University of Sheffield start-up secures £4m investment to bring ‘world first’ sensor to mass market

A University of Sheffield spin-out company has secured the backing of leading deep tech investors to bring its revolutionary infrared sensors – a game changer for robotics and self-driving machines – to the mass market.

Phlux Technology, which has designed high-performance sensors that surpass the capabilities of silicon-based sensors, has secured £4 million in seed funding in a round led by Octopus Ventures.

Spun-out of Sheffield’s Department of Electronic and Electrical Engineering – known as a world leader in semiconductor R&D – Phlux has developed infrared sensors using the semi-metal element, antimony, which dramatically improves their performance in LiDAR systems – the technology behind the control and navigation of autonomous machines, such as cars and robots.

The sensors developed by the Sheffield start-up are the world’s first antimony-based LiDAR sensor chips with architecture that is 10 times more sensitive and has 50 per cent more range compared to silicon-based sensors. Its design also reduces the cost of manufacture of LiDAR sensors, opening them up to mass market adoption.

This radical new approach underlines the limitations of silicon-based sensors and how they struggle to enable low-cost autonomous applications.

Ben White, CEO and co-founder of Phlux Technology, said: “Our ambition is to become the Nvidia of the sensor market starting off with delivering the world’s first LiDAR sensor chip using antimony.

“Industry will never achieve full autonomy with LiDAR if it relies on silicon-based sensors, so our approach will reshape the sensor market for robotics and self-driving machines.

“We are delighted to be spinning Phlux out of the University of Sheffield at a time when it has ambitious plans to become a global centre of excellence for semiconductor research and the UK is looking to demonstrate its capabilities as a global science superpower.”

Infrared sensors, such as those that Phlux is building, have applications beyond LiDAR in satellite communications and enabling Internet in remote regions, fibre telecoms, autonomous vehicles, gas sensing and quantum communications.

Amy Nommeots-Nomm, deep tech investor, Octopus Ventures, said: “We are delighted to be leading this investment round for Phlux Technology, as this innovative breakthrough is critical to the future direction of transport, communication and emission monitoring systems. Today, there is market consolidation among the silicon-based sensor companies, precisely because they can’t solve the problem that Phlux has cracked, making its potential hugely exciting.”

The range of investors backing the start-up include Northern Gritstone – the investment company chaired by Lord O’Neill that is seeking to boost the commercialisation of university spin-outs in the North of England. It’s the second Sheffield-based start-up to receive investment from Northern Gritstone, since it was launched by a consortium of northern universities in 2021.

Duncan Johnson, CEO, Northern Gritstone, said: “Phlux Technology is a fantastic example of the exciting new generation of science and technology businesses in the North of England turning research into reality. The company’s innovative approach demonstrates how world beating technology, with the potential to change entire industries, is emerging from the Sheffield, Leeds and Manchester triangle. Northern Gritstone exists to support and supercharge businesses like Phlux.”

Investors also include the Foresight Williams Technology Fund, the Innovation Fund, industry specific angels and grant funding from Innovate UK.

Matthew Burke, head of technology ventures at Williams Advanced Engineering, said: “Increasing sensor performance whilst driving down cost are key enablers for accelerating the uptake of higher levels of driving automation and with this seed funding, we look forward to seeing Phlux’s sensor technology transition to full commercialisation.”

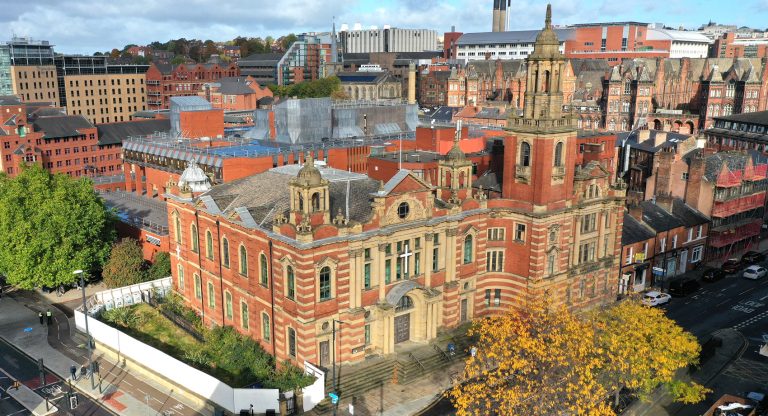

Major Leeds landmark to be sold

Lambert Smith Hampton have been instructed to find a buyer for the iconic, Grade II listed, Oxford Place Mission in Leeds city centre’s Civic Quarter.

