Fresh merger expands Lincolnshire accountants’ footprint

Eminox names Andy as new Business Unit Director

2025 Business Predictions: Barry Jackson, Head of North at BGF

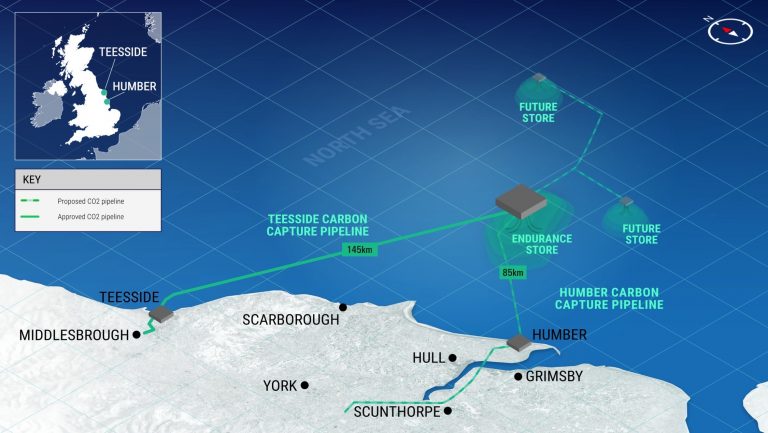

Government gives green light to Equinor CO2 storage scheme

Daniel joins Leeds-based property regeneration consultancy

Imported Chinese excavators could face 83% anti-dumping cost

Disappointing shrink for UK economy

Steelmaker gives full-time roles to almost 40 apprentices

British Steel has given full-time positions to almost 40 apprentices who’ve completed their training.

The company’s new employees, who specialise in mechanical, fabrication and welding, or electrical engineering, received the news after completing a three-year apprenticeship with the business.

23 of the apprentices are based at our headquarters in Scunthorpe, with 14 more at our operations in Teesside and Skinningrove.

Operations Director Matt Stockwell, said: “I congratulate the apprentices for their achievements and hard work during the last three years. We welcome them into their permanent positions. I am sure they will be major assets to our business, and I wish them every success.”

Heather Bateman, Early Careers Advisor, added: “It is fantastic to see so many young people entering the business and completing their apprenticeships.

“These apprentices are the future of our business, and it is wonderful to see them achieve their goals. We look forward to seeing how their careers develop as they progress with British Steel. They all have a superb opportunity.”

Council commits to one of its largest-ever property schemes

North East Lincolnshire Council has committed to continuing with one of the largest property schemes it has ever undertaken – the Freshney Place leisure scheme and associated new food hall and complementary market.

Council leader Philip Jackson said the council’s decision to bring forward and support the project would transform the centre of Grimsby.

The leisure scheme will occupy the western end of Freshney Place, the area that is currently the Top Town Market Hall, and some units on the Bullring, which will provide a new offering for the people and businesses in Grimsby town centre.

A pre-let agreement is in place with Parkway Cinema to bring a five-screen cinema to complement its offering at Cleethorpes.

Richard Parkes, owner of Parkway Cinema, said: “We’ve long discussed options for bringing a cinema to Grimsby, and reinventing Freshney Place is precisely the right approach. Town centres are not just about shopping – that doesn’t work any more. We need to provide more reasons to visit and offer more things to do at more times during the day, and that’s just what we’ve signed up for – to bring that to Grimsby.

“We’ll be a living, breathing presence right in the heart of the town, with a new cinema open to and accessible to everyone alongside a new market hall and food outlets. It’s just part of something that will improve the whole town centre for a new generation, alongside the youth zone and other areas of the town like St James Square and the Riverhead. There’s a lot going on, and we can’t wait to be part of it.”

The development also includes plans for a new, vibrant food hall together with an attached complementary market on the area of the former BHS building.

Four additional new leisure, food and beverage, or retail opportunities, including a larger unit to-let are also in the scheme footprint, alongside four refurbished units within Freshney Place, with the return of Starbucks already agreed, and discussions under way with a leading food outlet.

Work is expected to start on site early in the new year.