Mayor signs UK Steel Charter to support regional jobs

Manufacturing output falls but firms expect modest rise in quarter ahead

- Output volumes fell in the three months to March, at a similar pace to the quarter to February (weighted balance of -18%, from -19% in the three months to February), and disappointing expectations for marginal growth (+4%). Output is expected to rise modestly in the three months to June (+8%).

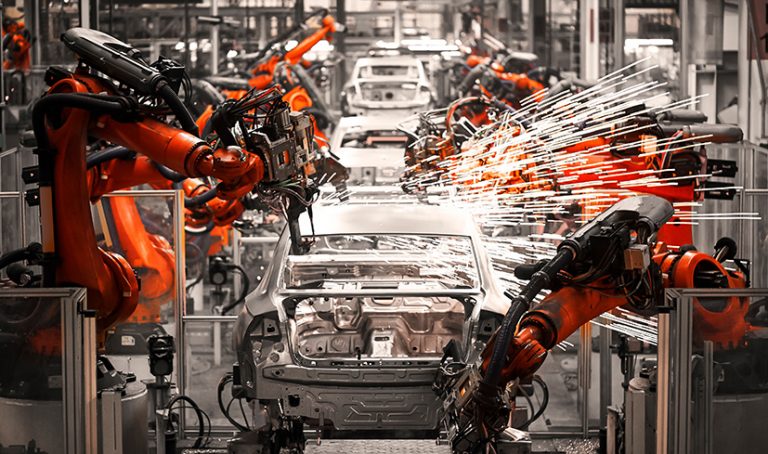

- Output fell in 11 out of 17 sub-sectors in the three months to March, including the chemicals, motor vehicles & transport equipment, plastic products and metal products sub-sectors.

- Total order books were reported as below “normal” in March and were broadly unchanged relative to last month (-18% from -20%) at a level slightly below the long-run average (-13%).

- Export order books were also seen as below normal and deteriorated relative to last month (-29% from -14%) to below the long-run average (-18%).

- Expectations for average selling price inflation accelerated in March (+21%, from +17% in February)—comfortably above the long-run average (+7%) and to the greatest extent since May 2023.

- Stocks of finished goods were seen as more than “adequate” in March (+12% from +11% in February), with stock adequacy broadly unchanged since the previous month (+12% from +11% in February), in line with the long-run average.

South Yorkshire aims to be part of the UK’s nuclear future

Vale of York farmer elected chairman of NFU’s Dairy Board

Dacres sponsor girls U14 football in Ilkley

North Yorkshire steel firm files Notice of Intention to appoint administrators

Due to losses on various contracts and a gap in production scheduling due to projects being delayed, the directors of the company have filed a Notice of Intention to appoint administrators Andrew Mackenzie and Louise Longley of Begbies Traynor to protect the company whilst options are explored and a buyer sought for the business.

S.H. Structures designs, supplies, manufactures and installs complex steel structures. Last year the business manufactured and installed the 46-metre-long pedestrian bridge, weighing 86 tonnes, at Forge Island in Rotherham, linking the flagship development with the town centre.Streets Chartered Accountants covers Virtual Finance Offices, Working Capital Cycles, Annual Tax on Enveloped Dwellings, and more in new news roundup

Streets Chartered Accountants covers Virtual Finance Offices, Working Capital Cycles, Annual Tax on Enveloped Dwellings, and more in its latest monthly news roundup.

New Virtual Finance Office (VFO) service

We are often asked what is a Virtual Finance Office or VFO? A Virtual Finance Office replaces the more traditional in-house finance department or team, with an external third-party virtual finance team.

Outsourcing your finance function often involves the sending out of work just for processing. In contrast a Virtual Finance Office not only provides the processing of transactions and production of information, but also greater additional financial input, support and advice. Read more.

Every business has a working capital cycle. This is the time it takes for your business to turn net current assets into available cash.

The longer the working capital cycle, the more time it takes for your business to get a robust cash flow. It’s good practice for businesses to manage their cycle by looking at each step where possible. This could be by selling stock or product quicker, collecting monies owed sooner and possibly paying bills later on. Read more.

However, the charge can apply to any UK residential property wholly or partly owned by a company (including a partnership with a corporate member). Read more.

The Budget 2024 – catch up!Last week Streets hosted a post Budget webinar, providing details of the announcements along with an update on topical issues affecting business clients and private individuals for the new tax year 2024/25.

This presentation was recorded and is now available on demand for those who weren’t able to join live. Watch now.

South Yorkshire’s Supertram back under public control

- A 10% discount on some tram-only fares for the first 100 days of operation has been introduced which will apply on 1, 5, 7 and 28-day adult and child tickets purchased onboard or through the new app.

- A new Supertram ticketing app has been launched through which customers can purchase tickets and store tickets on their smart phone. Later this year, a journey planning capability will be added to the app which will cover all modes of transport. The app can be downloaded from Google and Apple stores.

- A new Supertram website will have all the information customers need about tickets and their journey.

- Within the first 100 days of operation all tram shelters and stops will be deep cleaned.

- There will be a review of the tram timetable, looking at opportunities for it to change to better serve passenger demand.