Development consortium gains momentum to deliver affordable Yorkshire and Humber homes

Leeds agency wins work in support of property company’s Manchester development

Consultation extended on proposals for new electricity substation in Rotherham

Creative team moves into new space at Dean Clough

Navigo signs up as latest Foster Friendly business in North East Lincolnshire

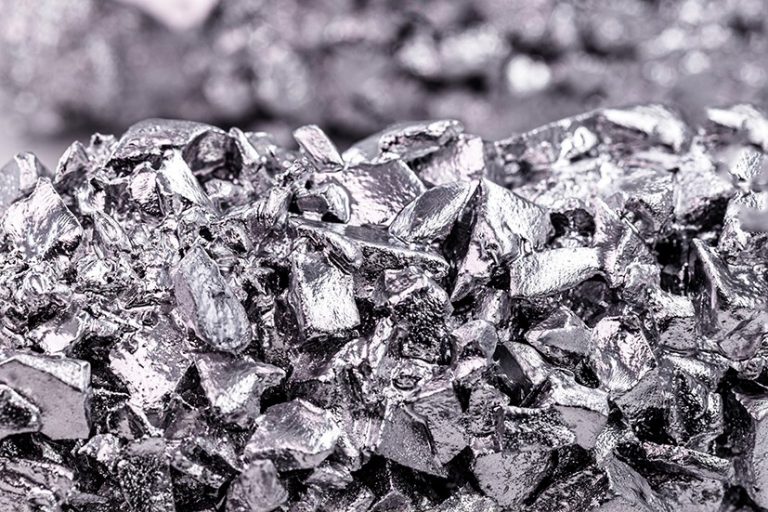

ASD acquires assets of Atlantic Steel

Five care homes sold for £8.8 million

Impact Healthcare REIT has exchanged contracts for the sale of five non-core care homes for £8.8 million, as part of its active portfolio management policy.

Impact has exchanged on the sale of three care homes in East Yorkshire for a total consideration of £4.3 million: Ashgrove Care Home, a 56-bed care home in Cleethorpes; Emmanuel House, a 44-bed care home in Hessle; and Hamshaw Court, a 45-bed care home in Hull.

The purchaser is a local owner and operator of care homes.

In addition, Impact has exchanged and simultaneously completed on the sale of two care homes for a total consideration of £4.5 million: Eryl Fryn Care Home, a 30-bed care home in Llandudno, Wales; and Stansty House Care Home, a 73-bed care home in Wrexham.

Impact acquired the five care homes as part of its IPO seed portfolio in May 2017. The homes have either had a history of relative under-performance, have low EPC scores or are smaller than the ideal size for a care home.

Following the sales, Impact will own 135 properties. The disposal of these five homes will help improve the sustainability performance of the Group’s portfolio either by reducing exposure to homes with an EPC C or D, or disposing of homes that have higher CO2e emissions per m2 than the portfolio average.

Accountancy firm’s first apprentice become part-owner of the practice

Harworth Group retail development moving forward at Rotherham

Potter makes space for reading at primary school

Yorkshire-based property company Potter Space has added a new modular library at Burneston Church of England Primary School twenty minutes away from its base at Potter Space Ripon Park in Yorkshire.

The 13.5m long and 10ft tall unit was originally donated by local business MES, owned by Derrick Potter and Andrew Frost towards the end of 2023, leaving the school to decide how to best use it. When the school saw the size of the unit, their aspirations went from a storage unit to something far more ambitious, a new library for the school.

Spearheaded by Derrick Potter, the team at Potter Space was instrumental in the delivery of the library and secured permission for the project from the church diocese, as well as planning permission from the New Unitary Authority of North Yorkshire.

The works included removing and disposing of old shed space that had previously housed children’s playground equipment, preparing new foundations with recycled stone, installing new underground drainage linked to the existing rainwater system and building wheelchair accessible entrances.

The interior was completely refurbished, with all wiring, electrics, light fittings and heaters renewed. New carpeting was additionally installed along with insulated panels to improve energy efficiency.

The mission expanded into Potter Space’s wider business network, with donations from many businesses in the area. The new library books came from further afield and were provided by Nony Boxer, MD of 66 Books Ltd, a customer at Potter Space’s Ely Park.

Suzy Smart, Burneston CE Primary School Headteacher, said: “We’re absolutely overwhelmed by the kindness and support shown by Derrick and the Potter Space team. Education is the foundation of success and ensuring adequate access to reading materials for children is of the utmost importance. Expanding on our existing materials and space has been a dream come true.”

Derrick Potter said: “The teachers at Burneston CE Primary School provide a crucial education service to the local community and Potter Space is passionate about supporting the communities where we operate. This project has been incredibly rewarding and, as their teachers let the children to be involved in the creation of their new library, it will be great to see them enjoying their new facilities.”

CBI Chief Exec warns new Government: You’ll have to be pro-green

30-second TV ad breaks new ground with AI technology

Paul takes on new ABP Chief of Staff role from today

New eight-year tourism strategy officially adopted for York

- A Regenerative Visitor Economy: York is a responsible, robust and profitable destination with a regenerative visitor economy.

- Green York: Our businesses and visitors’ commitment proactively contributes to York’s transition to net zero carbon emissions by 2030.

- Culture: York is renowned for its heritage, culture and cutting-edge approach to creativity, which attracts cultural tourists and supports the city’s regenerative visitor economy.

- Residents and Localhood: Local people experience the very best of their city and wider region alongside its visitors, with tourism contributing to the quality of life in York and beyond.

- Skills and recruitment: The visitor economy is a first-choice career for school leavers and graduates, businesses invest in upskilling, apprenticeships, training and career development, and commitment to equality, diversity and inclusion.

Offshore Wind Growth Partnership appoints non-exec director

Shipley interpreting firm snapped up by global language service company

100 year old Leeds fancy dress retailer sold following fall into administration

Croda names new CFO and Exec Director

- MEANWHILE, Ian Bull has been named as a Non-Executive Director. Ian has extensive experience with listed companies across a wide range of industries, both domestic and international, both as an Executive Director as well as Senior Independent Director and Audit Committee Chair. He was previously Group Finance Director of Greene King plc, Chief Financial Officer at Ladbrokes plc, and was most recently Chief Financial Officer of Parkdean Resorts Group. Ian was formerly a non-executive Director of Paypoint Ltd, Chair of Lookers plc and Senior Independent Director and Audit Committee Chair of St. Modwen Properties plc. Ian is currently a Non-Executive Director and Audit Committee Chair of Dunelm Group plc and Senior Independent Director of Domino’s Pizza Group Plc. He is a Fellow of the Chartered Institute of Management Accountants