Businesses urged to get behind Hull’s ‘Net Zero’ ambition

Hull businesses are to be encouraged to drive down their emissions and take positive action on climate change after a report into the Hull District Heating Project has found that it would be technically and financially viable.

The news comes as the council has this week announced its participation in the new Oh Yes! Net Zero campaign.

The report on the Hull District Heating project will be going to the cabinet next Monday, and recommends the plans move to the next phase.

The system would provide heating to businesses and residential accommodation in the city centre, and would also provide heating and hot water at a lower cost than other low carbon heating solutions, while saving more than 2,000 tons of CO2 a year. Heat is provided from a single central boiler that provides the heat and hot water to all buildings connected to the network.

Councillor Daren Hale, Leader of Hull City Council, said: “This is another significant step forward for the council and our city in meeting our carbon neutral ambition.

“The development of district heating continues the regeneration of the city centre and further enables us to deliver more carbon savings. It could create jobs in another green energy sector for the city, cementing our place as the energy city.”

The project also forms part of the council’s decarbonisation agenda, the Hull 2030 Carbon Neutral Strategy.

Steel from Scunthorpe could be used in 500km Turkish high-speed rail project

Steel rails from Scunthorpe could be part of the UK government’s biggest ever sustainable, civil infrastructure deal that’s to help finance a high speed electric railway line in Turkey, with major contracts awarded to British and Turkish businesses.

The EUR2.1 billion green financing will be guaranteed by UK Export Finance, through its Buyer Credit Scheme, with Credit Suisse and Standard Chartered structuring and coordinating banks arranging the transaction.

This is the first UK-supported rail transaction in Turkey for over 160 years, and forms part of Turkey’s plan to transform high speed rail in the country.

The new 503km electric-powered railway line will connect the capital Ankara to the huge port-side city of Izmir. When complete, the new line will provide a faster, lower carbon alternative to current air and road routes between the two cities, helping to fulfil Turkey’s climate change commitments made at COP26.

International Trade Secretary Anne-Marie Trevelyan said: “Turkey is a vital trading partner for the UK. Our shared global outlook on free trade and the environment is the driving force behind economic growth in our two nations.

“It is fitting that UK Export Finance’s biggest ever civil infrastructure deal is strongly sustainable. This is a proud moment for the UK railway industry, using its industrial roots to reduce emissions in heavily polluted cities.”

Turkey is one of the UK’s most important independent trading partners. The bilateral trading relationship was worth £17.5 billion in the four quarters to the end of Q3 2021, increasing by £1.4 billion from the same period in 2020.

The deal will secure major contracts for UK companies of all sizes to supply to the project, with several nine-figure deals for UK companies close to being agreed. Engineering and construction giants ERG International Group is using its close ties with the UK supply chain to support the project. UK companies are expected to supply British-made railway lines, turnouts, point machines, fasteners, material and equipment for signaling, telecommunication and electrification systems, as well as vital insurance and freight services.

The financing was led by Credit Suisse and Standard Chartered Bank with support from UK Export Finance and meets internationally recognised sustainability standards and is aligned with the Green Loan Principles. Reinsurance is also being provided by international export credit agencies such as SACE in Italy, SERV in Switzerland and OeKB in Austria, reducing the risk to the UK taxpayer.

Investment to see Sheffield environmental services group blossom

Palatine’s Impact Fund has acquired newly created environmental services group, Cura Terrae, further bolstering its commitment to investing in companies that create environmental or social change and generating returns with purpose.

Headquartered in Sheffield, Cura Terrae, the Latin form of ‘take care of the earth’, is led by experienced entrepreneur Professor Pete Skipworth.

Cura Terrae comprises three businesses, Environmental Monitoring Solutions (EMS), Ecus and Envirocare, and will look for further suitable complementary acquisitions to add to the Group as part of a strategic growth plan.

Collectively, the group employs almost 240 people, with this number expected to increase to 300 by the end of 2022 amid strong organic growth with combined revenues of around £18m.

