Business managed service specialists Connectus Business Solutions has made another acquisition as it grows across the north-west.

In a major new deal, the Doncaster firm has acquired the entire IT managed services customer base of The PC Support Company (PCSC), based in Scunthorpe.

It follows Connectus’ acquisition of Mango Tech in September and IT 4 Growth in April.

Roy Shelton, CEO of the Connectus Group, said: “As part of our ambitions for organic and inorganic growth plan, I am delighted to announce we have acquired the IT managed services customer base of PCSC.

“This brings together around 50 businesses who consume a very similar range of products, principally the Microsoft stack, which we can expertly integrate.

“The deal benefits all our customers and will ensure they get access to a great range of hosting, telephony, and cyber security managed services enhanced in a cost-effective, robust and secure manner.”

Gainsborough firm invests £1m in emission reduction technology

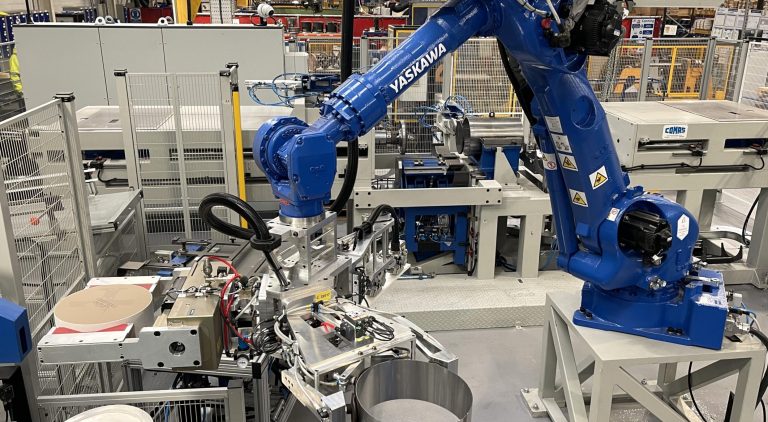

Gainsborough-based Eminox has invested more than £1m in machinery to help meet customer demand for its exhaust after treatment systems.

The investment has seen significant operational improvements in its manufacturing areas to allow the installation of key equipment which enhances production facilities and brings tangible benefits to all our stakeholders.

The Comas automated canning line which provides flexibility and consistent quality in volumes to suit customer demand for our exhaust aftertreatment systems, helping to support customers across many industry sectors including maritime, on road, power generation, agriculture, non-road mobile machinery, and rail.

This is complemented by a Comas servo press with a capacity of 80 tonne, delivering enhanced features including precision control over both speed and position and the large bed area can accommodate larger tools meaning greater flexibility for customers.

The press is driven by twin servo motors rather than being hydraulically powered. This gives greater flexibility in meeting operational and production targets for pre-forming and final forming strokes and unique programming for each tool to ensure quality and precision in manufactured components.

Finally, a large-scale exhaust aftertreatment welding platform has brought an enhanced level of accuracy to production capabilities, allowing us to support some of the largest engine manufacturers in the world with precision engineering, particularly in the maritime and power generation sectors.

The installation of Indeva lifting equipment has reduced the amount of manual lifting and manoeuvring of our products carried out by our workforce through assisted lifting for a seamless operation.

Additionally, the installation of Kardex units to streamline our inventory management and create more manufacturing space also reduces potential risks for our team, bringing HSE benefits.

Greg Kent, Operations Director, said: “These investments support our vision for the business and also our Environmental, Social and Governance values that are helping to determine the future of the business.

“By improving efficiencies, reducing risk, and considering the impact we make in all aspects of our business operations, we will maintain our reputation as a pioneer of emissions reduction technologies and as a responsible supplier, customer and employer.”

Motor group expands its presence in Lincoln with move to larger premises

Dack Motor Group has invested £100,000 in relocating its car and van body repair and restoration operation from a 3,000 sq ft building in Lincoln’s Doddington Road to a 9,500 sq ft unit in Station Road, North Hykeham, formerly occupied by Cromwell Tools.

The motor company’s new site, part of Lindum Group’s property portfolio, includes a spray booth big enough to accommodate the largest vans so that painting can be done in one go without the need to remove panels.

There is also new office and reception space, and the generous floor area means there is ample room for customers’ vehicles, as well as supplies and tools.

Five vehicle technicians, a receptionist and manager Dave Hornsey work at the new body shop and there are plans to take on two more technicians and an extra receptionist.

