BCO pilots new office grading system in Leeds

Drax partners with NGIS to monitor forest carbon stocks

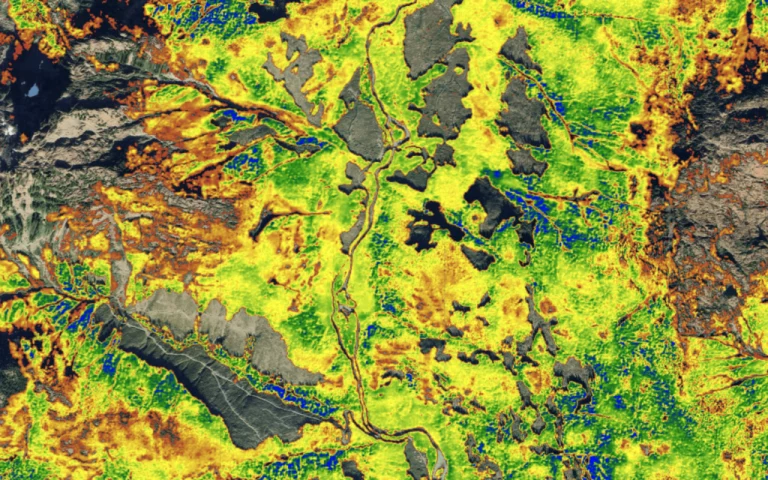

Renewable energy firm Drax has formed a partnership with geospatial technology specialist NGIS to track and model carbon stocks in forests across the US and Canada. These forests supply the biomass used to power Drax’s operations, including the UK’s largest renewable energy site, Drax Power Station.

The initiative supports Drax’s commitment to improving transparency within its biomass supply chain. Under its Sustainability Framework, the company aims to provide verifiable data on forest carbon stocks in all primary sourcing areas by the end of 2026.

NGIS, a Google Premier Partner, will use satellite imagery and machine learning to assess carbon sequestration, tree cover, and forest health. The results will be presented through a digital platform that allows users to view historical and current satellite images showing harvesting and regrowth patterns.

Miguel Veiga-Pestana, Drax Group Chief Sustainability Officer, said: “We are proud to launch this new partnership with NGIS. This agreement will help us deliver on the commitments we set in our Sustainability Framework, including taking action, with our supply chain, to be deforestation, degradation, and conversion free.”

Drax has begun integrating this data into its supply chain management to strengthen sustainability practices, evaluate biodiversity, and measure the effects of environmental events such as fires and floods. The company’s biomass supply largely comes from residual wood materials, including sawdust, bark, and offcuts from the timber industry, which are processed into pellets for renewable power generation.

aql backs digital talent in Leeds with £100k investment

Digital communications firm aql has strengthened its partnership with Leeds City College through the creation of a new innovation lab and a £100,000 investment. The aql Innovation Centre, based at the college’s Printworks Campus, aims to accelerate digital learning and provide hands-on experience in artificial intelligence, data processing and connectivity systems.

The company has worked with the college, part of the Luminate Education Group, for the past two years on hackathons that simulate real-world IT challenges. The new lab formalises that collaboration, giving students access to dedicated servers, sensors, and software tools to develop skills for the region’s growing digital economy.

aql’s latest contribution includes equipment and engineering support to develop a next-generation 5G innovation lab network at the college over the next year. The initiative aligns with broader efforts to connect industry and education, helping to address the shortage of digital and engineering talent in West Yorkshire.

The launch event brought together senior figures from aql and the Luminate Education Group, underlining a shared commitment to long-term investment in digital skills, innovation and workforce readiness for the region’s business community.

Yorkshire clean tech company reaches battery milestone in Africa

Sheffield-based green technology firm MOPO has reached 30 million battery rentals across Sub-Saharan Africa, marking a major milestone in its mission to expand sustainable energy access.

The company provides solar-charged battery rentals through a network of local agents who operate centralised charging hubs. This system removes the need for customers to invest in costly infrastructure or rely on credit.

Each MOPO battery is part of a closed-loop system that supports reuse and recycling. The MOPO50 model powers household needs such as lighting and phone charging, while the MOPOMax unit delivers one kilowatt-hour of power suitable for small businesses and communities with limited or no access to the electricity grid.

MOPO’s operations now span six African countries, serving both residential and commercial customers. Its agent-led model is designed to make renewable energy distribution scalable and economically viable across remote and underserved regions.