As part of the new group the three businesses will benefit from a range of shared central services such as HR, marketing and finance. Each will maintain its area of speciality, whilst benefitting from Palatine’s ESG framework, expertise in returns-focused impact investing, and track record in buy-and-build, which has included completing more than 200 acquisitions to date.

In a fragmented marketplace for environmental services, CEO Prof Peter Skipworth sees a significant opportunity to build a leading nationwide environmental services and consultancy business.

He said: “Our mission at Cura Terrae is to take care of the earth. We believe that businesses have an obligation to solve the climate crisis and Cura Terrae will help them meet and maintain environmental standards across land, air and water.

“At Cura Terrae, we see our work as a vocational career, with a shared mission to protect the environment. This alignment with Palatine’s Impact Fund, their sector focus and their buy-and-build track record is what attracted us to them and it’s why I am very excited to grow the business in partnership with them.”

Piers Clark, the respected water sector professional, will become non-executive chair of Cura Terrae.

Palatine Impact Fund partner James Gregson, who led the investment with investment manager Greg Holmes, will also be joining the board, along with finance director Sara Blannin.

Ecus, EMS and Envirocare and their shareholders were advised by Claire Davis and team at Lava Advisory Partners (Corporate Finance), Andy Francey and Megan Atack at Freeths (Legal) and Craig Hughes at Brown Butler (Tax).

Palatine was advised by David Mkhitarian, James Down and Graeme Anderson at Hill Dickinson (Legal), Nicola Merritt and James Milton at Cortus Advisory (FDD), Peter Cookson at Armstrong (CDD) and Colin Smyth, Martin Cooper and Jake Hodgson at RSM (Tax).

James Gregson, partner at Palatine, said: “Cura Terrae is an outstanding purpose-led business and a trusted partner of many industry-leading companies across the UK. We have known the team for a number of years and are delighted to be working with Pete and the team to support the strategy for growth.

“Cura Terrae’s mission-driven approach is one that aligns perfectly with Palatine’s Impact Fund and the long-term commitment to place purpose, sustainability and responsible investment at the heart of our strategy.

“We see a significant growth opportunity in Cura Terrae and are delighted to be supporting Pete and the team as the group expands both organically and through further strategic and value-enhancing acquisitions.”

AES Engineering acquires controlling stake in Canadian company

The Edmonton company Performance Compression and Sealing (PCS), which specialises in the supply of fluid sealing products & services, has sold a controlling stake in its sealing business to AES Engineering Ltd.

The PCS Compression Solutions business remains an independent company. The acquisition, for an undisclosed sum, will result in the formation of a new company, AES Edmonton.

The AES Engineering Group, which is based in Rotherham, Yorkshire, also owns AESSEAL®, the homogeneous designer and manufacturer of mechanical seals.

Performance Compression and Sealing, which was set up in 2011, has established a reputation across Canada for its reliability-focused service aimed at maximising the long-term performance of its customers’ equipment. It now joins the group of similarly reliability-focused companies owned by AES Engineering Ltd.

The new company, AES Edmonton, will be set up in new premises and will continue to serve all industries in the local area and across the Canadian sealing market.

PCS president Tyler Wilson said that the combination of the entire AES product range in Wet and Dry Gas Sealing technology, coupled with the service reputation established over the years by PCS, would bring together like-minded employees to better serve the customer base across Canada.

“This agreement builds on many years of dedicated customer service on the part of PCS staff,” Mr Wilson said, “and strengthens our position as a leading service supplier. The selection of AESSEAL® as our partner was an easy decision due to their product technology, and their similar dedication to customer service and reliability.”

Chris Rea, Managing Director of AES Engineering Ltd, welcomed the acquisition and the formation of the new company.

“We are delighted to partner with PCS,” he said, “and to deploy our technology to serve customers in the Edmonton area and across Canada. This acquisition further improves our already well-established position as a leading sealing technology provider in the global market and builds on our recent acquisition of JATech Canada, a recognised leader in reliability and vibration monitoring services.”