With history dating back to the early 1800’s, the former chapel extends to over 33,000 sq ft and provides opportunity for expansion and development. It is located on Westgate, immediately adjacent to the world-famous Leeds Town Hall.

Planning consent has been granted for two different schemes, providing a boutique hotel of 70 rooms and 80 rooms, respectively and an increased floor area of over 40,000 sq ft. Other uses such as residential, education, health, and offices may be suitable, subject to planning. Offers and Expressions of Interest are being invited.

Richard Corby, director & head of Leeds Office at Lambert Smith Hampton, said: “We are excited to be marketing this outstanding opportunity to acquire a striking, large and historic city centre asset with significant redevelopment potential. The regeneration of Oxford Place provides the opportunity to deliver a scheme of huge social and economic benefit to both Leeds city centre and the public realm.”

Banks return to High Street in new shared space deal

At least four High Street banks will offer face-to-face banking in Cottingham near Hull through the opening of the UK’s fourth banking hub.

NatWest, Lloyds, Santander, and Barclays have each committed to set up shop on one day a week in the town\s former Lloyds Bank branch in Hallgate.

Cottingham was earmarked for a banking hub when it was announced earlier this year that Lloyds, the last bank in the village, was to close in September 2022.

Banking hubs are a new concept being rolled out across the UK following successful pilots in Cambuslang in South Lanarkshire and Rochford in Essex. Cottingham will be only the fourth branch to open in the UK after the opening of a hub in Brixham in Devon earlier in November.

The new hub is a face-to-face facility that will allow customers to access their account, deposit cash and cheques, pay bills and make withdrawals.

A counter service will be operated by staff from the Post Office, whilst selected banks will also provide community banking advisors, initially from five banks, on rotation to offer specialist advice and handle more complex enquiries on a drop in or appointment basis.

The schedule for community bankers shown below is based on local market share to reflect the needs of customers within the hub catchment area:

- Monday – NatWest

- Tuesday – to be confirmed

- Wednesday – Lloyds

- Thursday – Santander

- Friday – Barclays

2023 Business Predictions: Graham Edward, Managing Director, Edward Architecture

It’s that time of year, when Business Link Magazine invites the region’s business leaders to offer up their predictions for the year ahead.

It has become something of a tradition, given that we’ve been doing this now for over 30 years.

Here we speak to Graham Edward, Managing Director of Edward Architecture.

Edward Architecture experienced an increase in activity in the first 3 quarters of 2022. This was despite expecting workload to calm down due to an unstable government, interest rates rises and escalating build costs. In the last quarter though, it’s just starting to feel like there is a tightening of belts in the property market as these effects start to hit the market.

I believe 2023 will see a continuation of this tightening effect rather than a huge dip in activity. Demand is still huge in both the residential and logistics markets. However, the viability of new shed schemes has quickly become tight as build costs have risen to well over £100 per sq ft and volatile interest rates are making funders resistant to invest. As the market tightens, build costs and rates should stabilise and possibly even come back to more viable levels.

To help business growth in 2023 and get the country firing on all cylinders again, the government needs to focus on resolving the unreliability of public sector organisations and inflation to stabilise interest rates.

Our order book and enquiry level remains healthy and exciting in residential, strategic land and accessible design. We have also noted that the modular market has become more competitive, particularly in the South East of England where traditional build rates have risen fastest.

We also forecast opportunities leading from local authority asset sales. Our work with the Landsolve framework exposes us to many local authorities. They have key issues to deal with in additional costs and the low carbon commitment. This will prompt sales of assets in building and land to help realise funds and take buildings with expensive energy costs out of their portfolio.

Successful turnaround for Sheffield components manufacturer

South Yorkshire manufacturer P&B Metal Components is back in the black recording a £606k profit with sales growing to £22.75m for the last financial year following two years of significant losses.