The company’s progress has been recognised by the Africa Sustainable Futures Awards, where it was shortlisted in the Access to Electricity and Infrastructure category. This recognition reflects the growth of the UK-based firm’s influence in accelerating clean energy adoption across emerging markets.

Chris Longbottom, CEO of MOPO, said: “By removing the financial and logistical barriers that prevent access to clean energy, MOPO is transforming energy delivery across underserved regions. Our simple but unique agent-driven, tech-enabled model makes solar energy flexible, accessible, and affordable for the people who need it most, positioning MOPO as a pioneer in Africa’s clean energy transition. “We’re proud to have been recently shortlisted for the Africa Sustainable Futures Awards in the Access to Electricity and Infrastructure category – a powerful endorsement of our business and the impact we’re making across the six countries where we operate. This recognition is a testament to the dedication of our colleagues, agents, and suppliers, whose hard work has been instrumental in driving our growth. Power is the key to uplifting people’s lives, and with our current growth trajectory, we’re excited about what lies ahead.”Clearwater reports surge in private equity-led deals

Clearwater has seen a sharp rise in private equity-backed transactions during the first half of its financial year, underscoring renewed investor confidence across the UK mid-market.

Between April and September, the corporate finance advisory firm completed 28 deals, 20 of which involved private equity funding. Activity was concentrated in technology, business services, and financial services, which together made up around three-quarters of all transactions.

The firm’s recent work reflects the continued strength of capital deployment in the sector. Highlights include advising Vitruvian Partners on its acquisition of York-based Great Rail Journeys, assisting Pollen Street Capital in its investment in Manchester-based Leonard Curtis, and overseeing the sale of Keltic Traffic Management to Equistone-backed BUKO Group.

Other completed transactions involved UAP Group’s sale to an Allegion subsidiary, Palatine’s investment in fulfilmentcrowd, and Beech Tree Private Equity’s acquisition of Inspiro Learning.

Operating from offices in Leeds, Manchester, Birmingham, and London, Clearwater said it is investing in technology and advisory expertise to strengthen its market position. The firm anticipates steady deal flow into 2026, supported by private equity funds’ need to deploy capital and release older investments.

University of York spin-out company secures funding boost

Sheffield startup tackling quantum-powered cyber attacks raises £7.5m

Ryecroft Glenton eyes Yorkshire expansion after strong first year in York

Ryecroft Glenton has marked the first anniversary of its York office with plans to grow its team and client base across Yorkshire and Humberside. The advisory firm, headquartered in the North of England, opened its York base on Micklegate last year to strengthen its regional presence.

Since then, it has become an established name in the local business community and has built relationships with regional companies and professional networks. The firm’s corporate finance division has grown its portfolio of Yorkshire clients, advising on acquisitions, disposals, management buyouts and buy-ins, debt financing and private equity investment.

Ryecroft Glenton has also been active in York’s business scene, hosting and supporting events across the city and partnering with York St John University’s Department of Business on a new research project to support undergraduate students.

Nick Johnson, Corporate Finance Partner at RG, said: “York has proved to be the ideal location for our Yorkshire office. We’ve been made to feel very welcome by the city’s business community and have enjoyed an incredibly positive first year, advising clients and developing new relationships across the region. The response has reinforced our decision to invest here and underlines the significant opportunity for RG in Yorkshire and Humberside.

“As we move into our second year, we are excited about expanding our team locally to meet demand, and about the role we can continue to play in creating opportunities for clients and the wider market.”

Spencer Bridge Engineering completes UK testing for Pattullo Bridge access system

Spencer Bridge Engineering has completed factory testing on a bespoke access system designed for the Pattullo Bridge Replacement Project in British Columbia, Canada. The system, developed by the company’s in-house team, will be used to inspect and maintain the bridge’s stay cables.

Following successful testing in the UK, witnessed by representatives from Fraser Crossing Constructors General Partners (a joint venture between Acciona and Aecon) and an independent checker, the equipment is now being shipped to Canada for installation and commissioning.

The Pattullo Bridge, which spans the Fraser River near Vancouver, is being replaced to meet modern safety standards and improve connections between Surrey and New Westminster. Spencer Bridge Engineering was contracted to design, manufacture, test, and commission a semi-permanent access system that allows engineers to reach all stay cable elements.

The adjustable cradle system can operate across varying cable lengths and angles, maintaining level positioning during inspections. The project required dual compliance with European and Canadian standards and included the creation of a new winching and control system.

This milestone marks the final stage before on-site installation, ensuring long-term maintenance capability for the new bridge infrastructure.