Acquisitive Yorkshire accountants snap up London firm

Chartered accountancy and business advisory firm, Hentons, has acquired London-based accountancy firm Clayton Stark & Co, for an undisclosed sum.

The acquisition of Clayton Stark & Co will see turnover at Hentons climb to £8.3m and staff numbers increase to 130.

The investment into the London office by Yorkshire-headquartered firm Hentons, reflects the firm’s strategy of increasing its national footprint and service offering to clients.

Managing Director at Hentons, Peter Watson, said: “Clayton Stark & Co has a particularly strong audit offering and the entire team will join and complement our colleagues in London, who provide a full-service offering including audit, accounts, financial planning, wealth management and taxation services.”

Jan Kariya, senior partner at Clayton Stark & Co, said: “We have been trading for over 66 years and have a loyal client base who will benefit from a number of enhanced service offerings through our partnership with Hentons.

“As well as accessing a larger audit team, clients can now take advantage of specialist financial planning, tax advisory, corporate finance and cloud-based accounting solutions. Hentons also has specialist payroll teams, which several of our clients are keen to use.”

Managing partner at Hentons, Nadeem Ahmed, added: “Last September, we created Hentons Corporate Finance via a joint venture with South Yorkshire based Mackenzie Spencer and with this latest acquisition, we now employ over 130 people across our offices in London, Leeds, Sheffield, York, and Thirsk.

“The acquisition underpins our commitment to our team and clients and firmly places us as a significant industry player, as well as one of the top 100 firms in the UK, specialising in advising SME businesses, family companies, entrepreneurs, and high net worth individuals.

“With ambitious acquisitive and organic growth plans for the future, we have seen that the growing demands on compliance, the need to invest in technology and the challenges of attracting the best talent in a competitive market place, has prompted many well established independent firms of accountants to consider the benefits of joining Hentons, as we are a proactive practice that can help unlock their potential.”

Funding fuels growth for Grimsby engineering specialist

A Grimsby-based manufacturing company is looking to create eight new jobs and target multi-million-pound growth after securing a loan from alternative lending provider Finance For Enterprise and the Northern Powerhouse Investment Fund (NPIF).

Operating from Grimsby’s Enterprise Village, Smartflow Couplings now specialises in manufacturing innovative hose couplings which are used to improve both safety and efficiency whilst transporting hazardous liquids.

The company recently secured support from Innovate UK to bring a number of new products to market. Throughout the COVID-19 pandemic, the company worked closely with the National Engineering Laboratory and National Physics Laboratory to rigorously test the company’s new designs before bringing them to market.

Since the company was established in 2016, Smartflow Couplings has enjoyed significant organic growth. Up until 2019, it produced just one type of coupling, which was used by businesses operating in the oil, gas and chemical industries.

After successfully developing ideas for its new product range, the company spent much of the COVID-19 pandemic undertaking extensive testing, enabling 20 new types of coupling systems to be brought to market. With the new range launching in 2021, Smartflow Couplings quickly found that demand for its products were outstripping the number it could supply to customers. In order to fulfil the growing numbers of orders, Gary and his team sought additional finance and contacted Finance For Enterprise for support.

Working with investment manager Jeremy Meadowcroft, the company was able to secure a six figure loan, jointly funded by Finance For Enterprise and NPIF – BEF & FFE Microfinance, which is managed by BEF & FFE and part of the Northern Powerhouse Investment Fund.

With funding in place, Smartflow Couplings has been able to successfully reduce lead times and meet the growing demand for its new range of products. As a direct result of the financial support provided by Finance For Enterprise and NPIF, the company is aiming to treble its workforce, as well as target an eight-fold increase in turnover within the next two years.

Gary Thompson, Managing Director of Smartflow Couplings, said: “Smartflow Couplings has performed well over the past five years and until now, we’ve been entirely self-funded. However, we recognised that to reduce lead times and increase production capacity, additional investment would be needed to help us reach the next stage of our growth journey. When we secured a grant from Innovate UK to help us increase the number of products in our range, we saw this as a catalyst to drive growth within the business.

