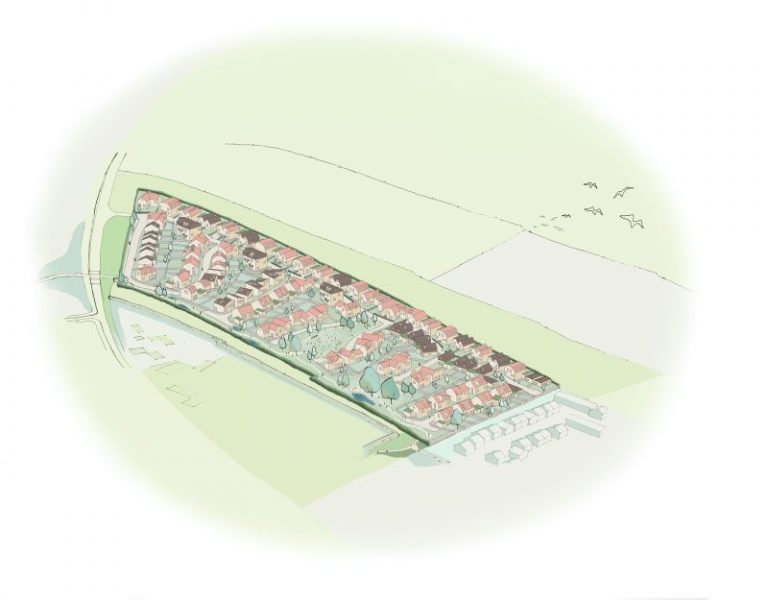

Leeds-based commercial property company Industruct has acquired a disused food production facility in Blaenau Gwent for £1.25 million, marking its first investment in the South Wales market.

The 116,520 sq ft site, located near Abertillery, was formerly operated by Tillery Valley Foods, which ceased trading following administration two years ago. The asset had remained vacant since.

Industruct plans to transform the site into a series of refurbished industrial units aimed at SMEs in manufacturing, production, and logistics. Units will start at 5,000 sq ft, with flexible layout options to meet varying operational needs.

Refurbishment work has already begun, with a focus on reconfiguring the property to enable multi-tenant occupancy. The move signals Industruct’s strategic expansion into regional markets and aligns with continued demand for modern industrial space outside core urban areas. Global consultancy Knight Frank advised the seller on the transaction.