4D Capital Partners has acquired Hepworth Clay, the UK’s last remaining producer of vitrified clay drainage systems, in a move that signals renewed investor interest in vertically integrated manufacturing assets.

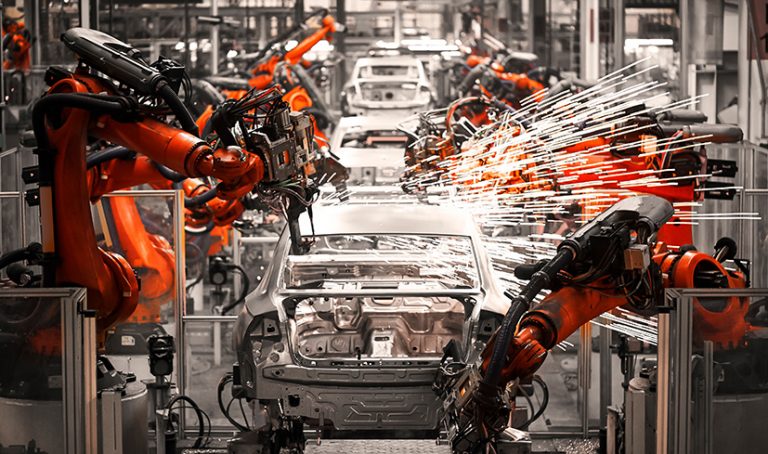

The Yorkshire-based firm, formerly part of Orbia subsidiary Wavin, operates across two production sites totalling over half a million square feet. Its operations span the full value chain, drawing raw materials from its own 18-million-tonne clay reserves, an increasingly rare advantage in UK industry. Alongside its core drainage systems, Hepworth also produces terracotta components for flue and chimney ventilation.

The acquisition positions Hepworth as a standalone business under private equity ownership, with 4D Capital expected to focus on expanding its capacity, modernising operations, and driving long-term value through operational independence.

The deal was supported by advisers including Quantuma, Shoosmiths, Dickson Minto, K3, and Ford Campbell Freedman.

Alex Silk, founder of 4D, said: “We are delighted to have invested in Hepworth Clay and very proud to become the custodians of this heritage brand. There is an excellent team in place with some exceptionally talented people who share our passion for high-quality manufacturing. We look forward to working with them to realise the full potential of Hepworth Clay.”