Hospitality venture planned for historic York building

UK economy contracts after better than expected first quarter

CMA probes Evri–DHL ecommerce merger

The UK’s Competition and Markets Authority (CMA) is reviewing the proposed merger between parcel delivery firm Evri and DHL Group’s UK ecommerce logistics division. The deal, announced in May, would see DHL Group take a significant minority stake in Evri, while Apollo-managed funds retain majority control.

The combined operation would bring together more than 30,000 couriers and van drivers, 12,000 employees, and a fleet of 8,000 vehicles. Together, they are expected to handle over one billion parcels and one billion business letters annually.

The CMA is assessing whether the transaction could substantially lessen competition in the UK parcel delivery and ecommerce logistics market. As part of its standard process, the regulator has invited to comment from interested parties, which closes on 25 June.

Evri, formerly Hermes UK, traces its origins to Grattan Mail Order in Bradford in 1974. It currently operates over 10,000 out-of-home locations and has a growing network of automated hubs and depots nationwide. The merger is positioned by both parties as a move to enhance consumer and business delivery options through improved scale and efficiency.

British Business Bank expands financial reach to support growth

The British Business Bank’s financial capacity is being raised to £25.6 billion, allowing it to scale up investments to approximately £2.5 billion annually. The expansion aims to unlock significant private capital and support high-growth, innovation-driven UK firms, particularly those in the life sciences, deep tech, and venture capital sectors.

The move follows confirmation of governance and financial reforms to the Bank, as outlined in the latest government Spending Review. These changes are expected to be implemented by the end of the current financial year.

The Bank has already backed 22 of the UK’s current unicorns through its equity programmes, representing over half of all such firms in the country. With its expanded mandate, the institution is expected to play a pivotal role in delivering the government’s upcoming Industrial Strategy and broader ambitions for regional growth and scale-up funding.

Business confidence rebounds but hiring and demand remain uneven

New data from NatWest’s May Regional Growth Tracker points to a modest resurgence in business confidence across the UK, with firms reporting more optimistic outlooks and slight improvements in activity levels. Half of the 12 monitored regions reported growth in output, while sentiment about future activity rose in all areas. The North West and London saw the largest monthly increases in expectations, with the West Midlands remaining the most optimistic overall.

However, the recovery remains patchy. Wales posted the fastest growth in business activity during May, while London recorded its weakest performance in two and a half years. Inflows of new business rose only in Wales and stabilised in the East of England, with all other regions seeing a drop, led by a sharper decline in the East Midlands.

Employment figures were generally down, with Scotland being the only region to report a slight increase in headcount after six months of stagnation. The North West continued to cut jobs for the eighth straight month, though the pace slowed.

Order backlogs fell across the board for the third consecutive month, with the North West experiencing the most significant drop in outstanding work. Scotland saw the mildest decline.

Pricing trends moderated slightly, with the rate of increase in average prices charged slowing in every region compared to April. Wales recorded the biggest fall in output price inflation, while Northern Ireland and the West Midlands saw the highest ongoing pressure.

Input costs rose at a softer pace than the previous month but remained above historical norms. The South West and East of England faced the steepest increases, while Scotland saw the most subdued rise. Businesses continue to raise prices to manage persistent cost pressures, including rising labour expenses following April’s national insurance changes.

Construction ball raises £30,000 for St Luke’s Hospice

Royal recognition opportunity for high-performing businesses

North Lincolnshire businesses have the opportunity to gain national prestige through the King’s Awards for Enterprise, with applications now open until 9 September 2025.

Open to companies, non-profits, and public sector bodies with at least two UK-based employees, the awards celebrate excellence across four categories: innovation, international trade, sustainable development, and promoting opportunity through social mobility.

Winners benefit from national visibility, use of the King’s Awards emblem, and access to high-level networking via a Royal reception. Honourees also receive an official visit from the Lord-Lieutenant, acting on behalf of His Majesty The King.

