PM urged to continue safeguarding land around Leeds Station

New hires strengthen Airedale Group’s focus on health and safety

Calderdale College signs five-year lease on more space at Dean Clough

JM Glendinning acquires Birmingham firm

Leeds’ JM Glendinning Insurance Brokers has acquired Birmingham-based Madoc & Rhodes (Lea Village) Ltd, strengthening the JMG Group portfolio.

Incorporated in 1967, Madoc & Rhodes is a team of seven insurance brokers headed by MD Paul McGrory, who has worked in the insurance industry for over 37 years. The business will continue to deliver vehicle, home and property insurance services from its Lea Village office, whilst working closely with JM Glendinning’s Birmingham-based business.

Paul McGrory joined Madoc & Rhodes in 1985, became co-owner in 1997 and sole owner in 2008. Paul says: “We’ve experienced significant growth over the last 12 months and by joining the JMG Group, we are now stronger than ever.

“We are a friendly and proudly traditional team that thrives on delivering outstanding customer service. Every client is important to us and we have a fantastic retention rate. In fact, we have fifty clients who have been with us for over 50 years – I think that makes us unique!

“I was considering a change in career when this opportunity came about but I am delighted that the right business came along at the right time. This move will allow me to get back to the shop floor, working directly with clients and investing time in the team and developing our offering.”

Jake Fox, group managing director at JM Glendinning, says: “This is a great opportunity for JM Glendinning and will unlock many opportunities as we build upon the existing well-known brand and quality service that’s already associated with Madoc & Rhodes.

“As a long-standing firm in Birmingham, we believe Madoc & Rhodes will complement our established team in Birmingham, led by Chris Hitch, and add breadth to our existing base in the city and beyond. Paul’s strong, principled leadership will no doubt help continue driving growth in the business.”

Madoc & Rhodes was advised by Worcester-based The Company Solicitor and MDP Accountants.

