Land sale paves way for new factory near Boston

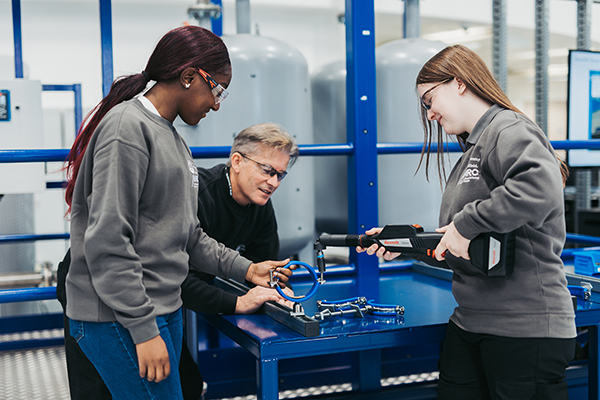

Nuclear industry develops apprenticeship scheme for employees of the future

Yorkshire companies acquired by logistics group

Aon names new Leeds-based partners

Aon plc, the professional services firm, has promoted two of its Leeds-based colleagues to partner.

Sue Austen has had a career in the UK pensions industry spanning over 30 years, the majority of which have been spent with Aon. She leads a team of over 100 colleagues who support trustees and in-house pensions teams in the management of their pension arrangements.

Sue said: “Having briefly held roles at other consultancies, it was joining Aon that provided me with the opportunities that have shaped my career.

“The mix of continuing to advise clients, developing industry-leading solutions, and holding management responsibilities provides genuine variety which, when combined with working with an inclusive and diverse team, makes this such an exciting role.

“The pensions industry continues to face challenges and with regulatory changes on the horizon, I am very much looking forward to continuing to work with clients and colleagues.”

Andrew Grime is a qualified actuary with over 20 years of pensions industry experience, advising a range of pension schemes, varying in size from £40 million to £4 billion.

With his breadth and depth of expertise, Andrew helps schemes set and execute long-term benefit and financing strategies, with a key emphasis on the risk settlement market, where he has a particular focus on the rapidly developing superfund and capital-backed journey plan market.

Andrew said: “I’ve spent my entire career at Aon and am privileged to be part of such a diverse and highly talented team.

“My role is all about helping clients solve problems, and the pace of change within the pensions industry has provided an enormous opportunity for sponsors and trustees to improve member outcomes, as well as providing exciting opportunities for colleagues looking to broaden their career paths.

“Becoming a partner will enable me not only to shape and influence wider business priorities, but also to focus on further developing the fantastic junior colleagues within the team, so they are equipped to support evolving client needs.”

Growth Hub supports Dales-based furniture maker

2024 Business Predictions: Dr Edward Ziff, Chairman and CEO, Town Centre Securities PLC (TCS)

Sewell FM helps health centres reduce carbon footprint through lightbulb switch

Hull-based Sewell Facilities Management has worked with Hull Citycare to replace almost 7,000 light fittings with low-energy LEDs in 13 health centres across the city.

The final light of the programme was fitted by Sewell FM technicians Andy Richardson and Craig Webb at Elliott Chappell Health Centre, making Hull the only city to have all its health centres fully fitted with LEDs. Sean Henderson, MD of Sewell FM, who manage building maintenance for the health centres, said: “Changing a lightbulb in a health centre isn’t as easy as you think, as you need to close off the space, put up barriers and sometimes even bring in mobile elevating working platforms to reach fittings in higher and difficult to reach areas. It causes disruption for the building’s users and staff, takes our facilities team away from urgent jobs and then, a year or so after you’ve put the new lightbulb in, it needs replacing again. “After trialling LEDs at Bilton Health Centre, we knew the benefits that moving to LEDs would bring for the buildings, patients and our staff, so we agreed to pay for and fit the new lights to all the health centres ourselves. It was an ambitious target to get all the replacements completed within two years, and our technicians have worked really hard to get the job finished. Now we have much longer lasting lights that don’t need changing every year, they can put their time and energy into ensuring all our buildings stay in the best condition.” Tim Wigglesworth, Chief Executive of Hull Citycare, said: “Decarbonisation is at the top of everyone’s priority list at the moment, so when Sewell Facilities Management came to us saying they could reduce energy consumption and also save money, it seemed like a win-win situation. It’s already saving the health centres thousands of pounds every year, which is money that can be spent on clinical services and making the health centres even better for patients.”Financial services volumes dip in fourth quarter

- Business volumes fell at a quick pace in the quarter to December (weighted balance of -23% from +27% in the quarter to September). Firms expect volumes to be broadly flat next quarter (-3%).