Mr Hornsey said: “Since re-locating, we have already had so many people asking us to take more work on, whereas previously we did not have the space to do it. The new spray oven is 12ft high which means it’s big enough to get a Mercedes Sprinter in for painting – previously we had to remove the panels for painting separately.

“We use less gas as a result so it’s a greener way of working. Our technicians are qualified and experienced in repairing electric, diesel and petrol vehicles. All paint is mixed on site and all metal, oils and bumpers are recycled.”

Goole-based Venari Group announces £10m equity investment

Goole-based Venari Group, which makes emergency vehicles, has announced a £10m equity investment from shareholders to secure long-term growth and support for its customer-focused innovation programme together with skilled British manufacturing jobs.

Managing Director Mark Brickhill said: “Venari’s ambulances are built and tested to the very highest standards which are subject to VCA Conformity of Production auditing once certified. Our paramedics, crews and patients deserve nothing less and I am proud of our team of engineers, skilled coachbuilders, auto-electricians and fabricators who together have made this possible.”

Ensuring these high standards sees the group uniquely placed to embark on significant growth in ambulance production for the NHS, its supporting private fleet operators, and export customers. Deliveries this financial year will top 800 vehicles, with the ambition to grow further in the coming years following the latest investment, together with a likely consolidation of production at the Group’s site in Goole which this year celebrates 35 years of British manufacturing. Venari’s latest innovation is an industry-leading all-electric Ford Transit Patient Transport Service vehicle which was unveiled at the Emergency Services Show, at the NEC, in September.

To ensure that the business remains cost-competitive at Goole, Venari proposes to end production at its Brighouse, with all their shop-floor workers being offered comparable roles at Goole, together with financial incentives to retain them. Mr Brickhill added: “This investment will allow us to offer more highly skilled British jobs, together with a growing apprenticeship programme, in Goole which is the UK’s oldest, and largest, ambulance manufacturing site. We are starting the employee consultation process today to ensure that together we both maximise job retention and deliver the best value to our customers.”

Venari’s envisages significant further investment at Goole driving production efficiencies, increased capacity, speed and improved customer service, whilst streamlining operations and supporting the Group’s commitment to being carbon neutral by 2027. The company’s investment plans will see it continue to develop as a specialist vehicle converter. This year already over 100 armoured vehicles have been delivered to Ukraine, a state-of-the-art Drone Command Vehicle was showcased at the Emergency Services Show together with partner Heliguy™, and the Venari Team are currently developing a new high-tech range of Rapid Response Vehicles using light-weight materials from the aviation industry to minimise weight.

The company has also announced it is in negotiations over the sale of its firefighting division to former CEO Oliver North, securing some jobs in the Brighouse area, following a period of due diligence and employee consultation. Mr North’s new business, North Fire Engineering, will then continue vehicle production and equipment distribution into the firefighting industry supported by its world-class engineering, production and sales team.

Mr Brickhill added: “Venari will continue to invest in Yorkshire with over 90% of our supply chain spend supporting other British businesses. That is why there is a 2.4 times return for every pound invested by the Government in Britain. I therefore urge the UK Government to buy British, which will both protect skilled manufacturing jobs and support our economy.”

Tevalis secures £11.5m investment for expansion

Tevalis, the leisure and hospitality electronic point of sale (EPOS) solution providers, has secured an £11.5 million investment from BGF.

Headquartered in Hull and with more than 800 customers across 2,000 sites, Tevalis provides EPOS solutions to help leisure and hospitality operators manage, streamline and deliver their food and beverage operations.

Founded in 2005, by CEO James Cook, Tevalis has scaled organically to more than £8 million of annual sales. With BGF’s funding, the business has ambitions of trebling recurring revenues over the next three to five years. This will be supported by additional investment in sales and marketing, product and partners, as well as looking at potential opportunities for international expansion.

James Cook, founder & CEO of Tevalis, said: “It was important for us to find an investment partner who understood our sector and could take a long-term, patient view. We also wanted an investor who could help us scale and take the business to the next level – in BGF, we have that and we are looking forward to leveraging their network over the coming months and years to support our growth.”

As part of the deal, Rob Caul has been appointed as non-executive chair, following an introduction via BGF’s Talent Network – one of the largest groups of board-level non-executives in the UK and Ireland.

Caul brings with him a wealth of experience in scaling innovative software businesses, having founded, scaled and taken Kallidus, a HR software business, through multiple rounds of private equity investment.

The deal was led by Rob Johnson and James Baker – investors in BGF’s Yorkshire and North East team.

