Ofgem called upon to take action on standing charges paid by small firms

Tax take rises by almost 5% to £827.7bn in 23-24

Property consultancy doubles Leeds city centre office space

Leeds property consultancy, GV&Co, has expanded into new city centre offices, in a move that follows the company’s twentieth anniversary celebrations.

GV&Co has relocated into a 2,800 sq ft office suite on the fourth floor of Carlton Tower on St Paul’s Street, which is double the size of its previous office in the same building, where the team have been based since 2010.

The company currently employs a 17-strong team and has invested in a major fit-out in the new office to create an open-plan layout, stylish breakout areas, four meeting rooms and large boardroom.

Gavin Ritchie, a director from GV&Co, said: “In the last couple of years we have recruited across all our divisions, as well as launching a specialist lease advisory and asset management service.

“We had outgrown our previous office, so when the opportunity arose to expand in Carlton Tower, which has been a superb base for us for almost 14 years, in the heart of Leeds city centre’s property and professional services district, it made perfect sense.

“The new office offers a very high quality work environment, with great meeting rooms and staff breakout areas, and it’s a brilliant way to follow our twentieth anniversary.”

ABP steps up to be gold sponsor at offshore wind event

Government launches free advice service for SMEs

2024 is the year of the SME and whether it’s through access to finance, support and advice, or removing barriers to growth: we’re helping them go further than ever before.

Help to Grow: Management Essentials is free, with content divided into three easy-to-access modules consisting of short videos and supporting resources covering the essential business concepts required to unlock growth. Business leaders can access the course through the Help to Grow website. Byron Dixon, founder of Micro Fresh said: “These Help to Grow: Management Essentials videos are jam-packed with inspiration and practical tips for small business leaders. I wish I’d had this type of resource available to me when I was scaling my business.” Martin McTague, National Chair of the Federation of Small Businesses, said: “FSB has been making the case for a streamlined, digital taster session version of the Help to Grow Management course, and we’re delighted to see this now delivered. Businesses with fewer than five employees were ineligible for the full Help to Grow course, so this is particularly good news. “This will better fit with the busy lives of small business owners who struggled with the initial commitment for 12-week intensive learning. It means many more can now access the benefits of Help to Grow and see the benefits of committing to the longer course as follow-up.“Improving the skills of small business owners is in FSB’s DNA, so we’re pleased to see this new option for those wanting to grow their businesses, and the economy.”

South Yorkshire sees record levels of tech startups during last year

South Yorkshire is a magnet for home-grown tech startups with a record 617 having ben created last year alone, and relocations into the region at the highest level ever.

Those are the findings of a new report published to mark the inaugural UK Tech Week celebration of tech ecosystems across the UK. Tracey Johnson, Project Director at TECH SY, said: “South Yorkshire’s tech sector is growing in significance and success, expanding despite headwinds and challenges in the global economy, and outperforming many other ambitious locations in attracting the talent and investment needed to turn great ideas into even better businesses. “This report underscores South Yorkshire’s emergence as a dynamic tech hub, fueled by innovation, talent, and a supportive community.”The report, published by South Yorkshire Combined Mayoral Authority, reveals:

● A record 617 tech startups were formed in South Yorkshire in 2023, more than ever before and an increase of a fifth (18 per cent) from 2022. Combined with falling tech failures, which declined for the second year running, South Yorkshire experienced a net gain of 88 home-grown tech companies last year, with growing numbers of active tech companies in every major urban area.

● There are at least 4,588 tech companies in South Yorkshire today – more than ever before. The region is a major centre of cleantech innovation and home to significant business activity in software development, life sciences, data, bioscience, advanced materials and photonics.

● An influx of tech companies from outside South Yorkshire is bolstering the tech sector. Analysis of businesses registered at popular tech locations in South Yorkshire found that 29% were previously based outside the region and that 2023 was the busiest year yet for relocations.

● Tech Welcome Grants totalling £130,000 have helped 29 companies specialising in high-value activities such as robotics, data analytics, and cyber security establish their first facilities in South Yorkshire and supported the creation of more than 140 jobs worth a combined £6.1 million a year.

● Investment in tech companies based in South Yorkshire has been more resilient than elsewhere in the UK. Data from analysts Beauhurst show South Yorkshire’s tech startups secured funding totalling £209 million between 2019 and 2023. Although tech investment in South Yorkshire declined by 38 per cent between 2022 and 2023, this was a less profound decline than the 54 per cent reduction in overall UK tech funding reported by Atomico last year.

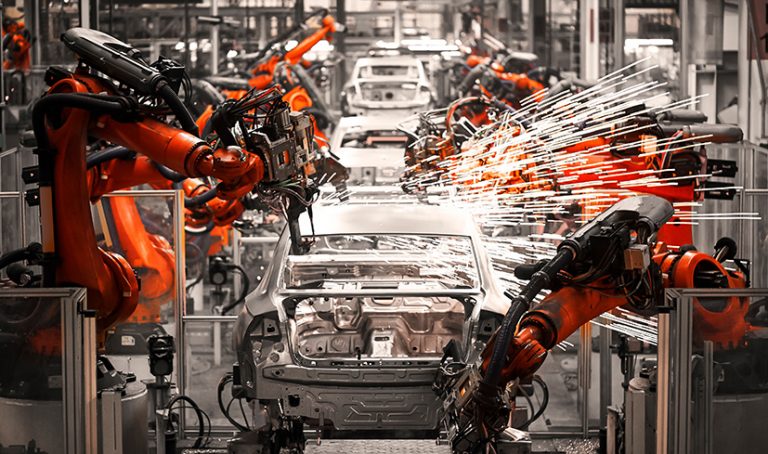

Manufacturing sentiment improves

- Business sentiment rose in the quarter to April, having been broadly unchanged in the three months to January (balance of +9%, from -3% in January). Export optimism for the year ahead also rose moderately (+6%, from -20%). Both sentiment indicators had shown declining optimism in all but one quarter throughout 2022-23.

- Output volumes were broadly unchanged in the quarter to April, after falling in March (balance of +3%, from -10% in the three months to March). Firms expect volumes to grow in the next three months (+11%).

- Total new orders fell in April, but at a slower pace than in the previous quarter (balance of -6%, from -13% in January). Manufacturers expect orders to return to growth over the next three months (+8%).

- Growth in average costs per unit of output rose strongly but at a slightly slower pace in the quarter to April (balance of +39%, from +43% in January; long run average of +18%). Cost growth is expected to remain elevated in the quarter to July (+42%).

- Domestic selling prices increased over the three months to April (+10%, from +2% in January). Export price inflation decelerated from January (+9% from +14%, and now the weakest since January 2021). Both domestic and export price growth is expected to pick up in the next three months (+27% and +22%, respectively).

- Investment intentions for the year ahead improved relative to January. Manufacturers expect to raise investment in product & process innovation (+15% from -5% in January, the strongest since the quarter to January 2022). Investment in training & retraining is expected to be broadly unchanged (+1% from +6%). Investment in tangibles is expected to be unchanged, including buildings (-3% from -29%) and plant & machinery (+2% from -15%), with the balances having recovered from three-year lows in January.

- The main constraint on investment was uncertainty about demand (cited by 49% of manufacturers), followed by inadequate net return (36%), and a shortage of labour (+15%, the lowest in three years). Concerns around the cost of finance have retreated from a 33-year high (excluding the pandemic period) but remain double the long run average (11% from 22%).