The awards are designed to recognise organisations with strong environmental, social, and governance (ESG) credentials, making them especially relevant to B2B firms looking to enhance credibility, attract partnerships, and scale operations in competitive markets.

North Lincolnshire Council has encouraged local businesses across key industries, including engineering, manufacturing, and logistics, to leverage this platform for growth and recognition. Recent winners such as Wrendale Designs have reported tangible benefits in staff morale, global brand perception, and new market access following their award.

The application process is now live. Interested businesses are advised to begin preparations early to meet the September deadline.

Rabobank backs third UK solar project with Aura Power

Aura Power has secured financing from Rabobank for its third UK solar installation, the 49.9MW Grimsby Solar Farm in North East Lincolnshire. The funding adds to two previous deals between the developer and the Dutch bank: £44 million for the Kemble Solar Farm in Gloucestershire and £33.1 million for Burtree Lane in County Durham.

All three projects fall under the UK’s Contracts for Difference Allocation Round 5. Preliminary work on the Grimsby substation is already underway, with complete construction due to start shortly and energisation targeted for early 2026.

This move strengthens Aura Power’s UK pipeline, which totals 0.5GWp and is expected to be built out by 2028. The Bristol-based firm also has a global solar and battery energy storage pipeline of approximately 12GW.

Rabobank has been accelerating its UK clean energy portfolio. In recent months, it committed £135 million to Aukera Energy for five solar projects totalling 220MWp and co-financed a £42 million loan with ING for 125MW of battery storage projects led by Field. It also supported Enray Power in closing finance for the 68.5MWp Camblesforth Solar Farm, which includes a co-located 24MWh battery.

Qualcomm to acquire Leeds’ Alphawave Semi

University of Sheffield spinout company awarded £2.3m to develop motor neuron disease therapies

Biotechnology company Crucible Therapeutics, a University of Sheffield spinout company, has been awarded £2.3m to develop breakthrough therapies that address underlying causes of motor neuron disease (MND).

The grant from the Innovate UK Biomedical Catalyst program will support the advancement of Crucible’s differentiated siRNA program aimed at treating MND, which is also known as amyotrophic lateral sclerosis (ALS), and other devastating neurodegenerative conditions.

The funding will enable Crucible, in partnership with Sheffield Institute of Translational Neuroscience (SITraN), to scale up manufacturing and advance its lead clinical candidate into pivotal non-clinical safety studies – an essential step toward initiating first-in-human clinical trials for MND/ALS.

Crucible’s unique therapeutic approach targets rogue RNA molecules and toxic proteins that contribute to neurodegeneration, aiming to protect motor neurons from progressive damage. This innovative strategy holds promise as a first-in-class, disease-modifying treatment for patients affected by MND/ALS.

MND/ALS is a progressive, fatal neurodegenerative disorder characterised by muscle weakness, paralysis, and ultimately respiratory failure. Toxic protein accumulation, seen in the vast majority of MND cases, directly damages motor neurons, disrupting nerve signaling and leading to severe muscle atrophy and loss of function that defines the disease.

Jonathan Foley, executive director and CDO of Crucible Therapeutics, said: “We are thrilled to receive Innovate UK funding as part of the Biomedical Catalyst, which will accelerate our research into a potential new treatment for ALS. This funding will support crucial translational research that brings us a step closer to delivering a therapy that could make a real difference for people living with this devastating disease.”