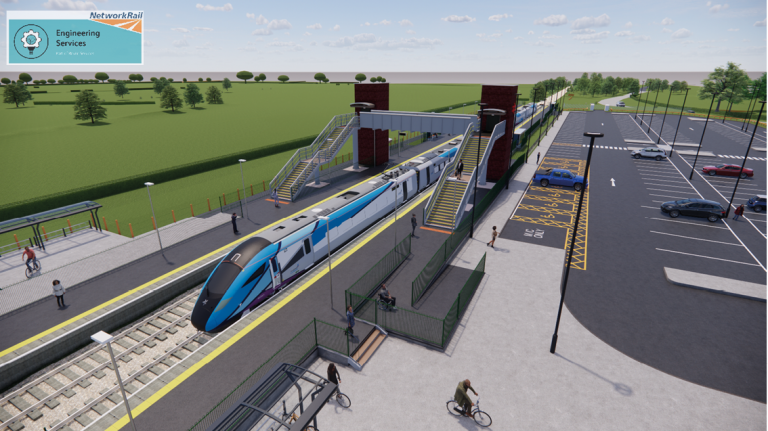

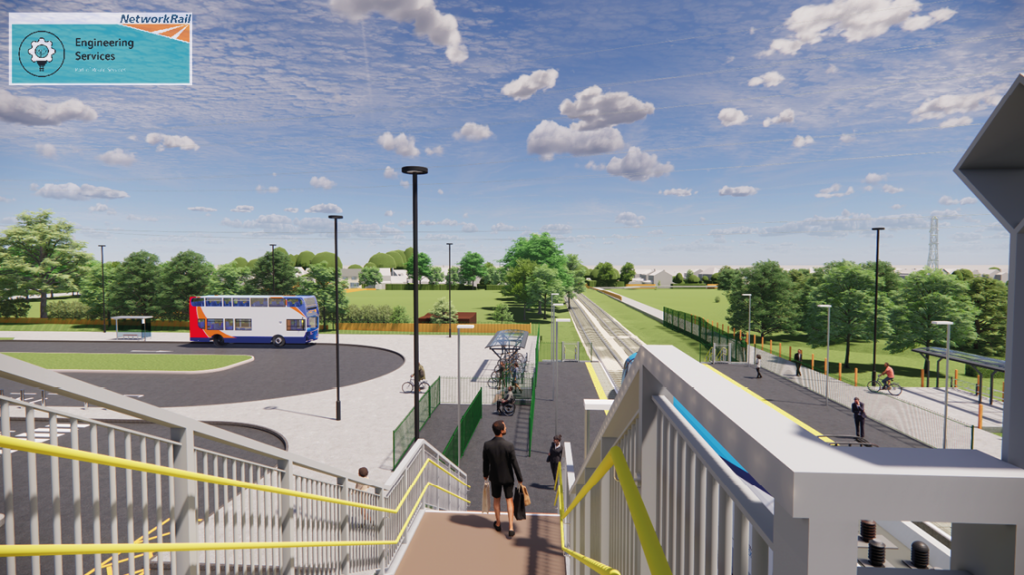

Planning application submitted for multimillion pound station development in Haxby

Government approves Kirklees Council’s plans for major health industry investment

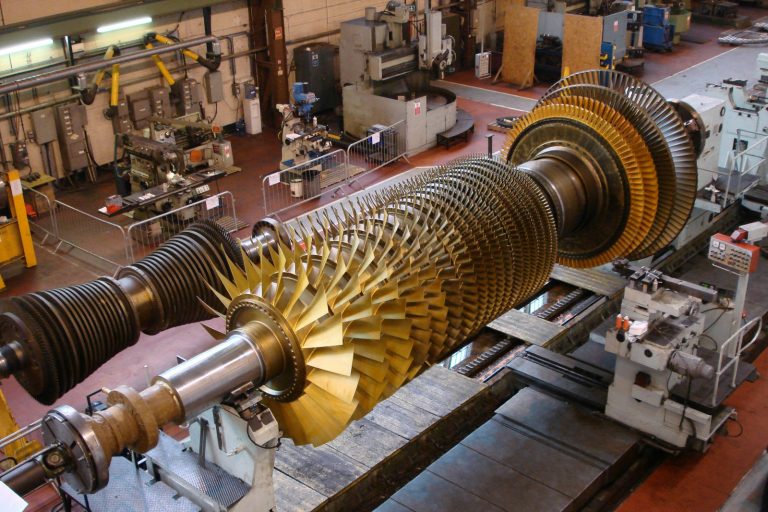

RWE sells Ferrybridge engineering workshop

Councillors plan talks on the future of Harrogate Convention Centre

Next week councillors will meet to discuss a major investment in Harrogate Convention Centre to make sure it can continue to support the town’s multi-million pound visitor economy.

They’ll be talking about sidelining proposals for development plans, and instead look at more affordable options to bring long-awaited improvements.

Executive director for finance, Cllr Gareth Dadd, who is the authority’s deputy leader, said: “The convention centre is a very important venue for both Harrogate itself and the county’s wider economy, and we are therefore committed to ensuring that it continues to play a key role in the future.

“However, all major projects are being affected by the high rates of inflation and the rising costs of materials and labour.

“We need to make sure that we are providing the best value for money for residents and businesses across North Yorkshire, and we will carefully consider the options that are available for renovating the Harrogate Convention Centre.

“We need to decide how best to take the re-development plans forward while protecting the impact that would have on the public purse and the economy of the town.”

Members of the executive will be told that a two-phase development plan for the building was drawn up eight years ago, with the first stage due to revamp the existing building.

The second phase of the re-development outlined in the plan would see the existing exhibition halls replaced with a new event space, and the overarching project was expected to cost £47 million at the time when the proposals were drawn up.

However, when a business case revealed that the first phase alone was estimated to cost £48 million, the second stage of the development was deferred.