“When we launched the product range at the end of 2021, I knew this would be transformative for the business, but there were also challenges we needed to overcome. For example, purchasing additional raw materials and recruiting staff to reduce lead times. I spoke to Jeremy and he talked through the different funding options available to us. He made the application process very straightforward, and kept me updated throughout the process.

“The funds Finance For Enterprise helped us to secure has enabled us to purchase the essential raw materials to produce our new valve range, and we’re also hoping to recruit new members of staff as the business grows. The result of the investment has also meant that we’re able to increase capacity in the business, helping our customers to benefit from lower lead times.”

Jeremy Meadowcroft, investment manager at Finance For Enterprise, said: “The Recovery Loan Scheme was created to help businesses prepare for future growth after being impacted by the COVID-19 pandemic. Having invested significant amounts of money in research and development to bring new products to market, Smartflow Coupling’s plans were impacted by the COVID-19 pandemic, due to the impact of sourcing raw materials.

“The support we were able to provide through the Northern Powerhouse Investment Fund and the Recovery Loan Scheme is likely to see the business enjoy significant future growth. Since launching the new product range the company has seen a significant rise in orders from across the world and with plans to treble its workforce, within the next two years, the innovative work Gary and his team are undertaking is having an immediate positive impact upon the local economy.

“Since providing Smartflow Couplings with the additional funds needed, the company is already recruiting members of staff, as well as providing the vital cashflow to overcome the challenges associated with the rising costs of raw materials.”

Wedding venue acquires a further 29 acres of estate land

The owners of Bawtry Hall Wedding Venue and the town’s Crown Hotel have acquired 29 acres of the former estate of Bawtry Hall.

This acquisition adds to the portfolio for Directors and Shareholders, Craig Dowie and Jason Cooper, who also own and operate the Bawtry Hall Wedding Venue and The Crown Hotel.

Craig Dowie said: “We are excited at the purchase of this woodland as our next phase of developments in Bawtry. We have two outstanding successful venues already with Bawtry Hall and The Crown, and this land has the perfect location to expand our leisure tourism operations in Bawtry. Work will soon begin making the woodland area and lake safe for our future plans and development.”

Jason Cooper added: “Acquisition of this important part of the former Bawtry Hall Estate not only allows us help to return Bawtry Hall to its former glory, but also continues our desire to make Bawtry a leading leisure destination for all.”

Fisher German completed the purchase.

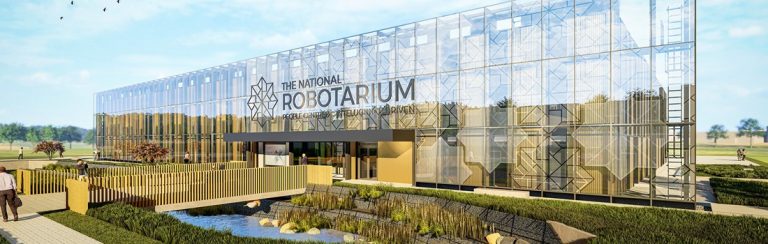

British Steel sections support world-leading robotics facility in Scotland

Construction continues on a world-leading research facility for robotics and artificial intelligence, using about 350 tonnes of structural sections supplied by British Steel, which makes them at Scunthorpe and Teesside.

Based at Heriot-Watt University’s Edinburgh campus, the National Robotariumm is supported by £21 million from the UK Government, and £1.4 million from the Scottish Government as part of the Edinburgh and South East Scotland City Region Deal.

Expected to open in autumn this year, it will create innovative solutions to global challenges using cutting-edge research, product design and industry collaboration.

Bringing together academics and global companies, the facility will provide a catalyst for entrepreneurship and is expected to deliver sustainable economic benefit to Edinburgh, the UK and beyond. Key areas of research application will include hazardous environments, offshore energy, manufacturing, construction, healthcare, human-robot interaction, assisted living and agritech.