Rob Johnson, investor at BGF, said: “We’re excited to be investing in a high-quality technology business of scale, with an ambitious growth plan.

“Operating in a fragmented market, James and the team have done an impressive job in establishing the Tevalis brand, with clear opportunities to increase market share, both at home and abroad. We look forward to building on the excellent relationship we’ve built with James through the deal process.”

National Park Authority names Derek twine as new Chair

Former chief exec of the Scouts Derek Twine has become the Chair of the Yorkshire Dales National Park Authority replacing Neil Heseltine, who has completed a four-year term.

Mr Twine was elected today by the 25-Member board of the National Park Authority, and said the National Park Authority had much to do, working with partners on nature recovery, carbon reduction, rights of way, helping local councils to provide more affordable housing and supporting young people.

“Why did I put myself forward for this role? Because there is so much good already being done by the National Park Authority, right across the Dales, yet there’s so much more that needs to be done – and that has to be done,” he said.

“The most important issue we are working on at the moment is the development of the new five-year National Park Management Plan. This will set out our plans, and those of many other organisations who operate in the National Park. The coming years are crucial as we attempt to reverse the decline in nature and mitigate against the worst impacts of climate change.

“As a planning authority we are also working on a new Local Plan, which will set out policies for development in the National Park for the next 15 years.”

Mr Twine said he would be keen to draw on his experience leading the Scouts. “Young people are the future. There’s even more we can do on apprenticeships, on building on the success of our youth volunteering programme, and on making sure young people are able to shape our policies and plans.

“Then there are our bread and butter work programmes to keep up: rights of way maintenance and access, development management and farm conservation. On the latter, we want to build on the success of the Farming in Protected Landscapes programme and engage with a new Government on its plans for land use. In particular, we need to ensure the Environmental Land Management schemes are working well for upland farm businesses.”

£5.8m project redeveloping vacant York office building into residential accommodation completes

A £5.8 million project to redevelop a vacant office building into city residential accommodation in York has been successfully completed.

York-based property specialist Helmsley Group, the owner of the three-storey Gateway Two building located in Holgate Business Park, has led the project with development work delivered by Artium Construction.

The 14,472 sq ft building has been transformed into 35 modern one-bedroom apartments, offering both permanent and rental accommodation.

Each apartment features open plan living with an integrated kitchen, contemporary bathroom, air source heat pump and large windows.

Tom Riddolls, development surveyor at Helmsley Group, said: “Helmsley Group has an enviable reputation for completing change of use projects of this type alongside delivering affordable residential accommodation for people in York and beyond.

“With a scarcity of residential space across York, we are already seeing demand from residential buyers and buy to let investors at Gateway Two. The development is ideally placed to provide a much needed offering to the city and its residents, and will bring a host of benefits to the local economy.”

Garry Shaw, director at Artium Construction, added: “The valuable repurposing of office space to residential, particularly in key city locations such as York where suitable accommodation is at a premium, is a priority for Artium Construction and we were delighted to join Helmsley Group on this project.

“Gateway Two further evidences how our expertise and experience can have a transformative impact on the built environment and with an established and healthy project pipeline, we are confident of delivering continued excellence for our client partners, including Helmsley Group.”

Partners on the project include Walker Dsp Architects, Ousebank Consultancy, Gallagher Planning, WA Consulting Engineers, HG Consulting Engineers, RDS Safety Management, LHL Group and Cook Brown.

Rats run riot to raise money for East Yorkshire charity

Hull Trains is supporting a sculpture trail which will see six-foot tall rats across East Yorkshire raising money for the Daisy Appeal charity.

The company has partnered with the ‘Mischief of Rats’ exhibition, which will be installed in the summer of 2025, as a tribute to the Hull band ‘The Rats’. The rockers included guitarist Mick Ronson, who was also famously part of David Bowie’s ‘Spiders from Mars’.

The launch of the project coincided with the annual Humber Business Week. All proceeds will go towards The Daisy Appeal, a charity based at Castle Hill Hospital in Cottingham, where it raises funds to help with the detection of cancer, heart disease and dementia.

Lou Mendham, Service Delivery Director at Hull Trains, said: “The Daisy Appeal is an inspirational charity and we’re very pleased to play a small part in supporting them providing cutting-edge research and state-of-the-art facilities. We are proud to be the first organisation to partner with this great project and looking forward to it being installed next year.”

Previous trails have attracted many thousands of extra visitors, who travelled to the city to see unique and colourful sculptures decorated by a wide variety of artists.

