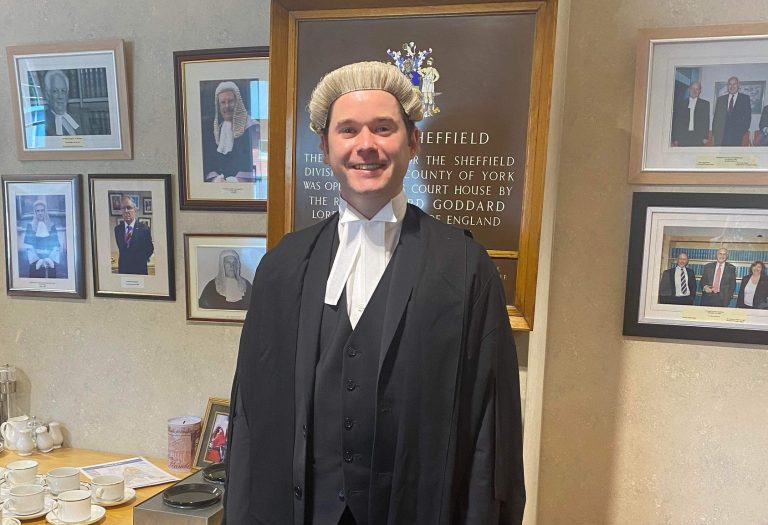

Sheffield solicitor secures recorder appointment

A Sheffield lawyer appointed as a recorder to sit in the civil jurisdiction is believed to be one of the youngest solicitors to be given the role.Carl Jones, a partner at boutique firm MD Law and who specialises in insolvency litigation, begins his formal induction as a recorder this September and should begin sitting by the end of the year – all before he turns 35.Carl was surprised to learn of his recommendation for the position after deciding to apply on a speculative basis.The 34-year-old said: “I am so pleased to have been appointed. I was very surprised to learn I was being recommended for appointment. I’ll be 10 years qualified in September, so I thought it was more a speculative application. “It’s something I wanted to do, but applying was as much about getting experience and going through the process. To actually get appointed, I was very pleasantly surprised.”Carl was appointed a deputy district judge in 2020 and the following year was authorised to sit in the Business and Property Courts in Leeds and Newcastle. He added: “I see this appointment as a recorder as the next step in the judicial ladder. It’s my ambition to become a full-time judge eventually.”Matthew Dixon, founder and partner of MD Law, said: “We warmly congratulate Carl on his recorder appointment. Allowing our lawyers to pursue their judicial ambitions means they can broaden their knowledge and experience, and that can only help enhance the firm’s reputation.”

Manufacturing company fined after employees diagnosed with hand-arm vibration syndrome

A manufacturing company has been fined following reports that two of its employees had been diagnosed with hand-arm vibration syndrome (HAVS).

The two staff members at Ross & Catherall Limited – a company that manufactures and supplies metal bars for the aerospace and automotive industries – worked at the firm’s Forge Lane site in Killamarsh, Sheffield, South Yorkshire, in 2019.

The two employees carried out a variety of tasks, which included the use of vibrating tools, throughout the company’s manufacturing process.

Both operators used these tools for extended periods of time, over a number of years, without adequate systems in place to control their exposure to vibration.

RIDDOR reports submitted by Ross & Catherall Limited in May 2019 revealed the employees had been diagnosed with HAVS.

The RIDDOR reports prompted a Health and Safety Executive (HSE) investigation.

The HSE investigation found there was no hand-arm vibration risk assessment in place prior to, and at the time of the workers’ diagnoses, to identify what level of vibration the operators were exposed to. There were also no control measures in place to reduce exposure levels, with reasonably practicable measures only being implemented following HSE’s intervention.

Health surveillance was also inadequate. This was not carried out annually and there was no initial health surveillance assessment for new operators. Additionally, referrals were not carried out in a timely manner for those employees displaying symptoms of HAVS.

Ross & Catherall Limited, of Bretby Business Park, Ashby Road, Burton upon Trent, Staffordshire, pleaded guilty to breaching Section 2(1) of the Health and Safety at Work etc Act 1974. The company was fined £200,000 and ordered to pay £7605.37 in costs at Derby Magistrates’ Court on 17 July 2023.

HSE inspector Lindsay Bentley said: “Those in control of work have a responsibility to assess the risk from exposure to vibration, put in controls to reduce this risk and ensure that health surveillance is adequate to identify symptoms in a timely manner.

