UK manufacturing downturn continues at end of third quarter

Realise Training continues growth strategy with latest acquisition

West Burton picked as site for fusion energy plant, creating thousands of jobs

Trust turns up the heat with record revenues and national recognition

A Leeds business is celebrating after picking up a major national award in recognition of its entrepreneurial spirit and surging growth.

Garforth-based electric radiator manufacturer, Trust Electric Heating, triumphed at the annual Entrepreneur’s Circle awards (where it was up against hundreds of other businesses) after a surge in marketing and sales activity saw it record record revenues of £1m+.

The family business, which is run by Fiona and Scott Conor, saw sales soar following a campaign that challenged the stereotype that electric heating is more expensive to run than gas.

With their traditional residential market and landlords firmly in their sights, Trust also turned their attention to prospects within the educational sector and even the Church of England’s wide portfolio of properties.

Managing Director Fiona Conor explains: “We may be a relatively small, family run business (compared to our global competitors) but we have big ambitions. We’re also on a mission to help households tackle this ever spiralling energy crisis and contrary to popular belief, electric heating is often a much more effective and affordable solution than gas.

“It all comes down to the efficiency of your system and that of course includes your radiators. Ours are all made here in Garforth using components that are made in the UK – barring our soapstone core – and are nothing like the old electric radiators you might think of!

“The technology has come on in leaps and bounds and they are now slimline, stylish and super-efficient. That offering, along with being a family business that actively promotes UK manufacturing, resonates with our customers and has seen us record revenues this year which are just shy of £1.5m.”

Fiona received her award on the night from comedian Jimmy Carr and also met with popular BBC “Dragon” Sara Davies, who shared her entrepreneurial journey with the 1000+ audience.

“I am so excited and proud to have won but I will confess I was a little nervous walking onto the stage to be greeted by Jimmy! He was lovely though and reminded us all that there’s room for personality and a sense of fun in business.

“Meeting Sara was incredible. She is such an inspiration, so down to earth and so positive. It has been an incredible year for us but we’re not done yet. We have major goals both in terms of our business growth and our wider mission promoting British manufacturing and helping to play our part in tackling the energy crisis. Watch this space!”

Government plans to crank up pollution fines to £250million

“This 1,000-fold increase sends a clear signal that we want clean rivers and coastlines, and that the duty falls to the water companies to deliver – the polluter must pay.”

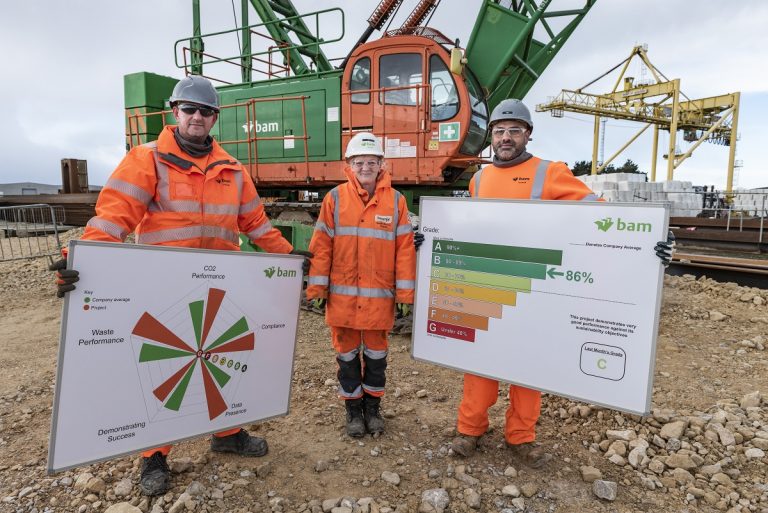

BAM accelerates UK and Ireland carbon reductions to Net Zero by 2026

Yorkshire law firm Gordons appointed by Ocado Retail

BHP responds to Chancellor Kwasi Kwarteng’s tax cut U-turn announcement

Opportunities for businesses and job seekers at employment & training event

- Job vacancies

- Apprenticeships

- Work placements

- Traineeships

- Career opportunities

- Higher level qualifications

- Guidance and advice on current training available

- Information on volunteering and work experience opportunities

Reward raises £15,000 for Aching Arms charity in Leeds to support bereaved parents

A year-long fundraising effort by staff at Reward Finance Group in Leeds has raised £15,000 for its local charity partner Aching Arms, which provides support to bereaved parents coping with the loss of a baby during pregnancy, at birth or immediately after.

The money raised by Reward will deliver much-needed funds to the charity which uniquely provides comfort bears to hospitals and hospices, for midwives and nurses to offer to bereaved parents in their care. Each year in the UK around 3,000 babies are stillborn and one in four pregnancies end in miscarriage.

Along with the comfort bears, it also provides a vital support service and community to parents after their loss and currently works with over 170 hospitals in the UK, as well as an increasing number of hospices, support groups and funeral directors. Since its launch as a small grassroots charity back in 2010 by Leanne Turner, Aching Arms has seen demand for its service double in the last 12 months.

Speaking about the donation, Mel Barclay, trustee for Aching Arms in Leeds, said: “Our 12 month partnership with Reward has been extremely successful. We are very grateful to all the team for the guidance, support and knowledge they have provided and the many physically challenging fundraising events they have hosted.

“The money raised will support the charity to continue its work in supporting newly bereaved families who experience the loss of their baby before, during or shortly after birth. On behalf of the whole team at Aching Arms, I would like to say a heartfelt thank you.”

From hosting its annual charity quiz at Leeds Arena to completing the Leeds 10k Clarion Corporate Challenge and coming first out of 40 companies, the team at Reward embarked on a range of fundraising initiatives to achieve its ambitious target.

Gemma Wright, Reward’s Managing Director for Yorkshire and the North East, added: “When we heard about Leanne’s heartbreaking personal story and the terrific work Aching Arms does to help parents coping with such tragic loss, we immediately wanted to offer our support.

“It really opened our eyes to the charity’s community and the essential services it provides to grieving parents, with the team here at Reward working tirelessly to reach a fundraising target that exceeded our expectations. We’d like to thank everyone involved who both raised money and donated and wish the charity all the best for the year ahead as demand for its services unfortunately continues to grow.”