A bid for £20 million in funding from the Government’s Levelling Up Fund proved unsuccessful, and rising costs have meant that the first phase of the re-development is now expected to be in the region of £57.2 million. In addition, there would be lost revenue when the building closed for the wide-ranging programme of work.

Convention Centre Director Paula Lorimer said: “We recognise that there is a real need for investment in the building, but more affordable options should also be explored. Alternative plans that are being considered would prevent shutting large parts of the venue for significant periods of time to avoid the loss of valuable revenue.

“This building is integral to the visitor economy of Harrogate. Its conferences, exhibitions, corporate events, banquets and live entertainment provide jobs and business to the town’s shops, bars, cafes, restaurants and hotels – worth about £45 million a year to the local economy.

“I do back the recommendation that is due to be discussed by the executive, as I have been a long-standing supporter of investment in the convention centre for a number of years and the venue must remain open during the works.”

Paula added that this year’s income from lettings is at the highest level since 2014, and the number of forward bookings is also the highest in recent memory.

She said: “This demonstrates that the venue is doing well, and tactical investment is the way forward to keeping the venue operational.”

However, the building has problems with ageing heating and air conditioning systems and there are also increasing maintenance and utility costs, as well as a layout that presents challenges for many events and conferences.

Sheffield FC welcomes architects as official partner as stadium development moves forward

JPG Group signs up as member of Leeds United Community Partnership

Jennifer takes leading role with Women in Property

West Yorkshire passive fire protection specialist snapped up

Simon May, Partner at IK and Advisor to the IK SC III Fund, added: “This is an exciting first investment for the IK Development Capital strategy in the UK. Under the stewardship of John and his team, Checkmate has established itself as a high-quality provider in a rapidly growing and increasingly regulated market.

“We have been impressed with the company’s journey to date and see plenty of opportunities for continued growth. We look forward to working with the team at Checkmate and leveraging the resources and expertise of the wider IK platform to deliver an ambitious strategy.”

Steve Harrison, Partner at YFM Equity Partners, said: “It has been an absolute pleasure working with John and the entire team at Checkmate since we first invested in 2018. The business has seen rapid growth and development during this period, establishing itself as the leading player in the UK passive fire protection market. We wish Checkmate the best of luck for the future with the support of IK.”New rail freight app secures £150,000 funding

Yorkshire Dales farmers to be offered share in grants totalling £2m

- Provide £2m of grants to the National Park’s farmers and landowners through the Farming in Protected Landscapes programme.

- Continue the Tees-Swale project, restoring peatland, hay meadows, woodland and other priority habitats across Swaledale and Arkengarthdale.

- Provide new, Education and Outreach projects: Championing National Parks for everyone, and the National Citizen Service project.

- Facilitate an extensive volunteers programme, young ranger, ‘Upskill Down Dale’ youth engagement programme, and apprenticeships, developing skills that lead to employment in the environmental sector.

- Implement the Coast to Coast National Trail through the National Park, and a variety of other ambitions.

Works progressing on next phases of Lincoln Enterprise Park

Construction works to deliver the next phases at Lincoln Enterprise Park are progressing to schedule with 80% of space already reserved.

Located on the A46 near Thorpe on the Hill, Lincoln Enterprise Park is progressing with phases 7 to 10, which will bring an additional 34,500 sq ft to the park and could potentially create up to 100 new jobs.

Following the continued demand for commercial property in and around Lincoln and a successful planning appeal in 2021, developer and site owner LEP Developments commenced works in October last year, acting as both developer and contractor.

With groundworks done, steel frames ups and roofs complete, works to phases 7 and 8 – which are 6,500 sq ft each – are on schedule.

In total, phases 7 to 10 will bring 13 new mixed-use units ranging from 1,451 to 11,500 sq ft to Lincoln Enterprise Park, offering in-demand expansion opportunities for current occupants and new commercial premises for other businesses.