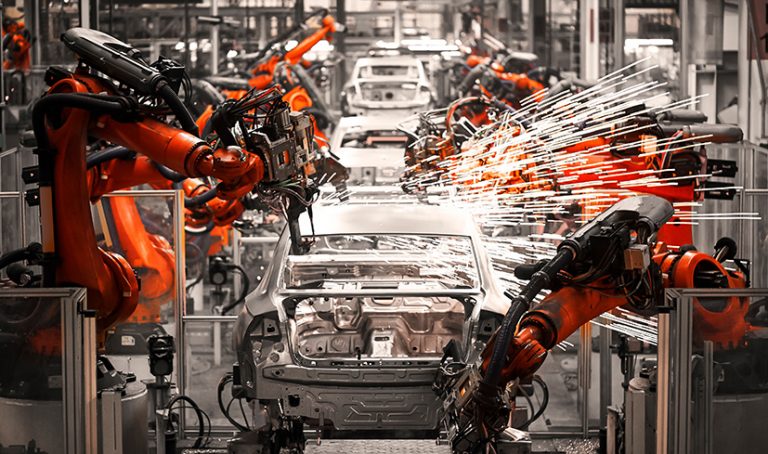

Zonal pricing model could unlock millions in savings for UK manufacturers

A new independent analysis by FTI Consulting suggests that adopting zonal pricing in Britain’s electricity market could save industrial manufacturers in East Yorkshire and Lincolnshire nearly £20 million, with broader national benefits exceeding £ 1 billion in cost reductions.

The study, commissioned by Octopus Energy, outlines how zonal pricing, which charges electricity based on regional supply and demand, would offer a more efficient alternative to the current flat-rate model. Under the proposed system, large industrial users in high-renewable or low-demand regions would benefit from significantly reduced electricity rates, relieving pressure on sectors already burdened by globally uncompetitive energy costs.

The findings are especially relevant for energy-intensive industries such as steel, chemicals, ceramics, paper, automotive, and tech, many of which are currently excluded from the government’s British Industry Supercharger scheme. While the Supercharger provides subsidies to about 370 firms, it does so by increasing costs for other consumers. That levy, currently totalling £410 million, is projected to more than double by the 2030s.

In contrast, zonal pricing is positioned as a zero-cost reform for households and small businesses. By reducing costs at the source rather than redistributing them, it could bring immediate relief to thousands of firms. Examples include savings of up to £19 million for a glassworks in Scotland, £14.5 million for a paper mill in North Wales, and £5–6 million for a car manufacturer in the North East.

The proposal has gained traction across the regulatory and industrial landscape, with support from Ofgem, NESO, Citizens Advice, the House of Lords Industry and Regulators Committee, and trade groups including techUK. These backers argue that energy cost reform is essential to maintaining the UK’s industrial competitiveness and attracting investment in future-facing sectors, such as data infrastructure and green manufacturing.

Electric HGV trial marks milestone in Royal Mail fleet transition

Magtec has begun a government-backed trial with Royal Mail to test new 19-tonne electric HGVs, as part of efforts to decarbonise one of the UK’s largest delivery fleets. The Rotherham-based manufacturer is supplying the fully electric trucks, developed and built in the UK, for operations at Royal Mail’s Greenford Mail Centre in North West London.

The project, supported by an £800,000 Innovate UK grant, will assess the vehicles’ performance under real-world conditions compared with Royal Mail’s existing fleet. With a range of up to 125 miles and a top speed of 56mph, the trucks are designed to handle typical urban routes while maintaining payload capacity for heavy-duty logistics. The flexibility of battery configurations allows operators to tailor the range to meet route requirements.

Magtec’s Gen2 electric driveline system builds on its proven track record, with over 2.5 million miles logged on UK roads. The company has previously delivered successful innovations under the APC and SBRI programmes and is positioning its technology as a scalable solution for fleet operators targeting net-zero emissions.

Royal Mail, which already operates over 7,000 electric vans powered by 100% renewable electricity, is on track to meet its 2040 net-zero target. The company reports the lowest carbon emissions per parcel among UK couriers and aims to halve its Scope 1 and 2 emissions by 2030. This trial provides an opportunity to extend decarbonisation into heavier segments of its fleet.

Outbound travel growth offers £62bn boost by 2030

The UK’s outbound travel sector is projected to grow 20% by 2030, reaching an annual value of £62 billion, according to new data from Abta. The report positions outbound travel as a critical contributor to the UK economy, up from its current £52 billion valuation, with significant implications for regional infrastructure and wider economic resilience.