- Optimism was broadly unchanged in the quarter to December (-3%).

- Average spreads declined slightly in the quarter to December (-4% from +5% in September). Firms anticipate that spreads will fall at a quicker pace next quarter (-23%).

- The value of non-performing loans was broadly unchanged in the quarter to December (+3% from +8% in September) but is expected to grow marginally next quarter (+4%).

- Profitability was broadly flat in the quarter to December (-3% from +13% in September) but is set to fall next quarter (-19%).

- Headcount grew at a fast rate in the quarter to December (+46% from +34% in September). Firms expect headcount growth to ease next quarter, while remaining quick overall (+32%).

- Firms expect to increase investment in IT and vehicles, plant & machinery in the next 12 months (compared to the last 12). Capital expenditure on land & buildings is set to be cut back.

- Uncertainty about demand was the most commonly cited factor likely to limit investment in the next 12 months (53% from 47% in September).

- The share of firms citing cost of finance as a potential limiting factor for future investment declined noticeably from last quarter (9% from 28% in September).

Farmers could get £25,000 flood recovery grants, says NFU

Leeds engineering group expands into the Midlands with Birmingham office opening

Business conditions are improving in South Yorkshire, says new report

Outdoor furniture manufacturer attracts multi-million pound investment

Doncaster distribution warehouse acquired for £21.2m

LondonMetric Property Plc has completed the acquisition of a long-let distribution warehouse in Doncaster for £21.2 million.

The 264,000 sq ft regional logistics warehouse is let to Next for a further 13 years at a rent of £1.42 million p.a.

Andrew Jones, Chief Executive of LondonMetric, said: “As the UK economy reaches an inflection point on both inflation and interest rates, we are increasingly attracted to triple net leased assets that have strong income compounding characteristics and certainty of growth.

“We have continued to successfully exit non-core assets and reinvest into sectors that benefit from structural tailwinds. We have now, based on purchase value, disposed of 39% of the Mucklow portfolio.”

LondonMetric was advised by GV & Co.

2024 Business Predictions: Matt Sheridan, Senior Fundraising Manager, St Luke’s Hospice

Knaresborough firm acquires Newcastle-based financial advice business

LCF Law makes high-profile appointment in insolvency division

Experienced insolvency lawyer, Natalie Nattress, has become the latest partner to join LCF Law’s specialist insolvency division in the firm’s Leeds city centre office.

Natalie joins LCF Law from Knights and has worked in insolvency in Leeds for more than 22 years, dealing with all types of business recovery scenarios, as well as handling large scale investigations in bankruptcy and liquidation estates.

She now predominantly specialises in contentious insolvencies and deceased insolvent estates, which often involves investigating where money and assets are, before seeking to recover them on behalf of financial institutions, insolvency practitioners and individuals.

She will work alongside the insolvency division’s existing partners, comprising of Jo Barnes and Wayne Parker, as well as its additional four lawyers in the team who handle all types of corporate and personal insolvency cases.

Natalie said: “I’ve known Jo professionally for more than 20 years and although we’ve never worked for the same firm before, our paths have crossed many times. It’s always apparent that we have a similar way of working and both Jo and Wayne are also renowned for offering solid, no nonsense commercial advice, which is something I pride myself on, so there’s no doubt we will complement each other.

“Plus, LCF Law has a reputation for having strong core values and being a quality employer, which all combined to make this an appealing career move for me.”

LCF Law’s head of insolvency, Jo Barnes, added: “Natalie is very well-known in the world of insolvency and adds significant experience and expertise to our team. Her appointment also comes at a time of very high demand for our services due to our strong track record for securing victories in several landmark legal cases, as well as businesses being forced to navigate the current challenges facing certain areas of the economy.

“Natalie is therefore a very welcome addition to our team and there’s no doubt that her track-record in solving her clients’ financial problems will further strengthen the level of service and expertise that we are renowned for.”

Specialist pensions law firm bolsters team with two new associates

High volume dispensing pharmacy sold to Lincolnshire operator

Lindum Group applies for permission to develop Overfield Park near Newark

Road closures planned as contractors start work on A180 bridges

- Monday 8 and Tuesday 9 January – full closure of Gilbey Road flyover

- Wednesday 10 and Thursday 11 January – full closure of Alexandra Dock flyover

- Friday 12 and Saturday 13 January – full closure of Cleethorpe Road flyover.