The Sheffield-headquartered company, with a subsidiary manufacturing facility in Malaysia, annually makes more than 500 million precision engineered metal components for the avionics, automotive and defence industries, as well as for domestic appliance manufacture, industrial control and automation segments.

A carefully developed plan for the turnaround included consolidating the company’s two UK sites into the Sheffield site, establishing a new business structure, rebuilding the Board of Directors and the senior management team, introducing a reinvigorated HR programme, an extensive recruitment campaign, exiting from loss-making contracts, refreshed branding, new website and a focus on growing segments in key geographies.

P&B now boasts a strong order book with further plans to increase its sales capacity to satisfy increased demand from its key customers in North America, Europe, Middle East and Asia.

Managing Director Brendan Kendrick, said the turnaround plan for P&B, established in 1961 and which celebrated 60 years in business in 2021, had involved consolidating sites and establishing a new business structure in Sheffield.

He said: “We consolidated Kent and Yorkshire operations in 2020, with the site in Sheffield now being the new HQ and only UK site, accompanied by one Asia-based site in Malaysia.

“The new business structure in Sheffield features a revised board including a Chairman, Managing Director, Technical Director, Finance Director, Operations Director, Sales Director and June Bushell, joint founder of P&B who is still active in the business today.

“After posting two years of losses we now have a £22.75m group turnover and we made a profit of just over £600k for 2021-22. Additionally, our site in Malaysia delivered a profit this year for the first time since being established in 2014.

“On the customer service side, we have established a new customer service function to deliver world class service for customers.

“Operations management-wise, we have reinvigorated our people strategy including wage increases, improved retention initiatives, skilled workforce recruitment and reinvigorated our apprentice program. We have our own in-house product and tooling design team for early customer engagement.”

As a contact assembly manufacturer, P&B supplies to a global market of over 200 customers spread across 30 different countries. It supplies multinational OEMs such as Siemens, Honeywell and Worksop-based Eaton with critical components.

Looking at the current market challenges, Brendan added: “We are now matching and exceeding customer volume requirements, we are seeing strong demand in our focus segments and geographies.

“We continue to work through the challenges of Covid and Brexit. P&B exports 90% of its products, so we are faced with Brexit, supply chain and international trade challenges.

“Through the factory consolidation and Covid, a key consideration was keeping key suppliers on board. We have a strategy to keep supply local and we are proud to have Sheffield-based Thessco, as a key supplier.

“There are supply chain challenges as lead times have increased from eight to as much as 26 weeks for some key base materials.”

Focussing on the outlook for P&B, Brendan added: “The business outlook is positive, and we are positioning the business for growth in line with the company’s business plan.

“The localisation of customers’ production manufacturing to North America, Europe and the Middle East will help drive growth as supply chain challenges associated with heightened political uncertainty grow.

“The growth through the automation, electrification, and digitisation of the world, where product lifetime is critical, will continue to drive demand for high quality components.

“Sales, marketing, and business development is the final piece of the jigsaw for P&B in 2022. The recruitment of a new Sales Director in September means the new Board of Directors is complete and ready to drive the business towards the achievement of its long-term goals.

“Refreshed branding and a new website was launched in October to give the company a fresh look and bring it more in line with the needs of customers.

“We currently employ 120 staff in Sheffield and 70 in Malaysia. A key challenge is people and the recruitment of skilled Toolmakers, Setters and Welding engineers including factoring in diversity and inclusivity.”

Ambitious Coney Street Riverside regeneration plans submitted to City of York Council

Yorkshire property specialist Helmsley Group has submitted plans for its Coney Street Riverside project to City of York Council (CoYC).

Proposals for the major regeneration project include the creation of 250,000 sq ft of mixed-use retail, leisure, commercial, residential, student and extensive public realm.

The vision also supports the introduction of a boutique, independent retail experience, alongside the creation and rejuvenation of the historic lanes and passageways joining Coney Street and the River Ouse together, helping to make the riverfront accessible to all.

Central to the plans are the sensitive preservation and rejuvenation of Coney Street’s heritage, in recognition of the vitally important role that the street and riverfront have played across York’s long history.

The proposals are the realisation of a 50-year ambition to create a riverside walkway, as outlined in the 1969 Esher Report.