The study highlights the role of outbound travel in sustaining regional airports, where leisure travel accounts for up to 90% of passenger volume in specific locations, such as the East Midlands, Manchester, Birmingham, Bristol, and Exeter. Without robust outbound demand, these airports risk financial instability, which could undermine inbound tourism and harm local economies that rely on visitor spending.

Abta also underlines the broader commercial ripple effect, including support for domestic tourism and facilitation of international trade via business travel and cargo transported on passenger flights.

However, the trade body warns that realising this potential depends on government support through targeted tax and regulatory reforms. These include advancing sustainable aviation fuel initiatives, easing UK-EU travel frictions, and avoiding compounding taxes on tourism businesses.

Abta is calling for policy acceleration and strategic backing to position the UK as a global leader in sustainable travel and strengthen the sector’s contribution to jobs, trade, and regional development.

Battery storage approved for West Yorkshire site

Wakefield Council has approved plans for a large-scale battery energy storage system (BESS) on a six-acre site near Castleford. The project, led by Harmony Energy, will feature 36 storage units designed to capture renewable energy and release it to the National Grid during periods of high demand.

The site, located off Holmfield Lane, was previously designated as greenbelt land under the council’s January 2024 Local Plan. Still, a national policy revision in December reclassified it as “grey belt,” easing planning restrictions. Despite objections from 49 residents citing concerns over traffic, fire risk, and wildlife disruption, the scheme was granted planning permission.

The project aligns with Wakefield’s target of reaching net zero by 2038 and reflects the wider national shift toward decentralised, renewable-focused grid infrastructure. The West Yorkshire Fire Service has requested that the design adhere to national safety guidelines for battery facilities.

This approval follows a similar green light for another BESS development less than a mile away near the former Ferrybridge Power Station, signalling increased momentum for grid-balancing infrastructure in the region.

Sheffield Forgemasters details £1.3bn plans

RIEGL UK expands footprint at York Science Park

LiDAR technology firm RIEGL UK has relocated to a larger facility at York Science Park to support growing demand across the UK and Ireland. The new site, located at No. 4 Innovation Close, offers expanded infrastructure to support increased project activity, new client inquiries, and operational requirements.

The upgraded premises feature a dedicated workshop for sensor calibration, validation testing, and light inspection work, designed to accelerate service turnaround times and enhance quality control. A new training facility has been introduced to deliver technical education to clients, partners, and end-users. The site also features expanded space for meetings, demonstrations, and customer engagement activities.

This move marks a strategic investment in local support and training capabilities as RIEGL UK continues to scale its presence in the region. It aligns with the company’s global strategy of delivering advanced LiDAR solutions with strong technical backing and regional service.

Medical tech firm expands in York with council backing

Canadian medical technology company Icentia has established and expanded its UK operations in York, citing the city’s talent pool, infrastructure, and tailored business support as key enablers of growth.

Founded in Quebec in 2012, Icentia develops wearable ECG devices that monitor cardiac rhythms and support early diagnosis of heart conditions. After a monitoring period of up to 14 days, patients return the devices by post to Icentia’s UK base in Monks Cross, where cardiac physiologists analyse the data and send results directly to clinicians.

The company initially launched at York Science Park and later relocated to larger premises at Monks Cross to accommodate its growing operations. Icentia has recruited several graduates from the University of York and York St John University, and continues to benefit from the region’s skilled workforce.

The City of York Council’s Economic Growth team has played a key role in the company’s growth. Assistance included site identification, local network access, funding introductions, and guidance on sustainability initiatives such as a bespoke Carbon Reduction Plan. The business is also navigating exports into Europe with the council’s help amid wider regulatory changes.

Icentia’s experience highlights the value of regional partnerships in supporting international firms to scale and embed within the UK’s life sciences sector.