“HAVS can be a life-changing condition which impacts all aspects of your life. Prevention of vibration damage is key and there is plenty of guidance available for employers to help them protect their employees’ health on the HSE website.”

This HSE prosecution was supported by HSE enforcement lawyer Nathan Cook.

West Yorkshire woman’s company aims to elevate the value of British wool

Fourth-generation farmer and wool champion Kate Drury has recently been named as one of 50 winners of Women in Innovation Awards for her attempts to increase market share for sustainable ropes for uses as diverse as dog leads, sheep halters, and offshore kelp farms.

Her Mytholmroyd-based company Sustainable Rope offers a sustainable alternative to traditional plastic rope, reducing microplastic pollution, by championing British wool and its value.

Kate is passionate about supporting British sheep farmers and championing wool and its value. She says not only does sourcing all her wool through the auction – where graders take about four years to learn their skill – give her both assurance and insurance, it also allows her to support all 35,000 sheep farmers as opposed to just one if she were to buy direct from the farm gate.

Kate, who was elected as a British Wool board member in 2021, is passionate that her rope can move from farm to consumer while being made solely in the UK, meaning she has oversight of the entire supply chain. The long-term aim is for her innovation to increase demand for wool, and, in turn, increase the return to Britain’s farmers.

She believes that in the face of tough wool prices and a difficult market the key is investing energy into innovation.

“Things must change because the market is not sustainable as it is. We know what we can head for but it’s the how we do it that is the issue. I want to empower farmers. Currently, their return is resultant of the market, so we’ve got to change that.”

The way to do it, she says, is to look beyond the traditional markets for wool and highlight the scope of innovation the fibre offers.

“There’s a lot of research around innovation within the product, but we need innovation in new markets that have never used wool, which is where I’ve positioned my company,” she adds.

Bowmer + Kirkland construction site first to power tower crane and heavy equipment with batteries

Bowmer + Kirkland believes it is the first construction company to use battery energy to power most of its equipment on site.

A project at West Bar, in Sheffield, is probably the first site in the country where the tower crane, mast climbers, hoist and temporary site supply to two buildings are all powered by only two batteries – this has saved 27 tonnes of CO2 in just the first two weeks of using this energy source.

The successful implementation of this sustainable energy is the culmination of years of research and development.

Initially B+K’s research and persistence recognised the carbon savings associated with the Punch Flybrid kinetic energy recovery system.

Developed for Formula 1 to recover energy from regenerative braking systems, the Punch Flybrid system uses a robust and durable flywheel energy storage system to significantly downsize generators powering tower cranes and other dynamically used equipment on site.

Construction site generators are inherently inefficient. Adding a flywheel to store kinetic energy, however, introduces efficiency, dramatically reducing fuel consumption and reducing carbon emissions.

Generators on construction projects are typically sized for peak loads. However, most of the time they run at low load factors, which results in poor fuel economy and high emissions. This is especially the case when running equipment like tower cranes, which oscillate between total idleness and full power.

On average B+K runs 20 tower cranes and 200 mast climbers on their sites at any one time; traditionally powered by generators. Bowmer + Kirkland conducted months of research into Flybrid feasibility and testing with their supply chain and instigated a first year roll out of the tech nationally across their construction sites ensuring B+K were the first UK contractor with multiple Flybrid units on one site.

From January – July 2023 using the Flybrid product alone, Bowmer + Kirkland saved 450 tonnes of carbon/172,000 litres of fuel.

Pushing the boundaries further led the team, in conjunction with equipment supplier Select, to investigate the possibility of battery power to enhance sustainability on site. As a result B+K was the first to power two tower cranes from one battery unit on trickle charge using a mains grid connection – this saved 98 tonnes of CO2 in just three months.

That pilot scheme was so successful that on their West Bar site in Sheffield, they are powering the tower crane, mast climbers, hoist and temporary site supply to two buildings via only two batteries on trickle charge. They are now looking into to using green renewable power to trickle charge the batteries – which would reduce carbon emissions even further.

To enable B+K to do this and change long-held attitudes and habits, they organised a number of pilot trials for the Flybrid and battery technology, involving all parties to demonstrate reliability and capability in reducing fuel consumption and realise carbon savings.

To support this, the team formulated a self-populating carbon spreadsheet and included all combinations of lifting equipment to demonstrate to site managers the fuel and carbon savings, which was instrumental in persuading them to adopt the technology. Equipment was tested to operating limits which was only made possible by the technical experience and dedication from B+K’s group crane team to drive innovation.

