New President for Sheffield Chamber of Commerce

Kirklees Council’s Cabinet approves sale of land for housing

CEO “pleased” with 2023 trading at Team17

Team17 Group’s new CEO is “pleased” with how 2023 trading closed, finishing the year with positive momentum across the games label’s portfolio.

In a trading update for the twelve months ended 31 December 2023, the Yorkshire-based business noted that all parts of the Group performed well over the key Black Friday and festive trading periods.

As a result, management continues to expect FY 2023 adjusted EBITDA to be at least £28.5m.

Steve Bell, CEO of Team17, said: “Having joined the business in September 2023, I am delighted to now formally take over as Group CEO, having spent the last four months fully immersing myself across the Group, with our people, portfolio of games and developers.

“I am pleased with how FY 2023 trading closed, finishing the year with positive momentum across the portfolio. I am extremely excited about the prospects for the Group in 2024 and beyond.”

Six-figure investment helps Barnsley firm go green

Almost 50,000 firms at risk of insolvency this year, says Red Flag alert

Leeds marketing firm acquires communications agency

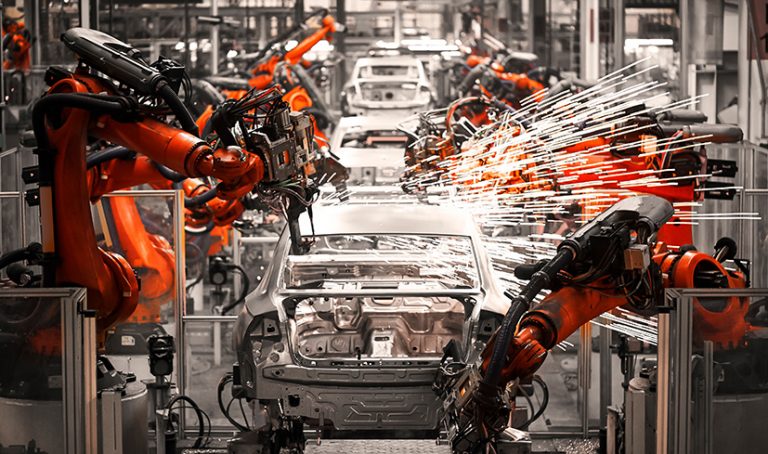

Manufacturers cut back investment as output and orders weaken

- Output volumes fell in the quarter to January, after being unchanged in December (balance of -10% from 0% in the three months to December). Firms expect volumes to rise marginally in the next three months (+7%).

- Total new orders fell at their fastest pace since July 2020 (balance of -13% from +2% in October) and manufacturers expect orders to remain unchanged over the next three months (-1%).

- Growth in average costs per unit of output accelerated in the quarter to January, with the pace of costs growth standing well above average (balance of +43%, from +29% in October, long run average of +18%). Cost growth is expected to remain elevated in the quarter to April (+43%).

- Domestic selling prices were reported as broadly stable over the three months to January (balance of +2%, from +5% in October), the weakest balance in over three years and matching the long-term average. Export price inflation accelerated from October (+14%, from +10%) and stands above the long-term average (-4%). Domestic price growth is expected to pick up in the next three months (+9%), while export price growth is expected to ease (+6%).

- Investment intentions for the year ahead were mixed. Manufacturers expect to raise spending on training & retraining (+6% from +5% in October). Investment in product & process innovation is expected to fall (-5%, from +6%, the weakest since the quarter to January 2021). Investment in tangibles is expected to fall rapidly, including buildings (-29% from -31%) and plant & machinery (-15% from -11%, also the weakest since January 2021).

- The main constraint on investment was uncertainty about demand (cited by 58% of manufacturers, the highest since January 2021). Other factors include: inadequate net return (40%, the highest since July 2020); the cost of finance (22%, the highest since January 1991 – excluding the pandemic period) and labour shortages (20%, down from a record 37% two years earlier – excluding the pandemic period – but still above the long-term average of 11%).