Private equity investor supports Hull’s The 55 Group

Historic England funding to spur on multi-million-pound redevelopment of Rutland Mills

Cllr Michael Graham, Cabinet Member for Regeneration and Economic Growth at Wakefield Council, said: “We’re investing alongside Historic England and City and Provincial Properties so that the former mill buildings can be transformed into vibrant spaces for creativity. They will provide world class facilities to artists and creatives based right across the north of England.

Utility corporation acquires Sheffield waste management business

Sheffield manufacturer acquires new site

Dunelm takes 20,400 sq ft logistics space in Barnsley

Harworth Group has let 20,400 sq ft of Grade A space at Gateway 36 in Barnsley, a major hub for logistics and manufacturing in Yorkshire totalling 127 acres.

Harworth has signed a 10-year lease with FTSE 250 retailer Dunelm, which will be used as a site to support the business’s Home Delivery Network, improving the 2-man delivery service for its customers. The unit is part of a total of 110,000 sq ft of new logistics space constructed in 2023 as part of the development’s second phase and has been built in line with Harworth’s commercial building specification, achieving a rating of BREEAM “Very Good” and benefitting from the installation of solar PV panels. The wider scheme includes 20 EV charging points, rainwater harvesting and a sustainable heating and cooling system, as well as a building envelope design that is sympathetic to the surrounding environment. With this letting now complete, only one 50,255 sq ft unit remains available for occupation within Phase 2. Phase 3 is also in the pipeline following the receipt of planning last year for a further 138,800 sq ft unit together with a further 429,000 sq ft envisaged across three more buildings. Gateway 36, which is located adjacent to Junction 36 of the M1, has benefited from significant infrastructure funding from South Yorkshire Mayoral Combined Authority and last year became part of the UK’s first Investment Zone, focused on advanced manufacturing. Jonathan Haigh, Chief Investment Officer, Harworth Group plc, said: “We are seeing strong demand for our newly developed industrial & logistics space across our regional areas of operation, including Yorkshire, where the supply of high-specification more sustainable space remains constrained. “Our development at Gateway36 is progressing well and we are delighted to welcome Dunelm to the scheme which aligns with our strategy announced in 2021 to progressively transition our Investment Portfolio to entirely modern Grade A space.” Harworth was advised by GV&Co and Knight Frank.Cathy named as Director to lead company’s regeneration activities

Cathy joins from the role of Head of Regeneration Delivery at Wirral Council where she led Birkenhead’s once-in-a-generation transformation programme.

He department will offer a range of support including project mobilisation, investment plans, business case development, delivery strategies, governance, grant funding advice, bid support, procurement strategy, project planning and risk management, making it a significant offer in the industry.

She said the launch of the dedicated service had come in response to the increasing demands for regeneration initiatives, driven by government funding for Levelling Up, Long Term Plan for Towns, Future High Street and Sustainable Transport Settlement Funds. “I am excited to lead the Regen Delivery service at Walker Sime and look forward to collaborating with Private Developers and Local Authorities to bring about positive transformative change in communities.

“We are already seeing significant interest from several authorities and developers, and I am confident that our expertise and comprehensive approach will help drive successful regeneration initiatives in our communities,” she added.Carbon emission take a battering at eco-friendly Barnsley chippie

First two plots sold on West Lindsey enterprise park

Theakston’s Brewery welcomes sixth generation to the business

Independent Yorkshire brewery, T&R Theakston, has appointed William Theakston as channel development manager. William is the eldest son of the company’s chairman, Simon Theakston, becoming the sixth generation of the Theakston family to become part of the business.

He joins the family brewery following a career as an officer in the British Army, where he completed two operational tours in Afghanistan and held a role in the Ministry of Defence.

Since leaving the military in 2016, he has held a number of roles in the drinks and hospitality industry, working with Fullers, Smith & Turner, Marston’s and most recently Charles Edge London, a company specialising in the development of brands, where he was export and UK sales manager.

William’s new role as channel development manager at T&R Theakston will see him develop the brewery’s on-trade sales force, with a particular focus on customers in the Southern half of England and Wales. He will work with wholesale partners, national pub companies and key account groups to grow the Theakston footprint outside of its traditional Northern heartland, as it looks to capitalise on consumer demand for quality British beer.

Managing Director of Theakston’s Brewery, Richard Bradbury said: “William’s appointment is the latest stage of a long-term growth strategy. Over the last four years, we have been steadily strengthening all aspects of our organisation in Head Office functions and front-line sales to support our ambitions.

“The investment in our organisation has been careful and measured to deliver commercial and financial return alongside our steady growth in market share. In parallel, we have worked hard to ensure our beers remain affordable to consumers and customers despite inflationary pressures.