Flybrid and battery technology is now a standardised offering across Bowmer + Kirkland sites.

Bowmer and Kirkland director, Matthew Cruttenden, said: As the company strives for our zeroby40 target, our group crane team has been instrumental in changing attitudes and increasing awareness and understanding of sustainable energy sources available.

“Traditionally, construction sites have powered plant with diesel-guzzling generators. Our operational staff now understand the possibilities open to us to protect the environment, reduce our emissions and save money.

“Our development and collaboration with specialist suppliers has revolutionised the way we power our site operations – who would have thought we could power an entire site by plugging into a couple of battery units on trickle charge? Within the construction community we are leading the way with our research and innovations.”

Under new rules sellers of illicit cigarettes could face £10,000 fine

With more than 27 million illicit cigarettes and 7.5 tonnes of hand-rolling tobacco seized under Operation CeCe in its first two years, new powers have been introduced for anyone selling such products.

From now on penalties of up to £10,000 for any business or individual who sells illicit tobacco products. The sanctions will bolster the government’s efforts to tackle the illicit tobacco market and reduce tobacco duty fraud.

The new powers will also see Local Authority Trading Standards given the ability to refer cases to HMRC for further investigation. HMRC will administer the penalties and ensure the appropriate sanction is applied and enforced.

Operation CeCe is a joint HMRC-National Trading Standards operation which has been working to seize illicit tobacco since January 2021.

Nis Bandara, HMRC’s Deputy Director for Excise and Environmental Taxes, said “Trade in illicit tobacco costs the Exchequer more than £2 billion in lost tax revenue each year. It also damages legitimate businesses, undermines public health and facilitates the supply of tobacco to young people.

“These sanctions build on HMRC’s enforcement of illicit tobacco controls, will strengthen our response against those involved in street level distribution, and act as a deterrent to anyone thinking that they can make a quick and easy sale and undercut their competition.”

North Yorkshire Council pledges to level playing field for contract-seeking SMEs

North Yorkshire Council has pledged to give more support and guidance to SMEs to help them compete effectively with larger competitors to secure public sector contracts.

The council expects to spend more than £600 million spent on contracts with the private sector during the current financial year alone.

A small and medium-sized enterprise called Go4Growth was recruited in 2021 to design a programme to bridge the gap between smaller enterprises and the public sector. This work has helped smaller, local and diverse organisations to develop the practical skills to enable sustainable growth through accessing and securing opportunities with the public sector.

Go4Growth offers free support for companies aiming to work with the council and other public sector organisations. Through this partnership, 250 suppliers were supported in 2021/22, with 86 per cent categorising themselves as micro-businesses or sole traders and 14 per cent stating they are small businesses.

Go4Growth’s director Gill Askew said: “Since we were recruited in 2021, we have built strong and productive working relationships with the public sector in North Yorkshire.

“We have been able to deliver support to small and medium-sized enterprises and voluntary and community and social enterprises across the county to hundreds of local providers.

“The single council will provide greater access to a broader marketplace of providers who want to secure growth within the public sector, both directly and indirectly with the authority.

“It means that we will be able to increase the breadth of support we are giving, ultimately supporting more local economic development.

“We’re really excited about what the future has to offer and we’re looking forward to providing more support to help North Yorkshire’s businesses and voluntary organisations to grow.”

The launch of a single authority to cover the whole of North Yorkshire will bring in millions of pounds of savings by having contracts for a single organisation, helping counter the challenging inflationary pressures amid the cost of living crisis.

Council leader Carl Les, said: “We recognise the important role that smaller businesses play in the success of North Yorkshire’s economy, bringing in vital investment and supporting tens of thousands of jobs.

“As a council, we have a firm commitment to helping these smaller enterprises flourish, and they are key to helping us deliver services to hundreds of thousands of residents across the county.”

North Yorkshire’s economy is heavily slanted towards smaller businesses and there is a total of more than 32,700 micro, small and medium-sized enterprises alongside 90 large businesses in the county.

Contracts with small and medium-sized enterprises worth hundreds of millions of pounds were signed by the previous eight authorities that merged to form North Yorkshire Council, which launched at the start of April.

The former North Yorkshire County Council alone spent £549 million on procurement during the last financial year, including £269 million with small and medium-sized enterprises – 55 per cent of the total figure.

