- £1.6 million to help build 63 new homes in Wakefield’s Civic Quarter.

- £2.2 million for a range of improvements at bus stations across West Yorkshire.

- £13.8 million to improve traffic capacity in Kirklees.

- £7.7 million to support cycling corridors across Leeds City Centre.

West Yorkshire leaders approve over £40 million for roads and homes

Move to Gainsborough puts Polish food firm in prime spot for network expansion

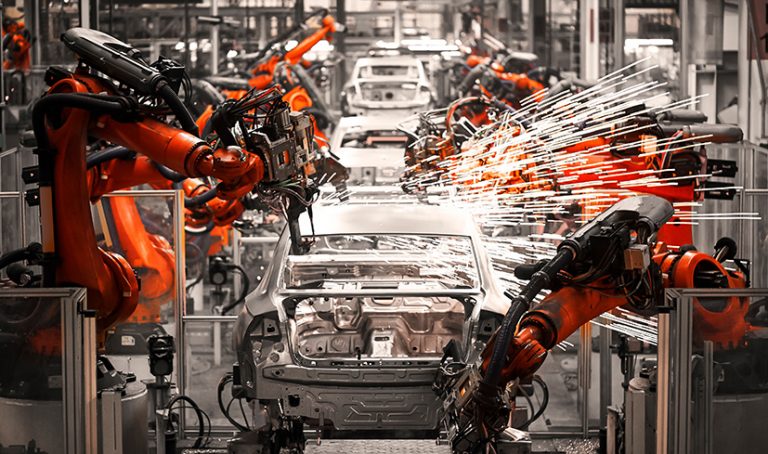

Manufacturing output expectations strongest since 2022

- Output volumes were broadly unchanged in the quarter to July (weighted balance of -3%, from +3% in the three months to June). Firms expect volumes to grow in the next three months (+25%), the strongest expectations since March 2022.

- Output rose in 6 out of 17 sub-sectors, with growth in the motor vehicles & transport equipment, chemicals, mechanical engineering and electrical goods sub-sectors offsetting declines in furniture & upholstery and metal manufacturing sub-sectors.

- Total new orders fell in July, at a similar pace to the previous quarter (balance of -9% from -6% in April). Domestic orders fell through the quarter (-15% from -6%), while the volume of new export orders was broadly unchanged (+3% from -14%). Manufacturers expect total new orders to be essentially unchanged over the next three months.

- Business sentiment fell in July, after rising in April for the first time in nearly three years (balance of -9% from +9% in April). Export optimism for the year was flat after rising last quarter (0% from +6%).

- Investment intentions for the year ahead generally strengthened compared with April. Manufacturers expect to raise investment in product & process innovation (a balance of +18% was the strongest since January 2022, up from +15% in April), in training & retraining (+7%, from +1%), and in plant & machinery (+6%, from +2%). Investment in buildings is set to fall (-11%, from -3%).

- The main constraint on investment was uncertainty about demand (cited by 44% of manufacturers), followed by inadequate net return (35%), a shortage of labour (20%), and a shortage of internal finance (19%). Concerns around the cost of finance have retreated from a 33-year high set in January (excluding the pandemic period) but remain double the long run average (10%).

- Average costs rose rapidly in the quarter to July (balance of +52%, from +39% in April; long-run average of +18%). Costs growth is expected to remain elevated in the quarter to October (+36%).

- Average domestic prices increased over the three months to July (balance of +15%, from +10% in April). Export price inflation also accelerated from April (+22% from +9%, and the fastest pace in over a year). Both domestic and export price growth are expected to slow in the next three months (+2% and +6%, respectively).

- Stocks of work in progress (balance of +4%) rose marginally in the quarter to July, while stocks of finished goods (+2%) and of raw materials (-1%) were broadly stable.

- Manufacturers expect stocks of work in progress (+13%) to rise at the fastest pace in over two years during the next three months, with stocks of raw materials (+7%) and of finished goods (+5%) also set to increase.

- Numbers employed were unchanged in the quarter to July, after falling in April (balance of 0% from -6%). Firms expect numbers employed to rise modestly in the next three months (+16%).

Construction firms want to scrap the levy and the CITB, reveals survey

Phil Nolan to step down as Chair of ABP, with Jon Lewis taking over in September

Wakefield warehouse changes hands in major investment deal

Sunny Bank Mills adds another string to its bow

Kier Group prepares for formal handover of Bradford’s revamped Darley Street Market

Business behind UKREiiF acquired

Infopro Digital, a French business information services company, has acquired Built Environment Networking Ltd, which runs UKREiiF, the event for the real estate, property and infrastructure communities held in Leeds.

This acquisition will strengthen Infopro Digital’s position as an international B2B trade show and event provider in the construction and public sector vertical. In France, Infopro Digital already runs SIMI, a trade show that attracts 26,000 attendees and has strong similarities to UKREiiF.

UKREiiF enhances Infopro Digital’s presence in the UK, where it runs brands such as Risk.net (Risk management), Haynes (Automotive) and Barbour ABI (Construction) and operates five offices with more than 450 staff.

“UKREiiF has become a leading brand in the real estate, property and infrastructure sector, resembling the success we have achieved with SIMI in France. We are excited to partner with the management team and help UKREiiF with its expansion goals,” said Julien Elmaleh, Group CEO with Infopro Digital.

“UKREiiF has become a key event for the real estate, property and infrastructure communities in a short time. We admired how it achieved this by offering relevant content, high-quality networking and a great delegate experience. We also recognise the huge efforts it made to support equality, diversity and inclusion,” said Christophe Czajka, Founder and Executive Chairman of Infopro Digital.

“Infopro Digital is the ideal partner to continue the development of our event, ensuring that the values and quality of UKREiiF are preserved. I am confident that under their stewardship, UKREiiF will reach new heights and continue to serve our community with excellence,” said Keith Griffiths, Founder of Built Environment Networking Ltd.

Huddersfield business gets £20m funding package from HSBC

Huddersfield-based global brand consultancy Principle Global is gearing up for international expansion after securing an eight-figure funding package from HSBC UK.

Principle Global will use the £20 million HSBC UK funding package as a platform for growth into new and existing international markets, targeting the UK, US, Europe & MENA regions. As a result, the company is expecting to strengthen the Management Team for the next generation of growth across multiple offices and generate double digit turnover growth over the next 12 months.

Company Chairman Richard Butterfield said: “As we are dedicated to enhance our offering globally, we knew we had to find a banking partner that bolstered our vision in becoming a world leading brand strategy, experience, design and implementation organisation.“With the support of HSBC UK, we can strengthen our business model in the UK while expanding our teams internationally and collaborating with an even more diverse array of companies in new markets. The next twelve months promise to be incredibly exciting for Principle Global as we embark on this journey of growth.”

Mike Edwards, Relationship Director at HSBC UK, added: “HSBC UK is committed to offering support that empowers businesses to create new jobs, secure new business and reach ambitious international expansion plans. We are excited to be part of Principle Global’s journey and to help them unlock new opportunities across international markets.”

Founded in 1987, Principle Global provides brand consultancy in more than 70 countries and employs over 700 individuals across the company. Principle Global clients include the automative giants Jaguar Land Rover and Jeep, as well as Bupa, Specsavers and O&CC, the largest outdoor retailer in the UK. Principle Global was advised by Squire Patton Boggs during the deal process.