Current occupant and bespoke kitchen and furniture manufacturer, Krantz Designs, has been on Lincoln Enterprise Park since 2020. With its expanding client portfolio and desire to manufacture all its products in-house, the company has bought phase 7 as well as securing the lease of part of another unit as part of phase 9, giving the company a total of 20,000 sq ft at the park.

Managing director of Krantz Designs, Jamie Krantz, said: “With our showroom on historic Bailgate in Lincoln, we currently manufacture about 90% of our products here at Lincoln Enterprise Park, but for some time have wanted to increase that to 100%.

“We had no desire to move from the park as it’s the perfect location for us, is well managed and has a supportive business network, therefore when Nick secured planning for the next stage of expansion, I jumped at the chance to design and build our new HQ.

“We will have approximately 30 skilled team members at the park when we move into our new spaces later this year, which will include CAD technicians, cabinet painters, machinists and office personnel, and we will be recruiting in due course to fill new roles. The team and I are pleased to be continuing our journey at Lincoln Enterprise Park.”

Managing director of LEP Developments, Nicholas Falkinder, said: “At Lincoln Enterprise Park we support economic growth by providing our premium product in a unique and highly accessible location.

“Because of what we have on offer here and the service we provide, we have been fully occupied for over seven years. Jamie and the team at Krantz Designs are a great example of the business community at the park and how we support those businesses through leasehold agreements, then on to freehold opportunities if required.

“From the outset interest in the new units has been high and this resulted in 80% pre-construction sales in just a matter of months. The majority have been taken by existing occupants, which is what we strive for, and we are welcoming some exciting new businesses later in the year.

“I’m passionate about this park and its success, and for the first time we are developer and contractor, which is an incredible journey to be on to both ensure quality and see the progress onsite each day. I want to thank our community of businesses here and everyone who has made these next phases possible.”

Phases 7 and 8 are due for completion in the summer this year, phase 9 in early autumn and phase 10 in early 2025. Two units remain available to rent or buy and are being marketed by local agents Pygott & Crone and Lambert Smith Hampton.

All contractors working on the site are East Midlands-based and include CM Civils, a Lincoln-based civil engineering company which has delivered the groundworks.

Subject to planning, there is scope for further expansion at Lincoln Enterprise Park.

Crown Estates confirms Projekt Renewable support by becoming a patron

The Crown Estate has officially registered its support for Grimsby’s Projekt Renewable by becoming a patron.

With a £50,000 investment now committed to further expand Grimsby’s Alexandra Dock-based Projekt Renewable, Director Richard Askam said: “Ever since I first floated the idea of Projekt Renewable to The Crown Estate, they have been so supportive of the logic and drive that lies behind what we are doing. To have The Crown Estate come onboard in 2024 as a #projektpatron and take a space at Projekt which is being designed to further everyone’s knowledge of marine conservation is just brilliant.”

Chelsea Bradbury, Senior Marine Data and Insights Manager with The Crown Estate, added: “We’re thrilled to build on our prior support of Projekt Renewable Grimsby with a financial investment, giving us a physical presence in the local community.

“Through this partnership, we want to make sure everybody in Grimsby and beyond is proud of what’s on their doorstep by showcasing the activity taking place on the seabed to reach net zero and the amazing work being done to protect and enhance nature and marine habitats.

“Potentially even inspiring more people to look at careers in this space. As an offshore wind hub, Grimsby is the perfect location to spark people’s imagination and curiosity, and we’re excited to work with the local community to understand what they would most like to know and learn about this industry.”

The Crown Estate manages land, the seabed and much of the coastline around England, Wales and Northern Ireland on behalf of the nation, creating long-term value for the country. It is focused on supporting the UK’s energy transition and improving energy security alongside stewarding the protection and restoration of nature. One of the ways it does this is by sustainably developing the seabed to support green, renewable energy industries, such as offshore wind. This partnership provides an exciting opportunity to connect people in Grimsby more closely with its role as manager of the seabed.

