Business Leaders discuss what’s needed to drive Hull’s regeneration

Planning permissions secured for ground-breaking renewable-focused hub

Leeds opens consultation on plans for George Street beside Kirkgate Market

Clifton Business Park ambitions take step forward

Duo of Yorkshire industrial assets sold for £16.1m

Yorkshire Water signs ten-year renewable power deal with Shell Energy

Goole business could share in £4m to spruce up town centre premises

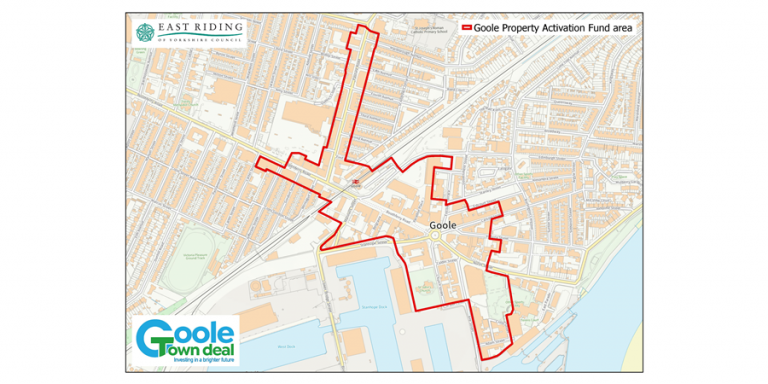

The Goole Town Deal programme has launched a £4million Property Activation Fund grant scheme to encourage developers, property owners, and tenants to make improvements to buildings in Goole town centre and bring empty or under-used sites back into use.

The Property Activation Fund aims to make the town centre a more attractive and appealing place to invest in and do business by restoring, refurbishing and, ultimately, reinventing buildings that are empty, under used or in a poor state of repair. A total of £4.175 million is available to help transform buildings and sites within the town centre and will be allocated to applicants in three different size brackets – small (up to £20,000); medium (£20,000 to £314,999); and large (above £315,000). Funding is available to businesses, charities, voluntary sector organisations, learning establishments and public sector organisations in several postcode areas within the town centre. Full details of the eligibility criteria is available in the Property Activation Fund Guidance Document, which will be made available to prospective applicants. More information is available via email to goolepaf@eastriding.gov.uk. They will then be able to complete an Expression of Interest form, outlining details of their business/organisation and the project that they’re seeking funding for. The information provided will be subject to a series of checks to ensure that the business and proposal are eligible. Once this has been confirmed, eligible applicants will then be invited to submit a full application, using the Guidance Document to help them. The Property Activation Fund team will also be attending and arranging further events in the Goole area during the coming months, details of which will be widely publicised to enable as many local property owners as possible to go along and find out more. Andrew Hewitt, Regeneration Project Manager at East Riding of Yorkshire Council, said: “There are two stages to the application process and the first of these is a really quick and simple Expression Of Interest stage. Eligible applicants will then be asked to submitted a full application, which will be appraised by the delivery team and then considered by the Property Activation Fund Investment Panel. Both stages of the application process can be completed via the council’s online Flexigrant Portal. “We’ll be looking to allocate grants of various sizes to sites and premises within the eligible postcode areas as part of our aim to regenerate Goole town centre, finding new uses for sites and creating new attractions to boost footfall and fuel economic growth.”Advertising creativity comes under the spotlight at Yorkshire event

Creativity in advertising will come under the spotlight next month when three Yorkshire digital agencies join forces for an event which is attracting industry colleagues and clients from across the region.

Hull-based 43 Clicks North will host the seventh edition of its Power Hour at Social in Humber Street, Hull, on Friday 7 July. Speakers will include Tom Berridge, the firm’s head of paid media, plus Dave Ellis, co-founder of Leeds-based Everything’s Fine, and Callum Devine, co-founder of cbsocial in Middlesbrough. Power Hour was launched by 43 Clicks North founder and MD Mike Ellis as a post-pandemic initiative to put top tech talent from East Yorkshire alongside some of the key players from bigger cities. Tom will pose the question “Is There Room For Creativity in PPC” and will outline how he uses data creatively to solve problems for clients and maximise results. Dave will discuss the work of his two-man remote design and motion studio that focuses on making things move, from explainer animations and social content to app demos and showreels. Callum, who specialises in Facebook and social ads, sees creativity as key to success and client performance for his firm’s work in Meta advertising and content creation. Mike said: “Numbers at Power Hour are increasing from one event to the next as we all work to bring together people from different agencies to build a digital community and develop skills in the sector across Yorkshire and the North. “Demand for this event is higher than ever but that’s not surprising because creativity really counts when times are hard and budgets are tight, and we’ve got three speakers who all work in advertising and have that at the heart of their skill set.” Power Hour is a free event and taks place at Social, Humber Street, Hull, at 1pm.