Innovative design means the cutting-edge resources will be matched by the building itself, with a focus on sustainability and energy efficiency. In winter, the intelligent façade will provide solar heat and recycle warm air. An ecological zone will integrate sustainable urban drainage systems, while a solar PV array will be installed on the roof. EV charging spaces will also be available. British Steel has supplied 350 tonnes of structural steel to fabricator BHC Limited for the facility, which will be the largest and most advanced of its type in the UK.

Apprentice star highlights T-Levels as route to employment

As many young people prepare to make life-changing decisions on their further education and career choices, East Midlands parents of 15 and 16-year-olds admit to having a bleak outlook on their child’s working future.

According to new research from the Gatsby Charitable Foundation over 93% of parents from the East Midlands think the job market will be concerning and uncertain when their child leaves education. However, businesses in England offer a contrasting outlook as 46% have experienced staff shortages in the last 12 months, and will be actively seeking new talent.

Whilst employers seek the technically trained people they need to fill roles, a huge 95% of parents from the East Midlands admit to worrying about their teenagers’ working future with the top concerns including that they will go into a job they dislike or hate (54%), they won’t be able to find a job (47%) and they won’t have enough work experience to get the job they want (31%).

Despite these concerns and 98% of parents from the East Midlands, many are unaware of T-levels – a new qualification focused on the real world of work.

Designed with employers across multiple industries, T Levels offer young people aged 16-19 an ideal first step into their future career. Combining classroom study with a 45-day industry placement, young people can put learnt skills, attitudes and knowledge into action, while also getting exposure to potential employers. The two-year T-level course offers a wide range of subject choices including Healthcare Science, Education and Childcare, Accounting, Digital Support Services, Legal Services, Management and Administration and many more. After a T-level young people may go onto employment, an apprenticeship, a higher technical course, or a degree as their next career step.

In the East Midlands, 29 schools and colleges already deliver T-level courses including Derby College, Leicester College, Loughborough College and University Academy Holbeach, with more to follow.

Apprentice star and father-of-two Tim Campbell said: “This term is a crucial time for young people to make their future choices, whether they decide to go into further education, or enter the working world. While many parents feel clued-up on some of the pathways their children can take, such as A-levels, this campaign aims to fill in any knowledge gaps when it comes to the recently introduced T-level.

“T-levels offer children the opportunity to develop a deep knowledge and understanding in a subject they are passionate about, then take their knowledge, attitude and practical skills to the next level through an industry placement. After a T-level your child could step into employment, an apprenticeship, a higher technical course, or a university degree.

“As both a businessman and parent, I can see the unique benefits T-levels present to both parents and employers. Parents can be reassured that their children are finding out more about the career opportunities open to them, while building their confidence and life skills. At the same time employers recognise that T-levels cover the key knowledge and skills areas of the most in-demand and growing sectors in the country, helping to address the skills gaps businesses are reporting.”

New Chilean export market reckoned to be worth £20m over five years for pork producers

UK pork producers will be able to export to Chile for the first time, in a move estimated to be worth £20m in the first five years of trade.

The new market creates new export opportunities for the pig industry as the Government, the UK Export Certification Partnership and Agriculture and Horticulture Development Board continue working to develop market access opportunities as part of work to support the sector.

This builds on measures including the launch of an immediate review of fairness in supply chains in the pig sector, using powers under the Agriculture Act 2020.

Farming Minister Victoria Prentis has held various roundtables with farmers and industry representatives and spoken to the agricultural leads at the major banks to ensure that they are showing pig farmers as much flexibility as possible. The Government has additionally introduced a Private Storage Aid Scheme, Slaughter Incentive Payment Scheme, and a bespoke temporary visa scheme for pork butchers.

The UK exported £339m of pork in 2021, with over two thirds going to non-EU destinations, demonstrating the value of new markets. Chilean authorities have now opened up their market to 27 firms across the UK.

Farming Minister Victoria Prentis said: “The pig sector is facing a range of challenges and we must make use of all levers available to us. That includes new export markets, and it is great to see the Chilean market open its doors to our pig producers. This will be worth £20m over the next five years and will build on other measures we have introduced to bolster the industry.”