“As we look forward to celebrating our bi-centenary in 2027, we seek to demonstrate that a business doesn’t survive for 200 years by ever standing still. Our focus is on building our business strength to support a successful third century, with William’s appointment forming a key part of that growth journey.”

William said: “I’m hugely proud and thrilled to be joining the family business and carrying on the work of growing our customer and consumer base in a very important area of the market. In past decades, we established a great track record of sales in the south of England and so I look forward to building on this proud heritage in the months and years ahead.”

£6m to be approved to drive economic growth through West Yorkshire’s creative industries

Hotel project kicks off at Bramall Lane

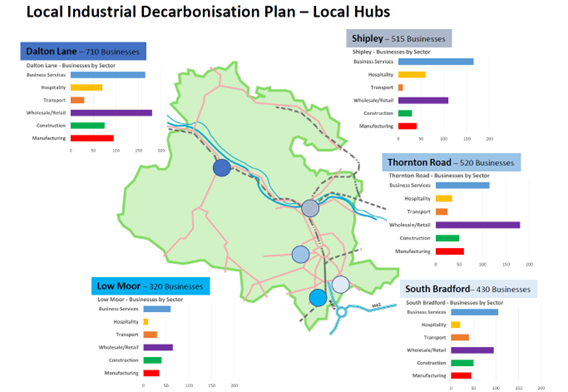

Decarbonisation funding granted to Bradford Manufacturing Futures partnership

Plans to develop 60-acre East Leeds site move step closer following allocation into local plan

Vital Energi gets £22m to build Hull East District Heat Network

Vital Energi has been awarded more than £22m from the Green Heat Network Fund for the commercialisation and construction of the Hull East District Heat Network, which will use waste heat from industry, with Phase 1 utilising heat from the Saltend Chemicals Park.

The heat network will provide low carbon heating to 14 council buildings and a mixture of industrial customers, helping to decarbonise one of the UK’s industrial hotspots. As part of the network, Hull East is also hoping to secure green solar energy to help power the network whilst feeding energy into other customers across Yorkshire Energy Park, a next generation energy and technology business park currently in development. Construction of the heat network is expected to begin later this year, and could expand to supply further connections and use using other renewable heat sources across the energy park once completed. Vital Energi MD Mike Cooke said: “Taking waste heat from Saltend Chemicals Park situated on the Yorkshire Energy Park, we aim to decarbonise commercial and residential buildings across Hull, bringing them closer to a net zero future with low carbon heat and hot water.” Lots of waste energy is generated in various industrial processes as well as in our daily activities. Manufacturing and human waste disposal processes produce waste heat as a by-product which can be harnessed to produce low-cost, low carbon heating. Today, funding from the Green Heat Network Fund continues to enable innovative solutions like these to be deployed.Uniper reveals plans for Humber hydrogen project

Equans cuts home energy bills by half in £25m Leeds scheme

Planning permission granted for Louth residential development

Planning permission has been granted to developer Charterpoint and housebuilder Snape Properties for a 90-home residential development in Louth.

It marks the sixth and final phase of the popular Westfield Park scheme masterminded by Charterpoint.

The developer has now sold the 12-acre site off Daisy Way to Snape Properties – paving the way for work to get under way on the final 90 homes.

Once these have been delivered, the 47-acre site will be complete – featuring a total of 330 homes, plus Meadows Park Care Home.

Adrian Goose, CEO of Charterpoint, said: “Westfield Park has developed into a flourishing community and this additional piece of land will facilitate the natural extension of it. It is the sixth and final phase of a residential scheme that we are very proud to have masterminded.

“The site off Daisy Way will provide 90 much-needed homes for the Louth area, and we are delighted that East Lindsey District Council has granted full planning permission for the scheme, which allows building work to start.”

The 90 properties include a mix of one, two, three and four-bedroom homes, plus a children’s play area, surface water attenuation ponds, wildflower meadows, sustainable drainage and an amenity lawn for communal informal recreation.

The site, which is bounded by the A16 Louth bypass to the north west and by Westfield Park to the south and east, will include green infrastructure to provide an attractive quality environment for residents and visitors with consideration given to access for pedestrians and cyclists, enhancement of wildlife biodiversity, sustainable drainage solutions and promotion of use of outdoor spaces for improved mental and physical health and well-being.

Open water, swales and ditches are also included as part of the sustainable drainage strategy to contribute to local biodiversity.

Increased GDP? Too early to celebrate yet, says FSB Policy Chair

Onto takes ownership of almost 850 homes from The Guinness Partnership

Innocent postmasters get £600,000 and have convictions quashed

- Were prosecuted by the Post Office or Crown Prosecution Service (CPS).

- Were for offences carried out in connection with Post Office business between 1996 and 2018.

- Were for relevant offences such as theft, fraud and false accounting.

- Were against sub-postmasters, their employees, officers, family members or direct employees of the Post Office working in a Post Office that used the Horizon system software.