An aspirational beacon for Grimsby and beyond, Projekt Renewable was always built with the view to extend and evolve to suit the demands of both the local community and the renewable champions operating within the area. To have The Crown Estate officially join its trio of boxes is an incredibly proud moment for the entire Projekt team.

Grade II listed Kitson House sold breathing new life into the building

Lambert Smith Hampton (LSH) has sold Kitson House, an iconic Grade II listed country house forming part of the Elmete Hall site, to Industruct Limited.

Situated in Roundhay along with the neighbouring Nicholson House, an affluent and diverse northern suburb of Leeds, the 5,700 sq ft property borders Roundhay Park, one of the largest city parks in Europe attracting nearly one million visitors each year.

The historic building has seen extensive redevelopment over the years, whilst maintaining many of the original period features including the peacock cupola dome lighting and cast-iron circular staircase in the main hall.

The adjacent Nicholson House (6,996 sq ft) is still available for sale. Both properties are currently utilised as offices, offering versatile potential for redevelopment across various sectors subject to planning.

Matt Procter, Surveyor at Lambert Smith Hampton, said: “We are delighted to have found a new owner for this historic site in the heart of Roundhay.

“The sale of Kitson House underscored the appeal of heritage properties in desirable locations, and we look forward to seeing the property’s continued revitalisation along with the potential offered by the neighbouring Nicholson House.”

York Handmade plays key role in London development

Paul brings together experts to support efforts with workplace mental health

Former trawlerman Paul Longley who set up his own consultancy to turn the tide on mental health issues in the workplace has put together a team of experts to help employers communicate with colleagues.

Paul Longley, who spent 32 years in the fishing and food industries before being made redundant in 2019, has recruited Scott Clark and Leon McQuade, co-founders of tech and cyber security specialist Think Cloud, as partners in Think GiANT. The directors of the new business, which is based in The Deep Business Centre, also include Christina Colmer-McHugh, a mental health advocate and inventor and founder of the Moodbeam real-time happiness surveying tool. Paul, a former employee of Andy’s Man Club who set up his own mental health first aid training company in 2020, said: “I left school with no qualifications at all and my first job was on the trawlers, following in my dad’s footsteps. I later moved into fish processing but when I was made redundant I took the opportunity to go to college and train up in mental health first aid. “I’d been struggling with my own mental health for over 20 years. Thanks to attending Andy’s Man Club, those overwhelming weeks and months have turned into difficult hours and minutes that I now have the tools to manage, and that enabled me to set up Think Mental Health. “Through that, I have worked with businesses in 23 countries which between them employ about 250,000 people. Speaking to the leaders and the managers of those companies, I find they all have a passion to support their employees but sometimes they don’t know how to do that. I spotted a gap in communication, and I knew the GiANT toolkit could massively help with that.”Small firms to be offered free advice at HR workshops

Invest East Yorkshire and Invest Hull are jointly staging a series of free HR workshops to support small business owners.

The free workshops have been developed to enable small business owners to maximise their efficiency and effectiveness when managing people so that they can harness the full potential of their workforce, ensuring that they’re better positioned for sustainable growth and success. Course leader Helen said: “We know that human resources and dealing with people challenges can often fall to the bottom of the to-do list for time-poor small business owners. It’s just one of many different roles that they have to fulfil. However, it’s well worth devoting time to making sure you fully understand what’s required of you and have appropriate and effective policies and procedures in place. Dealing with people issues in the right way will help protect you and your business, legally and reputationally. “These free workshops are a great opportunity to boost your knowledge, and pick up some useful tips and insights. Don’t miss this chance to transform your approach to human resource management; register now for these empowering workshops and take a confident step towards success!” Taking place over the coming weeks, the workshops will cover a range of useful topics, including how to recruit with confidence; methods for managing sickness and absence; and performance management strategies. They will be held online and in person at venues across East Yorkshire, with the first one taking place at Brough Business Centre on Thursday 7th March, from 10.30am to 1.30pm.