Rick Welton, Co-director of the project, said: “We’re thrilled that Hull Trains have come on board with this initiative. This is our most radical animal sculpture trail yet and we couldn’t do this without the support of brilliant local businesses.

“Our previous trails Puffins Galore, A Moth for Amy and Larkin Toads have raised hundreds of thousands of pounds for charity. We’re hoping for a repeat of that success when we auction off the rat sculptures at the end of 2025.”

Claire Levy, Fundraising Manager for the Daisy Appeal, said: “We’re excited that A Mischief of Rats will be raising substantial funds in such an imaginative and high-profile initiative. The auction proceeds will be vital to improve the life chances of patients living with cancer, heart disease and dementia in our region.”

Pat Coyle, Chair of Humber Business Week, said: “It was exciting to have the sculpture trail launched during Humber Business Week to celebrate the life and times of one of Hull’s great music legends, Mick Ronson.

“The support that Hull Trains have given to this remarkable project is a testament to their ongoing engagement with the cultural sector and highlights the importance for organisations to support local initiatives wherever they can.”

Bed manufacturer relocates Bradford manufacturing base

Bradford-based Wow Lifestyle, which manufactures beds and mattresses for leisure and hospitality sector clients such as Haven Holidays, Parkdean Resorts, Butlins and Scape student accommodation, is relocating its manufacturing base within the city.

The firm, which employs 22 people in Bradford, is relocating from its 20,000 sq ft premises at Wyke Mills and has acquired the historic 36,500 sq ft Stone Hall Mill in the Eccleshill area of the city.

Wow Lifestyle Managing Director, Darren Stega-Jones, said: “We are really keen to stay in Bradford after 15 years in the city. Having our own larger building means we can put down more permanent roots and will enable us to invest in sustainability and to switch to using renewable energy.”

He added: “We have just appointed one new experienced upholsterer to our team and have plans to create further new jobs in the coming months as we develop and expand our product range.”

The four-storey Stone Hall Mill was built around 1850 and was originally used as a woollen mill. Following a refurbishment programme, Wow will use its new premises to manufacture its range of beds and mattresses.

Leeds-based GV&Co acted on behalf of Wow in its purchase of the property. Eddisons acted jointly for the vendor with Bradford property agent Sharma Williamson.

ABP joins startup accelerator programme

Associated British Ports has joined the ‘Energy Ventures Accelerator’ to help promising startups scale their businesses in high-growth energy sectors such as hydrogen, floating wind and low-carbon fuels.

The Energy Ventures Accelerator will be delivered in partnership with Plug and Play, the world’s leading innovation platform and venture capital investor. ABP is the first UK port operator to partner with Plug and Play, which has a world-wide network of over 550 corporate partners and 65,000 startups in its network.

The announcement comes as ABP recommits to its mission of Keeping Britain Trading whilst signalling its intention to place increasing emphasis on Enabling the Energy Transition. This is underpinned by the company’s commitment to safety, sustainability and its people.

As part of the project, ABP joins Plug and Play’s global network of industrial, energy and technology companies, all with a common interest in connecting with leading-edge innovation in order to diversify, protect and expand their businesses. ABP will focus on developing focused centres for industrial decarbonisation in the Humber, floating offshore wind in South Wales and maritime decarbonisation in Southampton.

With major development sites and a customer base of blue-chip energy, industrial and shipping customers, ABP is uniquely placed to support start-ups access the key demand centres for their products. As they grow, they will have ready access to the port infrastructure needed to export to global markets.

ABP CEO Henrik L. Pedersen said: “The energy transition is both a huge challenge and an opportunity. Partnership and innovation are going to essential if we are to collectively rise to the challenges and grasp the opportunities.

“ABP is excited to use our assets to support the best and brightest companies to prosper, and these companies will be ABP’s customers of the future, bringing good jobs and investment into our port communities, while also supporting the UK’s energy transition and economic growth.”

Working across a wide range of different industries, from transport and sustainability to fintech and energy, Plug and Play is the most active global early-stage Venture Capital investor and seeks to build a globally recognised, open innovation platform, rooted in collaboration between corporates, startups, government and academia.

Kieran Borrett, Director at Plug and Play UK, added: ”I’m thrilled about this partnership because we believe that startups have a lot to gain from working with ABP and their industry partners. Ports are the connector of logistics, heavy industry and energy – they are crucial to UK’s energy transition. ABP’s assets and clear sustainability commitments make them the perfect partner for ambitious start-ups in the energy transition space.”