ireland. Founder Iain Shaw and chairman Martin Wright are exiting the business as part of the transition.

Elovade, formerly known as EBERTLANG, is pursuing strategic growth in European markets with a focus on IT security and managed services. The acquisition adds a UK distribution network to its offering and positions Brigantia as a key part of its plans, including the potential future rollout of Elovade Cloud Services in the region.

The transaction was advised by Watson Farley & Williams, BDO, and Singular Group AG on behalf of Elovade and HQ Equita, while KPMG and Squire Patton Boggs advised Brigantia.

Lincolnshire elder care charity shuts down amid ongoing financial strain

Age UK Lindsey, a long-established charity supporting older adults in Lincolnshire, will cease operations this week due to sustained financial pressure. The closure affects services provided across West Lindsey, East Lindsey, and North Lincolnshire.

The organisation cited a combination of long-term funding shortfalls, rising operational costs—including increases in National Insurance contributions and the national minimum wage—and lingering economic fallout from the Covid-19 pandemic and cost-of-living crisis.

While Age UK Lindsey is shutting down, related services in the region will continue through Age UK Lincoln and South Lincolnshire, which is working to absorb affected clients and coordinate future support.

This closure underscores a broader trend within the UK voluntary sector. According to the Charity Commission, financial pressures have reduced public donations significantly since 2020, even as demand for services has tripled. Many organisations are facing difficult decisions, including closures and mergers, as funding fails to keep pace with growing needs.

HMRC launches online tool to simplify tax compliance for businesses

HMRC has released a new digital tool designed to help businesses better navigate tax compliance checks. The Interactive Compliance Guidance platform consolidates essential information and support resources in a single location on GOV.UK, aiming to streamline the process for users engaging with HMRC over compliance matters.

The tool walks users through the steps involved in a compliance check, including the reasons HMRC may request documents, how to respond to tax assessments or penalties, how to request additional support due to health or personal circumstances, and how to challenge decisions. It also outlines how to authorise a third party to act on a business’s behalf.

Primarily targeted at unrepresented individuals and smaller businesses, the tool uses a question-and-answer format, instructional videos, and clear step-by-step explanations. It is intended to reduce confusion and improve accessibility across all stages of the compliance process.

This latest launch is part of HMRC’s broader digital support strategy, which includes tools like the VAT Registration Estimator. HMRC’s guidance pages collectively receive over 750 million visits annually, reflecting the growing demand for self-serve resources among the UK’s business community.

The tool is free, doesn’t require registration, and doesn’t collect user data. HMRC is continuing to gather feedback from stakeholders to refine its digital guidance offerings and enhance customer experience.