Coney Street is the latest project from Helmsley Group, which has been responsible for delivering landmark schemes across the city for the last 42 years, including the Old Fire Station, Westgate and Merchant’s Exchange on the Riverfront.

Max Reeves, development director at Helmsley Group, said: “Since 2019, we have been engaged in a period of careful and strategic site assembly across Coney Street, and have worked with key stakeholders and investors, and most recently with the general public, to develop this vision.

“This is a once-in-a-lifetime opportunity to sensitively regenerate an underappreciated area of York city centre, creating a vibrant community with heritage at its heart. The response to our plans from the York public and stakeholders has been overwhelmingly positive, as evidenced through our engagement exhibition and website feedback, and we look forward to hopefully securing the future of Coney Street not just now, but for generations to come.”

Neil Brown of Vincent & Brown, the architects behind the scheme, added: “The River Ouse and neighbouring Coney Street have played a fundamental role in York’s history since Roman times, and our vision for Coney Street Riverside has looked to this rich past as a means of informing its vibrant future.

“Through the introduction of new architecture, which complements the area’s unique heritage, we hope that Coney Street Riverside will act as a positive catalyst for city-wide inward investment, and further bolster York’s reputation as a fantastic place to live, work and visit.”

The project team for the scheme includes Helmsley Group, Vincent & Brown, O’Neill Associates, Montagu Evans, Aspect4, Gillespies, Troup Bywaters & Anders, Billinghurst George & Partners, Jane Simpson Access, Knight Frank, DS Emotion and Aberfield Communications.

Coney Street is the latest project from Helmsley Group, which has been responsible for delivering landmark schemes across the city for the last 42 years, including the Old Fire Station, Westgate and Merchant’s Exchange on the Riverfront.

Max Reeves, development director at Helmsley Group, said: “Since 2019, we have been engaged in a period of careful and strategic site assembly across Coney Street, and have worked with key stakeholders and investors, and most recently with the general public, to develop this vision.

“This is a once-in-a-lifetime opportunity to sensitively regenerate an underappreciated area of York city centre, creating a vibrant community with heritage at its heart. The response to our plans from the York public and stakeholders has been overwhelmingly positive, as evidenced through our engagement exhibition and website feedback, and we look forward to hopefully securing the future of Coney Street not just now, but for generations to come.”

Neil Brown of Vincent & Brown, the architects behind the scheme, added: “The River Ouse and neighbouring Coney Street have played a fundamental role in York’s history since Roman times, and our vision for Coney Street Riverside has looked to this rich past as a means of informing its vibrant future.

“Through the introduction of new architecture, which complements the area’s unique heritage, we hope that Coney Street Riverside will act as a positive catalyst for city-wide inward investment, and further bolster York’s reputation as a fantastic place to live, work and visit.”

The project team for the scheme includes Helmsley Group, Vincent & Brown, O’Neill Associates, Montagu Evans, Aspect4, Gillespies, Troup Bywaters & Anders, Billinghurst George & Partners, Jane Simpson Access, Knight Frank, DS Emotion and Aberfield Communications.

Coney Street is the latest project from Helmsley Group, which has been responsible for delivering landmark schemes across the city for the last 42 years, including the Old Fire Station, Westgate and Merchant’s Exchange on the Riverfront.

Max Reeves, development director at Helmsley Group, said: “Since 2019, we have been engaged in a period of careful and strategic site assembly across Coney Street, and have worked with key stakeholders and investors, and most recently with the general public, to develop this vision.

“This is a once-in-a-lifetime opportunity to sensitively regenerate an underappreciated area of York city centre, creating a vibrant community with heritage at its heart. The response to our plans from the York public and stakeholders has been overwhelmingly positive, as evidenced through our engagement exhibition and website feedback, and we look forward to hopefully securing the future of Coney Street not just now, but for generations to come.”

Neil Brown of Vincent & Brown, the architects behind the scheme, added: “The River Ouse and neighbouring Coney Street have played a fundamental role in York’s history since Roman times, and our vision for Coney Street Riverside has looked to this rich past as a means of informing its vibrant future.

“Through the introduction of new architecture, which complements the area’s unique heritage, we hope that Coney Street Riverside will act as a positive catalyst for city-wide inward investment, and further bolster York’s reputation as a fantastic place to live, work and visit.”