Of the 5,021 suppliers which the county council worked with during 2022/23, a total of 2,765 were small and medium-sized enterprises and the ambition is to increase this number even further with the launch of the new authority.

In 2022/23, 55 per cent of the total spend was within the local economy, which resulted in the county council working with 2,145 local suppliers. A total of £62 million of the county council’s spend – the equivalent of 11 per cent – was with 703 regional suppliers.

By joining up services and maximising spending power in its first few years, North Yorkshire Council is set to recoup between £30 million and £70 million, which will become annual savings.

However, the high rate of inflation and growing demand for services such as adult social care will mean difficult decisions and creative solutions will be needed to realise the multi-million pound savings.

Deputy leader and executive member for finance, Cllr Gareth Dadd, whose portfolio includes procurement, said: “The opportunities that we have now as one council to provide efficiencies of scale by signing contracts for a single organisation are set to bring millions of pounds of savings.

“These will be especially important as we face such a challenging financial situation with the current level of inflation and the cost of living.”

In the past 12 months, one of the largest procurement exercises, the Social Care Approved Provider Lists which delivers support to people in residential settings, their homes or providing day services, has been secured.

The work involved in the exercise highlighted some of the barriers which the voluntary and community and social enterprises and small and medium-sized enterprises report when trying to do business with councils.

A tailored engagement programme was developed to support providers through the application process and encourage more smaller enterprises to engage with the public sector. So far, 70 per cent of providers – a total of 216 – which have been appointed to the list in North Yorkshire are small and medium-sized enterprises.

The new Procurement Bill, which is due to be introduced by the Government within the next year, will provide more opportunities of making procurement quicker, simpler and more transparent while still delivering value for money and including specific criteria in deciding the award of contracts.

It is hoped that this will level the playing field for small and medium-sized enterprises and drive economic growth across the UK by reducing costs and making it easier for businesses which are bidding for contracts.

Scunthorpe-based food group wins national accolade

2 Sisters Food Group has been named National Egg & Poultry Awards Processor of the Year winner 2023.

Backed by the British Poultry Council and British Egg Industry Council, the awards celebrate, honour and exhibit best practice and excellence within the Egg and Poultry sector.

To win the award the company’s UK Poultry and Agriculture teams needed to demonstrate that 2 Sisters is an efficient business which has great relationships with our retailers and great partnerships with our suppliers. We’re committed to investing in our colleagues and machinery and able to show that our investments are delivering results.

Nick Davies, Group Agriculture Director, said: “We’re really delighted to win this award and be honoured as Processor of the Year. It’s a testament to all the hard work the 2SFG and supply chain partners have put in over a long period of time to create the right environment to move our standards even higher.

“Our delivery of the Oakham Gold higher welfare chicken also shows the teamwork of the wider orgnisation and our partners, that includes our customers, our commercial teams, our technical partners and the end to end project team. Together we have produced a great tasting, quality product that meets consumer expectations and reflects our willingness to deliver new brands to give our customers and the British shopper the widest possible choice for chicken.”

Business-boosting initiative comes to an end after seven years

The Collaboration 4 Growth project providing business support to SMEs who trade on a business to business has come to an end after seven years during which it has supported more than 350 businesses in nd around Lincoln.

The project was run through a collaborative effort involving Lincoln BIG and the Lincolnshire Chamber of Commerce, and funded by the European Regional Development Fund.

Charlotte Watson, Deputy Chief Executive at Lincolnshire Chamber of Commerce said “The C4G project has been an invaluable opportunity to support business growth for SME’s in West Lindsey, North Kesteven and the City of Lincoln. The variety of business support, free workshops and grants provided have proved a successful and required tool to help local start-ups and SME’s take the next step and grow.”

“A huge part of C4G was the revenue and capital grants available for micro, small and medium businesses. We are delighted to have awarded 123 businesses with more than £605,000 in grants, providing 60% of the total cost of staffing, equipment, and support. A grant beneficiary from Electric Egg Ltd stated “It successfully created logistical, financial, and creative benefits for us.”

Alongside the grants, C4G provided 242 businesses with 12 hours of support, this involved free business advice on a one-to-one basis, or in the form of workshops and /networking opportunities.

A workshop attendee from Five Rounds More commented ““It has provided a basic understanding which I’ve been able to use to go forward and learn more from, as a steppingstone to developing a better marketing and social media interaction for my customers.”

Workshops covered a variety of topics ranging from Social Media 101, Photography, Paid Advertising, Media Communication & Awareness, Presenting with Excellence and much more!

