Manufacturing output volumes fell in the quarter to June, at a similarly steep pace to the three months to May, according to the CBI’s latest monthly Industrial Trends Survey (ITS). Looking ahead, however, firms anticipate that the pace of decline will slow over the three months to September.

Total and export order books remained weak in June, with both balances broadly unchanged from last month and below their long-run averages. Manufacturers indicated that stock adequacy for finished goods fell slightly relative to May, with the balance dipping below the long-run average.

Expectations for selling price inflation eased this month relative to May but remain above the long-run average.

The survey, based on the responses of 335 manufacturers, found:

- Output volumes fell at a steep pace in the three months to June, broadly similar to May (weighted balance of -23%, from -25% in the quarter to May). Manufacturers expect output volumes to decline at a slower pace in the three months to June (-5%).

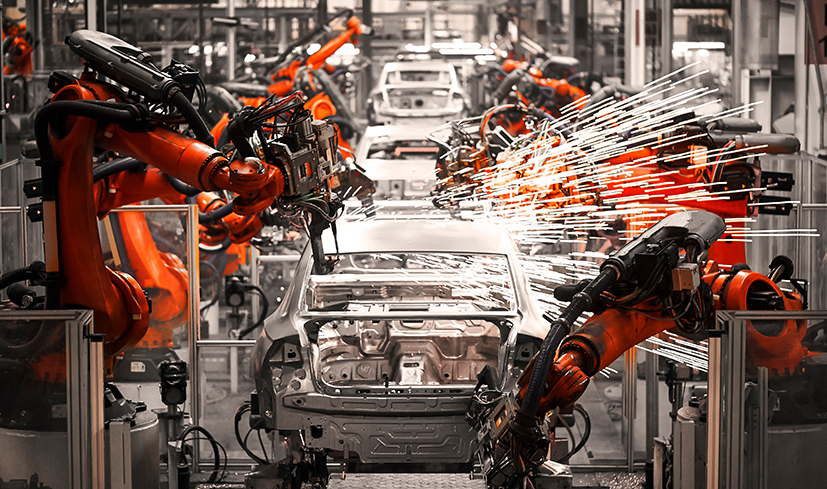

- Output decreased in 14 out of 17 sub-sectors in the three months to June, with the decline driven by the chemicals, metal products and mechanical engineering sub sectors.

- Total order books were reported as below “normal” in June (-33% from -30% in May). The level of order books remained significantly below the long-run average (-14%).

- Export order books were also below “normal” and broadly unchanged from last month (-26% from -29%). The balance stood below the long-run average (-18%).

- Expectations for average selling price inflation eased in June (+19% from +26% in May) but remained above the long-run average (+7%).

- Stocks of finished goods were reported as more than “adequate” in June (+6% from 10% in May), but the balance fell below the long-run average (+12%).

Ben Jones, CBI lead economist, said: “The UK’s manufacturing sector is under significant pressure, contending with high energy costs, rising labour costs, pervasive skills shortages, and a volatile global economic environment. With departmental budgets now set following the Spending Review, businesses are looking to the government to dismantle barriers to growth ahead of the Autumn Budget.

“Welcome progress has been made with the recent infrastructure and industrial strategies setting a clear long-term economic vision for the UK. This is complemented by a US-UK trade deal expected to mitigate tariff uncertainty, especially for automotive and aerospace, and British Steel’s agreement to provide 337,000 tonnes of rail track for Network Rail.

“With long-term strategies presented, the government must now continue to back up its ambitions with short-term delivery. This includes rolling out welcome energy cost interventions as soon as possible; delivering on Growth and Skills Levy flexibility; and pushing technology adoption to boost productivity.

“Businesses are ready to work in partnership to translate long-term ambitions into near-term investments, job creation and opportunities.”