Schofield Sweeney names a trio of new hires

Yorkshire Chamber acclaimed as one of the UK’s best

Government plans to bring ‘buy now pay later’ companies under control of the FCA

“Our approach will give shoppers access to the key protections provided by other forms of credit while providing the sector with the certainty it needs to innovate and grow.”

The new rules will allow the FCA to apply rules on affordability – meaning that Buy-Now, Pay-Later companies will have to check that shoppers are able to afford repayments before offering a loan, which will help to prevent people building up unmanageable debt. Companies will also need to provide clear, simple and accessible information about loan agreements in advance so that shoppers can make fully informed decisions and understand the risks associated with late repayments. Consumer Credit Act information disclosure rules will be disapplied so that the FCA can consult on bespoke rules that ensure users are given this information in a way that is tailored to the online setting in which Buy-Now, Pay-Later products are generally used. Buy-Now, Pay-Later users will be given stronger rights if issues arise with products they purchase, making it quicker and easier to get redress. This includes applying Section 75 of the Consumer Credit Act, which allows consumers to claim refunds from their lender, and access to the Financial Ombudsman Service to make complaints. Rocio Concha, Which? Director of Policy and Advocacy, said: “Which? has been a leading voice calling for the regulation of Buy Now Pay Later for years so it’s positive that new rules are coming in that should provide much-needed protections for users of these products. “Our research found that many BNPL customers do not realise they are taking on debt or consider the prospect of missing payments, which can result in uncapped fees, so clearer information about the risks involved as well as the use of affordability checks and options for redress would be a win for consumers.“We are keen to see legislation quickly passed to ensure that BNPL users are protected as strongly as consumers using other credit products.”

Council seeks farmers and landowners to become part of Northern Forest scheme

Insight agrees 15-year lease on Rotherham AMP property

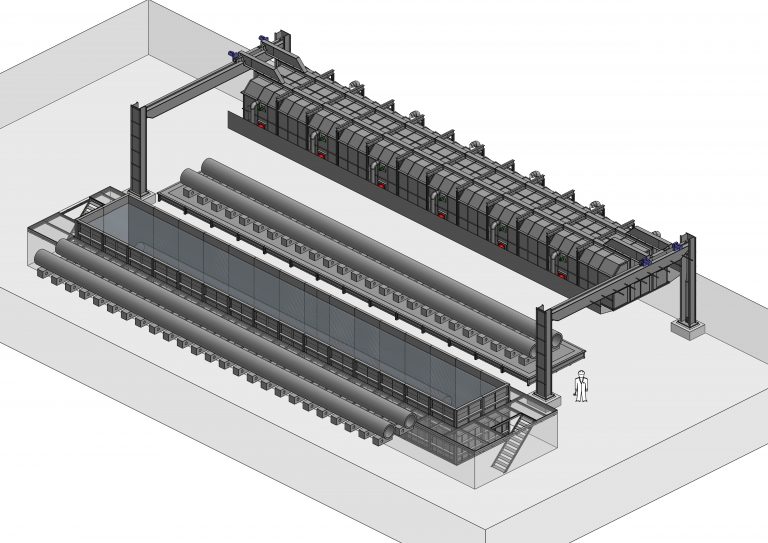

Harworth signed a 15-year lease with Insight for a new Grade-A Industrial & Logistics building at Rotherham’s Advanced Manufacturing Park.

Insight will use the 73,000 sq ft unit as a major European Solutions Integration Centre, bringing together a number of operational processes under one roof, including distribution, technology lab services and agile office space.

Jonathan Haigh, Chief Investment Officer at Harworth, said: “Insight is a global leader in its field and its decision to choose our Advanced Manufacturing Park to support its expansion plans is testament to the quality of space on offer, and appeal of the location. The AMP has established itself as an international centre of excellence for advanced manufacturing with its designation as part of the UK Government’s first Investment Zone, and we are proud to have played a role in its creation.

“We continue to focus on delivering high quality Industrial & Logistics schemes across the Midlands and the North of England in undersupplied markets where we are seeing strong demand from a wide range of businesses.”

The AMP is a major hub for manufacturing in the UK, and home to global businesses including Boeing and Rolls-Royce, as well as the UK Atomic Energy Authority and McLaren Automotive Composites Technology Centre.

Construction of a new 80,000 sq. ft. headquarters for Technicut, a specialist tool cutting manufacturer, is currently on site, with a further 0.4 million sq. ft. of consented developable space available.