The project aimed to create new opportunities for SME’s and successfully created 68 new job roles and 13 new enterprises.

Yvette Mills, Lincoln BIG’s Project Manager, stated “I have thoroughly enjoyed working on the project and have made a lot of new connections from a wide variety of businesses through hosting workshops, conferences and networking events. It has been a lot of fun and very rewarding supporting the businesses both through the grant scheme and also through workshops.”

Streets Chartered Accountants covers its Charity Golf Day, farmland inheritance tax reliefs, NICs and more in new news roundup

Streets Chartered Accountants covers the success of its Charity Golf Day, inheritance tax reliefs applicable to farmland, National Insurance Contributions, and more in its new news roundup.

Golf Day Secures Hole in One for Air Ambulance

Streets was delighted to host its tenth annual Charity Golf Day on Friday 7th July, raising a record amount of more than £8,000 for the Air Ambulance. The total amount fundraised will be divided between three regional charities; East Anglian Air Ambulance, Lincolnshire and Nottinghamshire Air Ambulance and Yorkshire Air Ambulance. The winning team on the day was Varley Orthopaedics with Civil Recovery Solutions coming in second and The One Group in third place. The winners of the Longest Drive and Nearest the Pin competitions were Adam Aisthorpe and Paul Ward respectively… Agricultural Schemes and IHT ReliefsThere are two main reliefs for inheritance tax that can apply to farmland. These are Agricultural Property Relief (APR) and Business Property Relief (BPR). APR applies to the agricultural value of the land and applies where it is occupied for the purpose of agriculture. The length of ownership and occupation required depends on who occupies the land; if it is occupied by the owner or a company they have a controlling holding in then the period is 2 years, if occupied by another, e.g. a tenant, then the period is 7 years… Retrospective Voluntary National Insurance ContributionsThe UK government has announced a further extension to the deadline for making retrospective voluntary NICs covering the period from April 2006 onwards. If there have been gaps in your National Insurance Contributions, there is a possibility that you may not meet the qualifying year requirement to receive the full state pension (dependent on the size of the gap and how close you are to state pension age). Retrospective contributions can fill these gaps and ensure the full state pension is received… Could you and your business get greater value from your Year-End? Not to be confused with the tax year-end which is 5th April each year, the year-end date for your business is specific to you. The largest proportions of businesses tend to opt for either a 31st December or 31st March year-end. Typically, most businesses, when it comes to their year-end will focus primarily on finance and financial reporting, with Directors, owners and shareholders keen to know the financial outcome… Streets Summer Newsletter 2023It is looking as if the only respite we will get from ongoing economic challenges this year is warmer weather. Hopefully, readers of Streets’ newsletter will find something of interest that will help ease the burdens of rising fuel, food and other energy prices and provide business readers with ideas to meet their current challenges. As always, if you would like more information regarding any of the issues Streets has flagged in this summer edition, please pick up the phone… SmartMoney – July/August 2023SmartMoney is the bi-monthly magazine from Streets Financial Consulting plc, Streets Chartered Accountants’ independent financial planning arm, full of news and helpful information on personal financial planning…4 ways to create a better workspace

The environment your staff work in has a big impact on their mood and productivity. Lincolnshire-based commercial design and fit out company APSS looks at four ways to make the office as appealing as possible.

Here are some ideas to consider when it comes to your office design:

Keep things simple

Technology means we now carry our work with us wherever we go, via laptops, tablets and mobile phones. With so many distractions already lowering productivity, companies don’t want to add to this. Keeping it simple is a good way to reduce distraction. Take time to declutter the office, a clean environment helps promote productivity. Make sure you have enough storage solutions for everything. Nice views, daylight and simple written graphics or sculptures are great. They aid creativity and lift the general mood. However, big TV screens, busy artwork or loud colours often go the other way.

Flexible noise

Different people work better with different noise levels. Consider what’s right for your office and your staff. Is it appropriate to play music? Do people have the need for headphones or do people need silence at certain points of their working day? Consider the neurodiversity of your employees. Neurodiversity is a topic that has seen more attention lately and with good reason. If people have certain triggers within an environment, every step needs to be taken to address this from an employer’s perspective. Creating a certain mood within a working space is integral to motivating employees. For business owners, it can increase employee productivity. Glass walls or partitions can be a great addition to an office space. Installing them creates a natural divide to give people privacy and quiet. However, they still give the feel of an open space.