The project team for the scheme includes Helmsley Group, Vincent & Brown, O’Neill Associates, Montagu Evans, Aspect4, Gillespies, Troup Bywaters & Anders, Billinghurst George & Partners, Jane Simpson Access, Knight Frank, DS Emotion and Aberfield Communications.

Coney Street is the latest project from Helmsley Group, which has been responsible for delivering landmark schemes across the city for the last 42 years, including the Old Fire Station, Westgate and Merchant’s Exchange on the Riverfront.

Max Reeves, development director at Helmsley Group, said: “Since 2019, we have been engaged in a period of careful and strategic site assembly across Coney Street, and have worked with key stakeholders and investors, and most recently with the general public, to develop this vision.

“This is a once-in-a-lifetime opportunity to sensitively regenerate an underappreciated area of York city centre, creating a vibrant community with heritage at its heart. The response to our plans from the York public and stakeholders has been overwhelmingly positive, as evidenced through our engagement exhibition and website feedback, and we look forward to hopefully securing the future of Coney Street not just now, but for generations to come.”

Neil Brown of Vincent & Brown, the architects behind the scheme, added: “The River Ouse and neighbouring Coney Street have played a fundamental role in York’s history since Roman times, and our vision for Coney Street Riverside has looked to this rich past as a means of informing its vibrant future.

“Through the introduction of new architecture, which complements the area’s unique heritage, we hope that Coney Street Riverside will act as a positive catalyst for city-wide inward investment, and further bolster York’s reputation as a fantastic place to live, work and visit.”

The project team for the scheme includes Helmsley Group, Vincent & Brown, O’Neill Associates, Montagu Evans, Aspect4, Gillespies, Troup Bywaters & Anders, Billinghurst George & Partners, Jane Simpson Access, Knight Frank, DS Emotion and Aberfield Communications.

Manufacturers get chance to tap into growth hub investment funds

The East Midlands Growth Hubs have secured £3m to support the region’s manufacturing businesses over the next two and a half years after pressure from Lincolnshire County Council and the Greater Lincolnshire LEP.

The funds are being made available through an extension of the Made Smarter Programme, and it’s estimated that the investment will generate £80m in additional productivity, based on data from other Made Smarter Adoption Programmes.

Darren Joint, Chair of the Greater Lincolnshire Local Enterprise Partnership’s Manufacturing Board and MD of Viking Signs, said: “Our board had three priorities this year: to develop the GLEAM network, to work with the further education sector to increase employer engagement, and to land a Made Smarter programme for Lincolnshire.

“I’m delighted that we have been successful with our Made Smarter proposals, not only for Lincolnshire but for the East Midlands.

“My business Viking Signs has benefited tremendously from digital adoption, and this programme will give manufacturing businesses in Lincolnshire the chance to embrace digital transformation and increase productivity by as much as 25% while boosting employee skill levels and increasing the number of highly skilled, well paid jobs.

“The programme will be launched imminently and I encourage businesses to get involved.”

Cllr Colin Davie, Executive Councillor for Economy at Lincolnshire County Council, said: “This funding supports small and medium sized manufacturing firms to boost their productivity by implementing digital technology and improving leadership and management skills.

“It has already been running in the North East, West Midlands, North West, Yorkshire and the Humber, with impressive results.

“I’m proud that we’ve led the East Midlands bid from Lincolnshire and that our manufacturing businesses will benefit from increased productivity and a higher skilled workforce as a result.”

The funding aims to provide advice to over 400 small and medium-sized businesses, undertake 133 business assessments, provide intensive support to 70 businesses and boost the leadership and management skills of 36 senior manufacturing leaders.

The programme helps businesses implement more automation and take advantage of new technologies such as 3D printing, artificial intelligence and virtual reality, creating more high skilled jobs in the process.

The East Midlands exports £16.6bn, 6% of all UK manufacturing exports, and accounts for nearly 9% of the UKs total manufacturing GVA making it an important contributor the UKs overall manufacturing sector performance.

To register or express an interest, visit www.madesmarter.uk.

Azets advise J.A.K Marketing Ltd on their sale to Woodley Equipment Company Ltd

Azets, the UK’s largest regional accountancy firm and business advisor to SMEs, has

advised the shareholders of J.A.K Marketing Ltd on its sale to Woodley Equipment Company

Ltd for an undisclosed sum.

Founded in 1995, and based in Sheriff Hutton, York, the company supply an extensive range

of products which includes everything a veterinary practice would require, from instruments

and day-to-day consumables through to sophisticated equipment.The company has a turnover of around £8.5m.

The acquisition will allow the shareholders of J.A.K to retire and is expected to provide

growth for both companies by offering J.A.K’s products via Woodley Equipment’s additional

routes to market both in the UK and overseas.

Woodley Equipment has three premises in the North West in addition to sales and

distribution facilities in New York, USA. The company supplies Veterinary Laboratory

Diagnostic, human laboratory diagnostic and medical equipment to both the Veterinary and

human medical markets.

In the Veterinary market the Company supplies an extensive range of Laboratory Diagnostic

products and has an ongoing programme to design and develop new systems with its

manufacturing partners.

In the medical market Woodley Trial Solutions provides complete equipment solutions in

support of the Pharmaceutical Clinical Trial industry.

Kevin Ingram, Chairman and Owner of J.A.K Marketing Ltd said:

“Having built J.A.K over the past 27 years, we’re pleased to be able to hand over ownership

to a reputable and growing firm which already has vast knowledge of the veterinary supply

sector. We look forward to watching the continued growth of J.A.K.”

“We have received terrific support from the teams at Azets, who helped us navigate and

negotiate the sale. We appreciate the dedication of the team in managing a smooth process

throughout and delivering a successful transaction.”

Mike Wickham, owner and director, Woodley Equipment said:

“We’re delighted that we have been able to purchase J.A.K, an established and highly

reputable company. The deal merges two strong Veterinary supply Companies which supply

different product ranges; we share common values and a strong desire to supply the best

product solutions to enable Veterinarians to provide the best care to their patients.”

“We believe J.A.K will benefit from Woodley Equipment’s routes to market and likewise. We

expect both companies to experience sustained growth over the coming years.”

Azets provided lead advisory services led by Nick Barker, Corporate Finance Director, with

support from the tax team (Bethan Hughes, Steven Holmes, Richard Whitelock and Naveen

Sahney) and the client long-standing accounts and business advisor, Director Chris Ward.

Nick Barker, Corporate Finance Director at Azets said:

“This is a fantastic deal for everyone involved and it’s always rewarding to see a strong

family business secure its legacy having sold to an ambitious buyer like Woodley Equipment

Company who are in a fantastic position to take it from strength to strength. This deal

demonstrates the vibrant business environment in the North.”

Bradford company brings home the silver in ‘business of the year’ contest

Bradford-based Mansfield Pollard completed a hat-trick of awards for 2022 at Wembley Stadium at the 2022 SME National Business Awards, by taking home the silver award for “Business of the Year”, capping an incredible year for the business.

This latest recognition comes in quick succession after two other award wins: ‘SME of the Year’ at the Constructing Excellence in the Yorkshire & Humber Awards and ‘Employer of the Year’ at the Bradford Means Business Awards.

A spokesman for the company said: “Winning these awards is the start of a bright new era for Mansfield Pollard as we continue to deliver on our ambitious development plans and structure for significant growth over the next few years.”

Farmers share in grants worth more than £870m

More than £95% of farmers have shared in £872m in grants from the Rural Payments Agency in the first few days of the latest payment window.

More than 102,000 payments have been made, bringing the total paid to farmers to £1.528bn, across various schemes supporting farmers to achieve certain standards and deliver environmental outcomes in a range of habitats.

As announced in May 2022, customers claiming Direct Payments have received two separate payments this year, with the first made from the end of July 2022 and completed by August 2022.

This was in response to the cost pressures faced by farmers caused by global gas prices rising and Putin’s illegal war in Ukraine, and to boost cash flow for many businesses during this uncertain period.

RPA Chief Executive Paul Caldwell said: “This has been a year of unprecedented challenges for our farmers and rural businesses, which is why the RPA has been working hard to make payments as quickly as possible – both in July and in the current payment window. We know how important these payments are to farmers and the wider economy, so will continue to work hard to process any remaining claims as quickly as possible.”